- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

Little Excitement Around LSL Property Services plc's (LON:LSL) Revenues

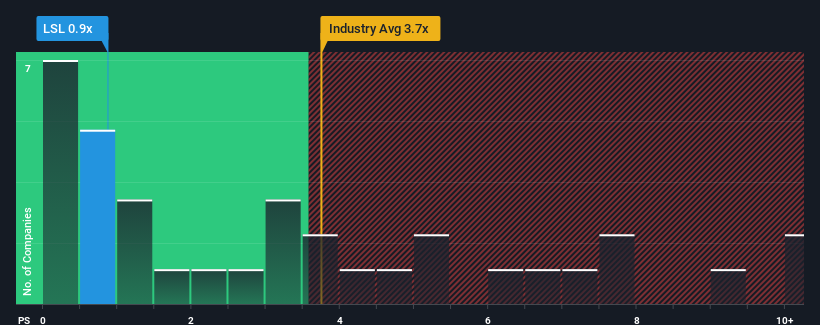

You may think that with a price-to-sales (or "P/S") ratio of 0.9x LSL Property Services plc (LON:LSL) is definitely a stock worth checking out, seeing as almost half of all the Real Estate companies in the United Kingdom have P/S ratios greater than 3.7x and even P/S above 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for LSL Property Services

What Does LSL Property Services' P/S Mean For Shareholders?

Recent times haven't been great for LSL Property Services as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on LSL Property Services will help you uncover what's on the horizon.How Is LSL Property Services' Revenue Growth Trending?

LSL Property Services' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.0%. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 45% over the next year. That's not great when the rest of the industry is expected to grow by 18%.

With this in consideration, we find it intriguing that LSL Property Services' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On LSL Property Services' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that LSL Property Services' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, LSL Property Services' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware LSL Property Services is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agent franchisees, and valuation services to lenders in the United Kingdom.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion