- United Kingdom

- /

- Real Estate

- /

- LSE:SVS

3 UK Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

The UK stock market has faced challenges recently, with the FTSE 100 index closing lower due to weak trade data from China and falling commodity prices impacting major companies. Despite these hurdles, there are opportunities for investors to find stocks trading below their intrinsic value, which can be particularly appealing in a volatile market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Liontrust Asset Management (LSE:LIO) | £6.38 | £12.30 | 48.1% |

| Gaming Realms (AIM:GMR) | £0.404 | £0.77 | 47.6% |

| EnSilica (AIM:ENSI) | £0.445 | £0.82 | 45.8% |

| AstraZeneca (LSE:AZN) | £126.10 | £244.26 | 48.4% |

| Mercia Asset Management (AIM:MERC) | £0.348 | £0.68 | 48.5% |

| Restore (AIM:RST) | £2.58 | £4.74 | 45.5% |

| Ricardo (LSE:RCDO) | £5.16 | £10.23 | 49.6% |

| Franchise Brands (AIM:FRAN) | £1.815 | £3.61 | 49.8% |

| Tortilla Mexican Grill (AIM:MEX) | £0.54 | £1.01 | 46.4% |

| Nexxen International (AIM:NEXN) | £2.74 | £5.36 | 48.9% |

Underneath we present a selection of stocks filtered out by our screen.

Bridgepoint Group (LSE:BPT)

Overview: Bridgepoint Group plc is a private equity and private credit firm focusing on middle market, small mid cap, small cap, growth capital, buyouts investments, syndicate debt, direct lending and credit opportunities in private credit investments with a market cap of £2.24 billion.

Operations: The company's revenue segments include £3.60 million from Central, £74.50 million from Private Credit, and £285.60 million from Private Equity.

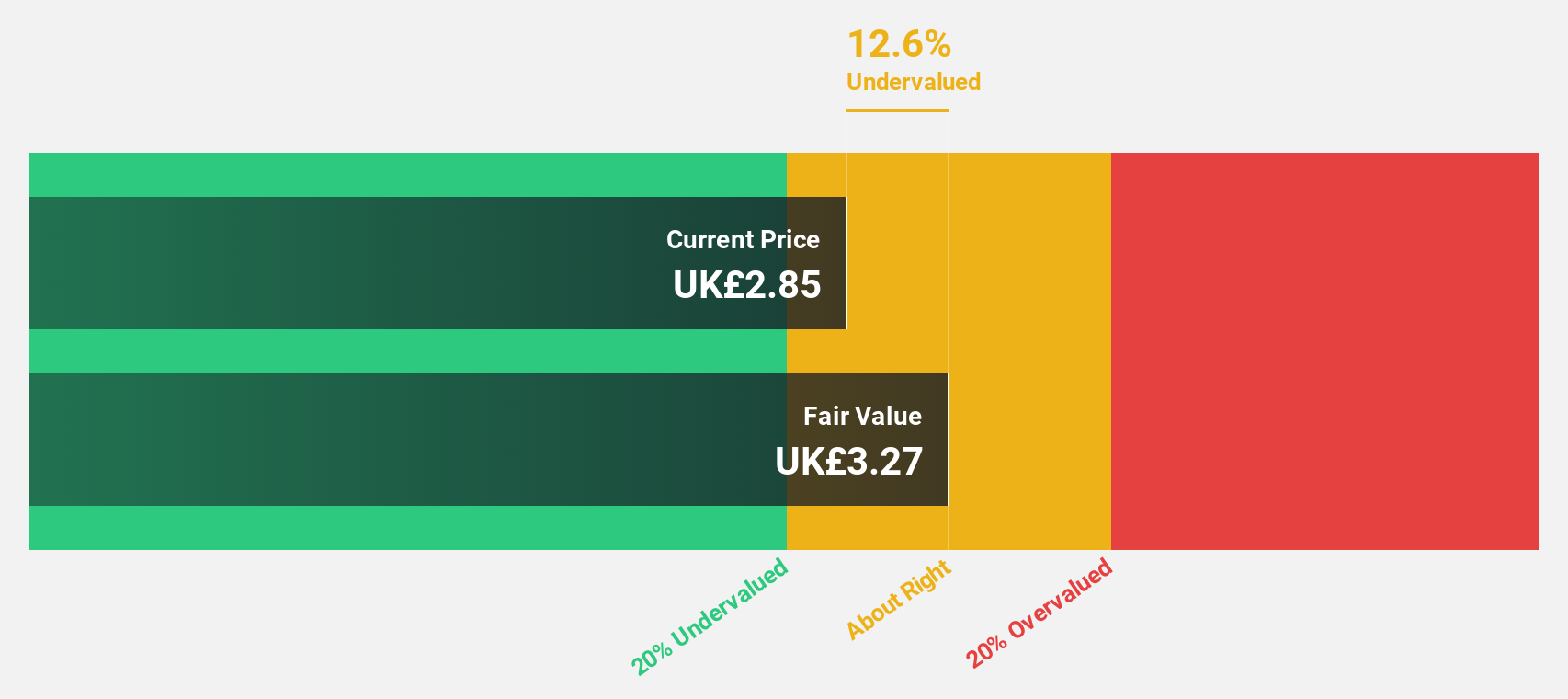

Estimated Discount To Fair Value: 23.8%

Bridgepoint Group appears undervalued based on cash flows, trading 23.8% below fair value estimates (£2.83 vs. £3.71). Despite lower profit margins (19.2%) compared to last year (40.7%), revenue and earnings are forecast to grow faster than the UK market at 18% and 33.3% per year respectively. Recent buybacks and dividend increases signal confidence, though current dividends are not well covered by earnings or free cash flows, raising sustainability concerns.

- Upon reviewing our latest growth report, Bridgepoint Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Bridgepoint Group with our comprehensive financial health report here.

NCC Group (LSE:NCC)

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £490.77 million.

Operations: The company's revenue segments include £258.50 million from Cyber Security and £65.90 million from Escode.

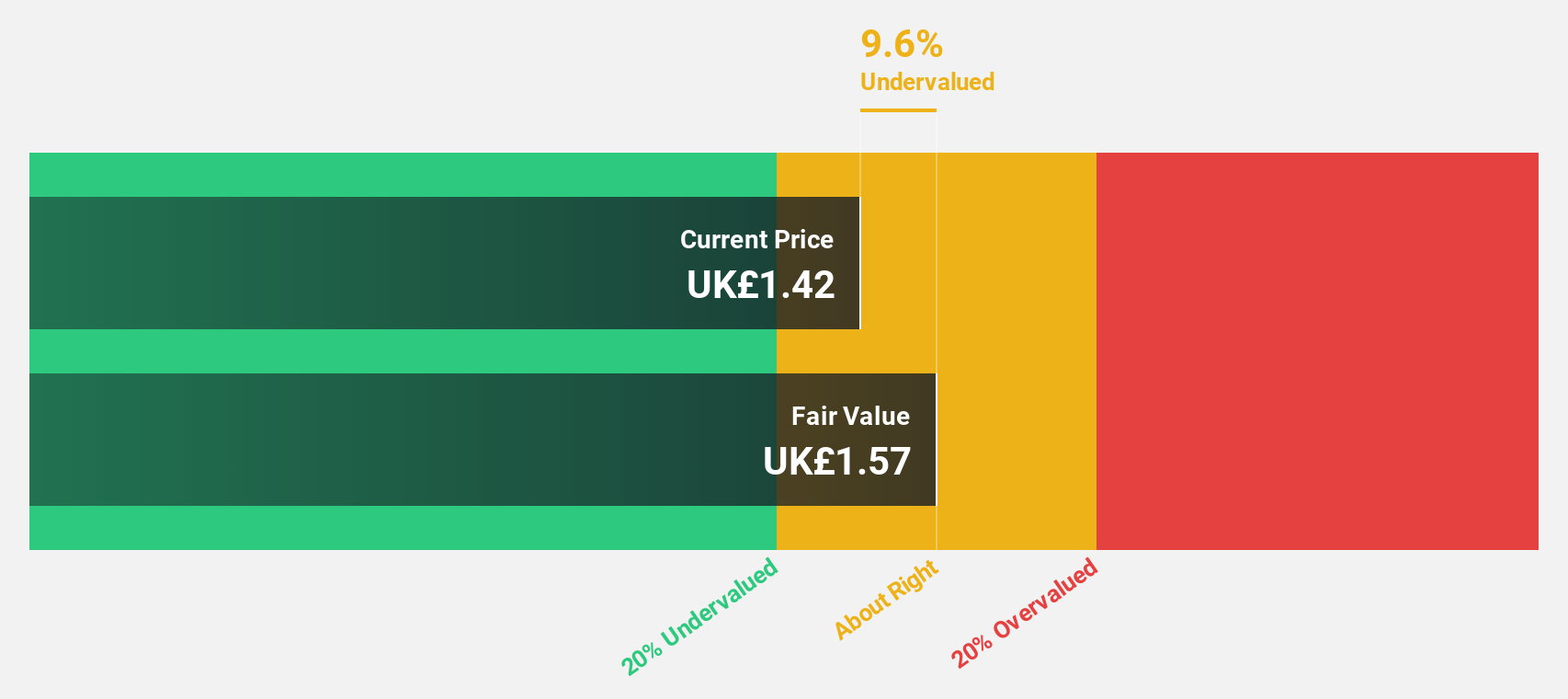

Estimated Discount To Fair Value: 42.8%

NCC Group is trading at 42.8% below its estimated fair value (£1.57 vs. £2.74). Despite a forecasted low return on equity (13.4%) and recent net losses (£24.9 million), the company is expected to become profitable within three years, with earnings projected to grow significantly each year (89.12%). However, revenue growth is modestly above the UK market average (4.7% vs 3.6%), and dividends are not well covered by earnings, raising sustainability concerns.

- In light of our recent growth report, it seems possible that NCC Group's financial performance will exceed current levels.

- Get an in-depth perspective on NCC Group's balance sheet by reading our health report here.

Savills (LSE:SVS)

Overview: Savills plc, with a market cap of £1.71 billion, provides real estate services across the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America and the Middle East.

Operations: Savills generates revenue from four main segments: Consultancy (£459.80 million), Transaction Advisory (£772.90 million), Investment Management (£105.80 million), and Property and Facilities Management (£899.50 million).

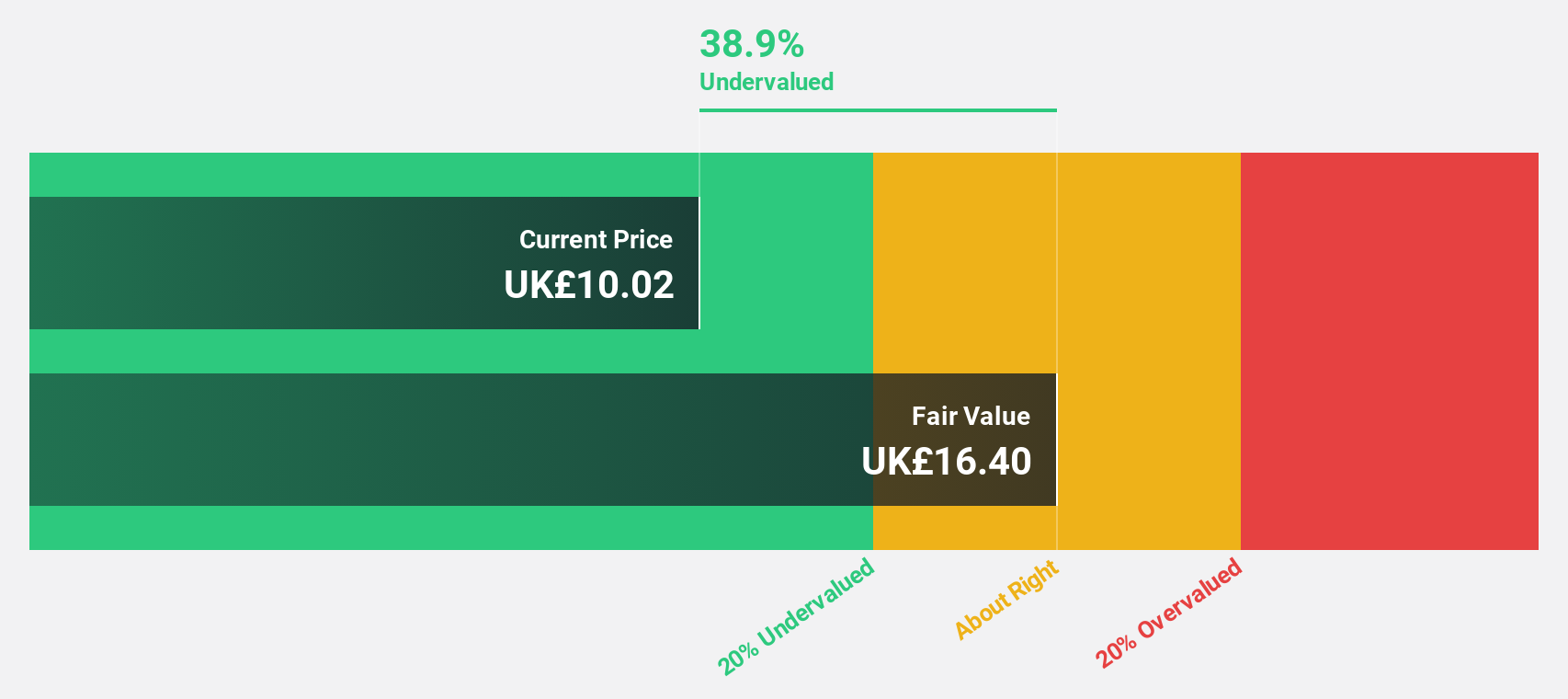

Estimated Discount To Fair Value: 28.4%

Savills, trading at £12.62, is undervalued by approximately 28.4% relative to its estimated fair value of £17.63. Despite a decline in profit margins from 5.2% to 1.8%, the company's revenue is expected to grow faster than the UK market at 4.6% annually, with earnings projected to increase significantly by 30.74% per year over the next three years. Recent strategic partnerships and executive appointments are poised to bolster growth and operational efficiency across key regions like London and Florida.

- The growth report we've compiled suggests that Savills' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Savills' balance sheet health report.

Seize The Opportunity

- Investigate our full lineup of 53 Undervalued UK Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SVS

Savills

Engages in the provision of real estate services in the United Kingdom, Continental Europe, the Asia Pacific, Africa, North America, and the Middle East.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives