- United Kingdom

- /

- Construction

- /

- LSE:KIE

Just Group And Two More Undervalued Small Caps With Insider Action In The United Kingdom

Reviewed by Simply Wall St

In the United Kingdom, market sentiment has been cautiously optimistic, with the FTSE 100 potentially extending gains amid broader global market fluctuations and ongoing economic indicators. Against this backdrop, identifying undervalued small-cap stocks such as Just Group that show insider buying actions could present interesting opportunities for investors attuned to both value and growth prospects in current conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ultimate Products | 9.6x | 0.7x | 17.72% | ★★★★★☆ |

| Robert Walters | 19.1x | 0.2x | 32.91% | ★★★★★☆ |

| Breedon Group | 13.4x | 1.0x | 45.79% | ★★★★★☆ |

| GB Group | NA | 3.1x | 24.21% | ★★★★★☆ |

| THG | NA | 0.4x | 42.48% | ★★★★★☆ |

| Bytes Technology Group | 25.4x | 5.8x | -0.95% | ★★★★☆☆ |

| CVS Group | 20.9x | 1.2x | 41.55% | ★★★★☆☆ |

| M&C Saatchi | NA | 0.6x | 47.91% | ★★★★☆☆ |

| Norcros | 7.9x | 0.5x | -13.46% | ★★★☆☆☆ |

| Hochschild Mining | NA | 1.8x | 45.84% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Just Group (LSE:JUST)

Simply Wall St Value Rating: ★★★★★★

Overview: Just Group is a UK-based financial services company specializing in retirement products and services, with a market capitalization of approximately £0.60 billion.

Operations: From 2013 to 2024, JUST experienced fluctuations in gross profit margin, ranging from a low of approximately 6.55% to a high of about 54.28%. Over the same period, revenue varied significantly, peaking at £4.65 billion in late 2020 before declining sharply.

PE: 9.9x

Just Group, with its earnings expected to grow by about 9.6% annually, recently declared a dividend increase, signaling financial stability and shareholder commitment. On May 7, 2024, they announced a final dividend of 1.50 pence per share for the year ending December 2023. This firm operates on a funding model devoid of customer deposits; instead, it relies entirely on external borrowings—a higher risk yet common strategy in its sector. Highlighting insider confidence, executives have recently purchased shares, underscoring their belief in the company's prospects and inherent market value amidst other UK small caps.

- Get an in-depth perspective on Just Group's performance by reading our valuation report here.

Examine Just Group's past performance report to understand how it has performed in the past.

Kier Group (LSE:KIE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kier Group is a construction and infrastructure services provider with operations spanning property development, building, and civil engineering, boasting a market capitalization of approximately £0.24 billion.

Operations: In recent financial periods, the company has generated revenues ranging from £3.22 billion to £3.72 billion, with a notable gross profit margin fluctuation between 5.91% and 10.12%. The net income has shown variability, recording values from significant losses up to £41.1 million in profit as of the latest reporting period.

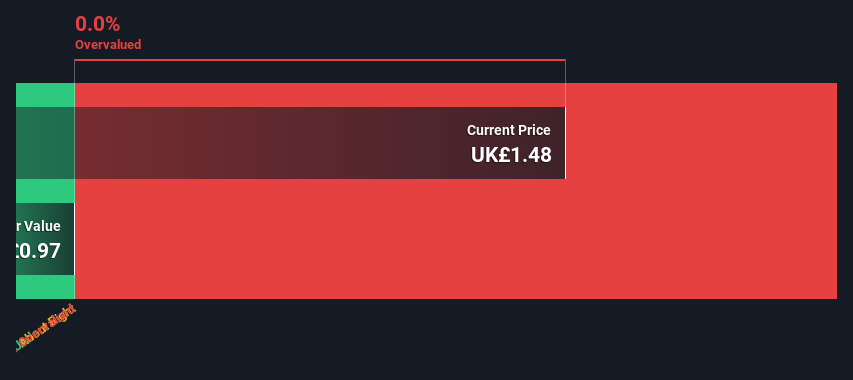

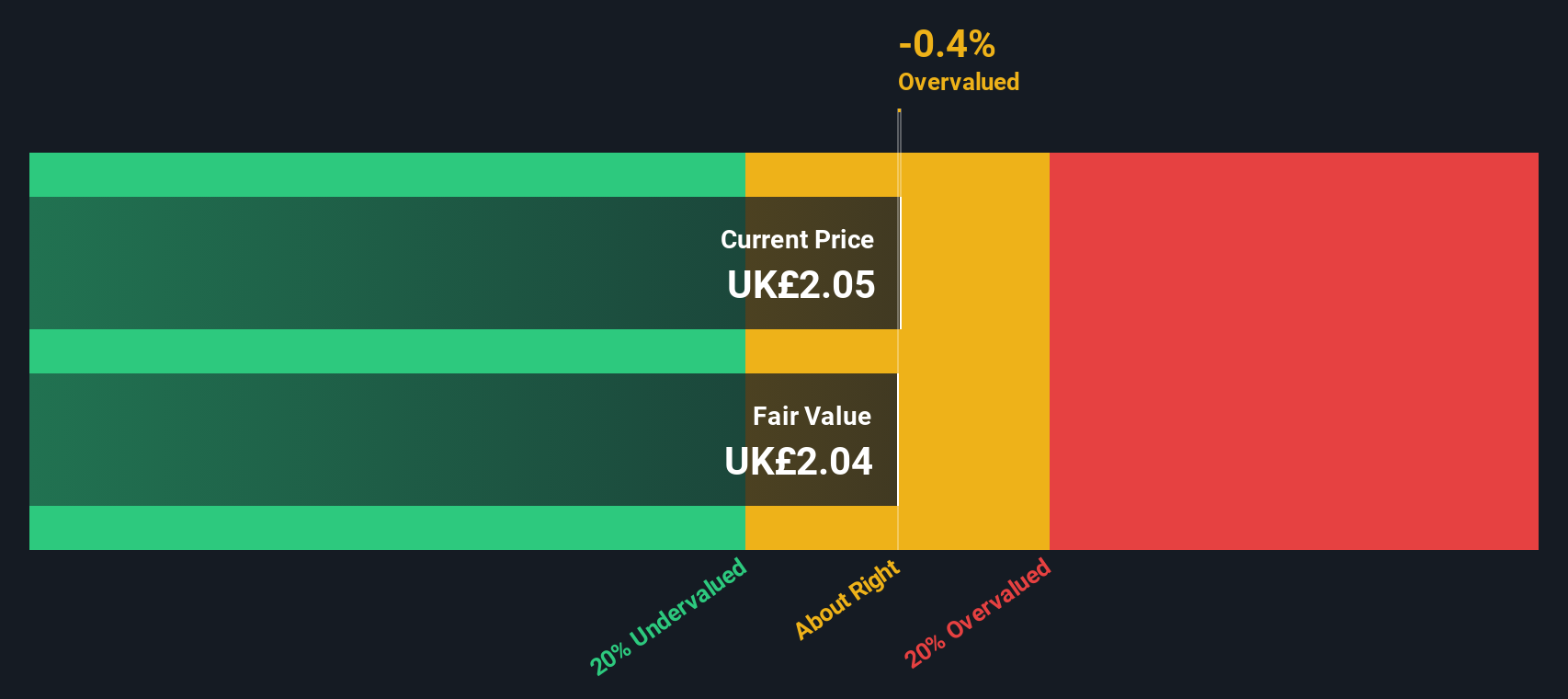

PE: 17.6x

Kier Group, a notable player in the UK's construction sector, reflects strong market potential, evidenced by a forecasted earnings growth of 23% annually. Recently, insider confidence has been bolstered as they purchased additional shares, signaling trust in the company’s trajectory. Despite relying solely on external borrowing—a higher risk funding method—its financial agility remains intact. Looking ahead, Kier is poised for continued growth amidst an evolving industry landscape.

- Dive into the specifics of Kier Group here with our thorough valuation report.

Assess Kier Group's past performance with our detailed historical performance reports.

Sirius Real Estate (LSE:SRE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sirius Real Estate is a company specializing in owning and operating business parks, offices, and industrial complexes primarily in Germany, with a market capitalization of approximately €1.31 billion.

Operations: The entity generates €289.40 million from property investment, exhibiting a gross profit margin of 57.50% and a net income margin of 37.25%.

PE: 16.0x

Sirius Real Estate, a notable player in the UK's small-cap sector, recently bolstered its financial agility through a £152.5 million equity offering, earmarked for enhancing its acquisition strategy. This move underscores management's commitment to growth, evidenced by their successful capital raise supporting ambitious expansion plans. Adding credibility, insider confidence shone brightly as Asset Management Director Craig Hoskins recently invested approximately £216 thousand in company shares—an act reflecting strong belief in Sirius’s potential. This strategic financial maneuvering and insider buying suggest Sirius is poised for further development, despite past earnings declines and funding challenges marked by reliance on external borrowing.

- Click here and access our complete valuation analysis report to understand the dynamics of Sirius Real Estate.

Evaluate Sirius Real Estate's historical performance by accessing our past performance report.

Next Steps

- Navigate through the entire inventory of 30 Undervalued UK Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kier Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KIE

Kier Group

Primarily engages in the construction business in the United Kingdom and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives