- United Kingdom

- /

- Specialized REITs

- /

- LSE:SAFE

Exploring 3 Undervalued European Small Caps With Insider Activity

Reviewed by Simply Wall St

In recent weeks, European markets have shown resilience with the pan-European STOXX Europe 600 Index rising by 0.65%, buoyed by easing trade tensions and expectations of a potential interest rate cut from the European Central Bank due to slowing inflation. As investors navigate these evolving economic landscapes, identifying promising small-cap stocks becomes crucial, especially those that exhibit strong fundamentals and insider activity, suggesting confidence in their future prospects amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.8x | 0.5x | 35.07% | ★★★★★☆ |

| AKVA group | 15.3x | 0.7x | 47.29% | ★★★★★☆ |

| FRP Advisory Group | 12.4x | 2.2x | 14.31% | ★★★★☆☆ |

| Tristel | 27.8x | 3.9x | 10.84% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.5x | 46.24% | ★★★★☆☆ |

| Eastnine | 18.4x | 8.9x | 38.88% | ★★★★☆☆ |

| Savills | 24.6x | 0.5x | 40.65% | ★★★☆☆☆ |

| Absolent Air Care Group | 22.6x | 1.8x | 48.61% | ★★★☆☆☆ |

| Italmobiliare | 12.2x | 1.6x | -226.55% | ★★★☆☆☆ |

| SmartCraft | 43.5x | 7.8x | 31.37% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Polar Capital Holdings (AIM:POLR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Polar Capital Holdings is an investment management company specializing in actively managed funds, with a market capitalization of approximately £0.55 billion.

Operations: The company's revenue primarily stems from its investment management business, with recent figures at £212.74 million. Over time, the net income margin has shown fluctuations, reaching 20.15% in the latest period. Gross profit margins have also varied, recently recorded at 88.16%. Operating expenses are a significant component of costs, with general and administrative expenses consistently being a major part of this category.

PE: 10.1x

Polar Capital Holdings, a smaller European investment firm, shows signs of being undervalued. Insider confidence is evident as Gavin Rochussen purchased 36,905 shares for £144,132 in recent transactions. However, the company faces challenges with earnings projected to decline by 4.7% annually over the next three years and relies entirely on external borrowing for funding. Despite these hurdles, insider activity suggests potential long-term value as they navigate their financial landscape cautiously.

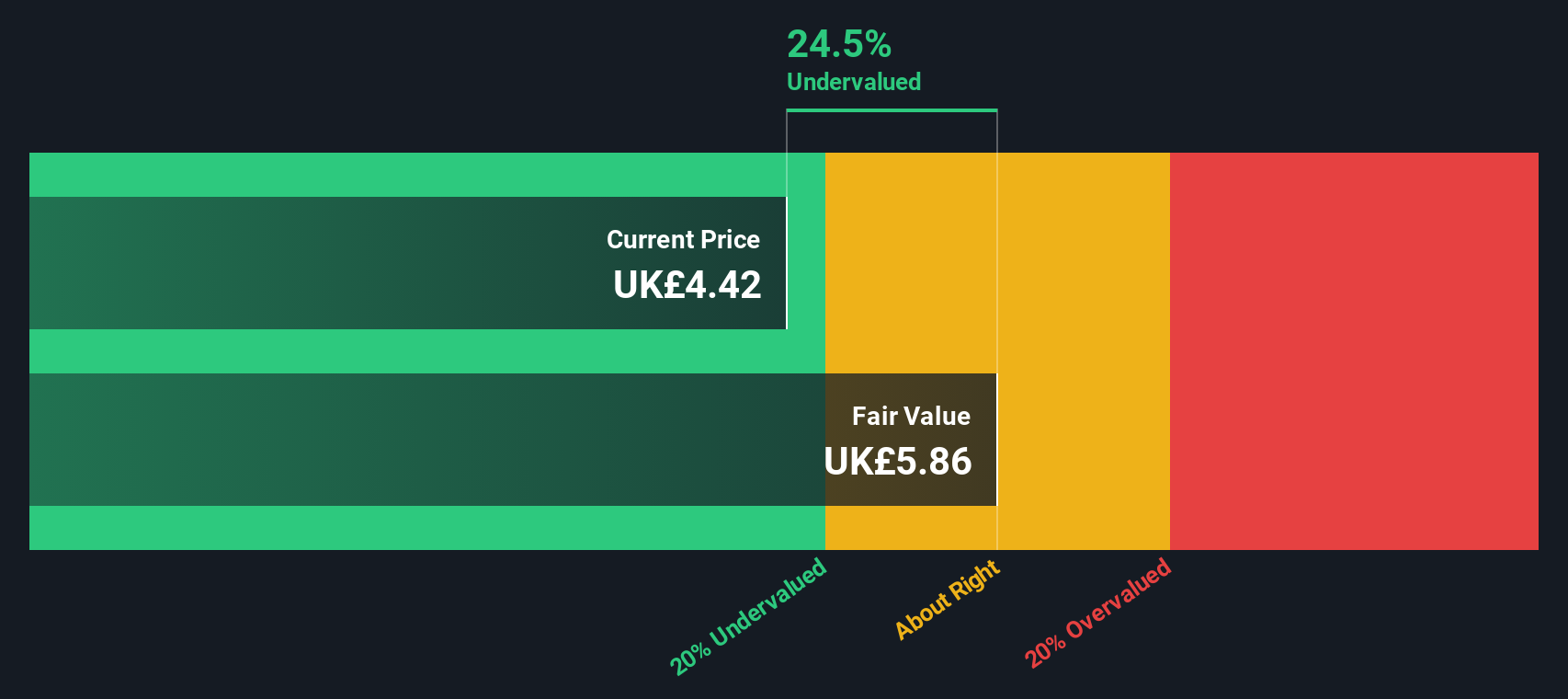

Safestore Holdings (LSE:SAFE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Safestore Holdings is a company that specializes in providing self-storage accommodation and related services, with a market capitalization of approximately £2.75 billion.

Operations: Safestore Holdings generates revenue primarily from self-storage accommodation and related services, with the latest reported revenue at £223.4 million. The company has experienced fluctuations in its net income margin, which reached 1.67% as of October 2024, indicating variability in profitability over time. Operating expenses have been managed consistently below £20 million in recent periods, contributing to the financial outcomes observed.

PE: 3.8x

Safestore Holdings, a player in the European storage sector, recently saw insider confidence as an executive purchased 70,000 shares for £379,120. This move suggests belief in the company's potential despite earnings forecasted to decline by 12.6% annually over the next three years. While revenue is expected to grow at 5.51% per year, reliance on external borrowing poses risks. A dividend increase to 20.40 pence per share was approved in March 2025, indicating financial stability amidst challenges.

- Click to explore a detailed breakdown of our findings in Safestore Holdings' valuation report.

Understand Safestore Holdings' track record by examining our Past report.

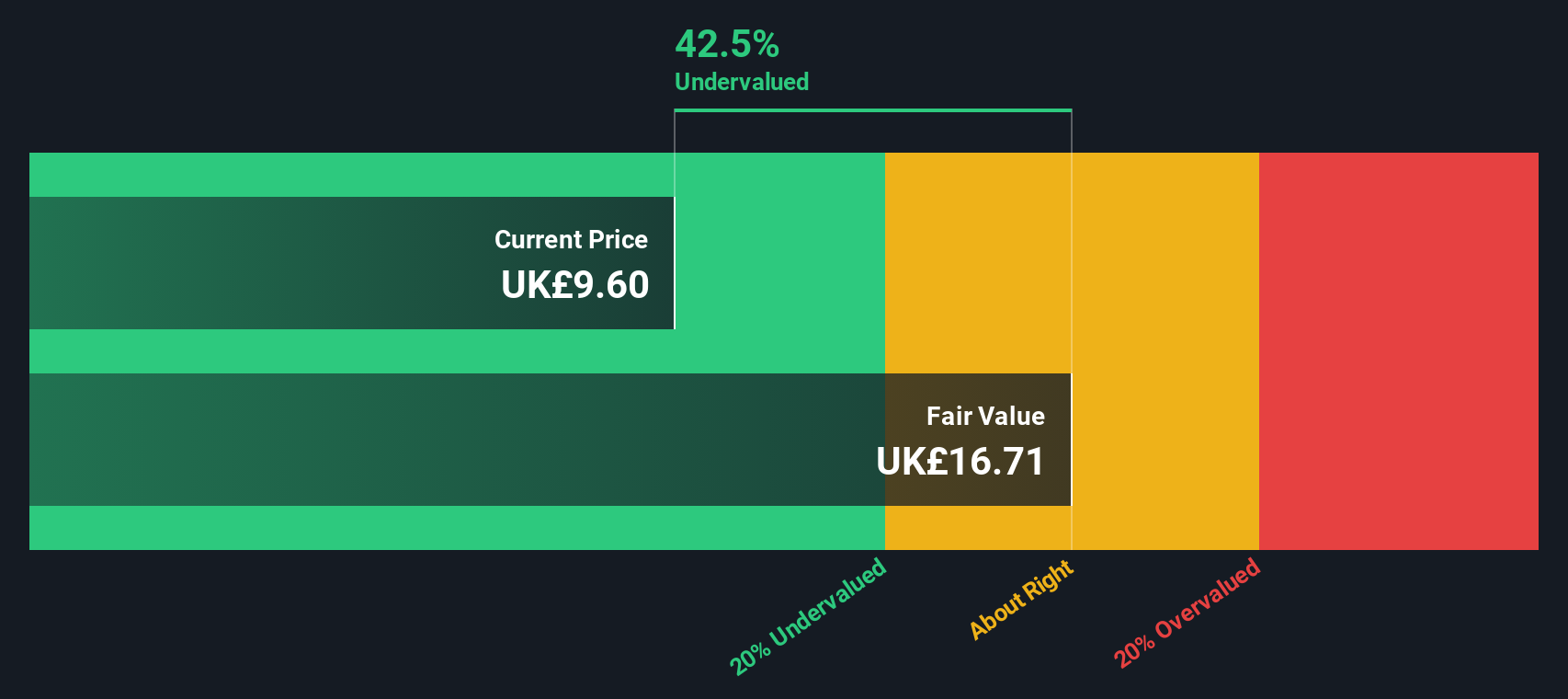

Savills (LSE:SVS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Savills is a global real estate services provider offering consultancy, transaction advisory, investment management, and property and facilities management services with a market capitalization of approximately £1.76 billion.

Operations: Savills generates revenue primarily from four segments: Consultancy (£495.5 million), Transaction Advisory (£870 million), Investment Management (£94 million), and Property and Facilities Management (£944.5 million). The company's net income margin has seen fluctuations, with a recent figure of 1.82% as of December 2023, reflecting the impact of operating expenses on profitability despite a gross profit margin consistently at 100%.

PE: 24.6x

Savills, a smaller player in the European market, shows potential for growth with earnings projected to rise by 27.82% annually. Recent financials reveal sales of £2.4 billion and a net income increase to £53.6 million from £40.8 million last year, indicating strong performance despite reliance on external borrowing for funding. Insider confidence is evident as executives have been purchasing shares throughout the year, suggesting belief in future prospects amidst leadership changes with Simon Shaw stepping up as CEO in 2026.

Where To Now?

- Delve into our full catalog of 76 Undervalued European Small Caps With Insider Buying here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SAFE

Safestore Holdings

Safestore is the UK's largest self-storage group with 210 stores on 31 July 2025; comprising 139 in the UK (including 78 in London and the South East with the remainder in key metropolitan areas such as Manchester, Birmingham, Glasgow, Edinburgh, Liverpool, Sheffield, Leeds, Newcastle, and Bristol), 32 in the Paris region, 16 in Spain, 16 in the Netherlands and seven in Belgium.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives