Discovering Opportunities: Iofina And 2 Other Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The United Kingdom's stock market has faced recent challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these broader market pressures, there remains potential for growth within specific investment niches. Penny stocks, though an older term, continue to offer intriguing opportunities for investors seeking value in smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.405 | £438.1M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.18 | £100.7M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.25 | £71.31M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4135 | $240.38M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £190.77M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.04 | £78.76M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Iofina (AIM:IOF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iofina plc explores, develops, and produces iodine and halogen-based specialty chemical derivatives from oil and gas operations in the United States and the United Kingdom, with a market cap of £36.45 million.

Operations: The company's revenue is derived entirely from its halogen derivatives and iodine segment, totaling $51.71 million.

Market Cap: £36.45M

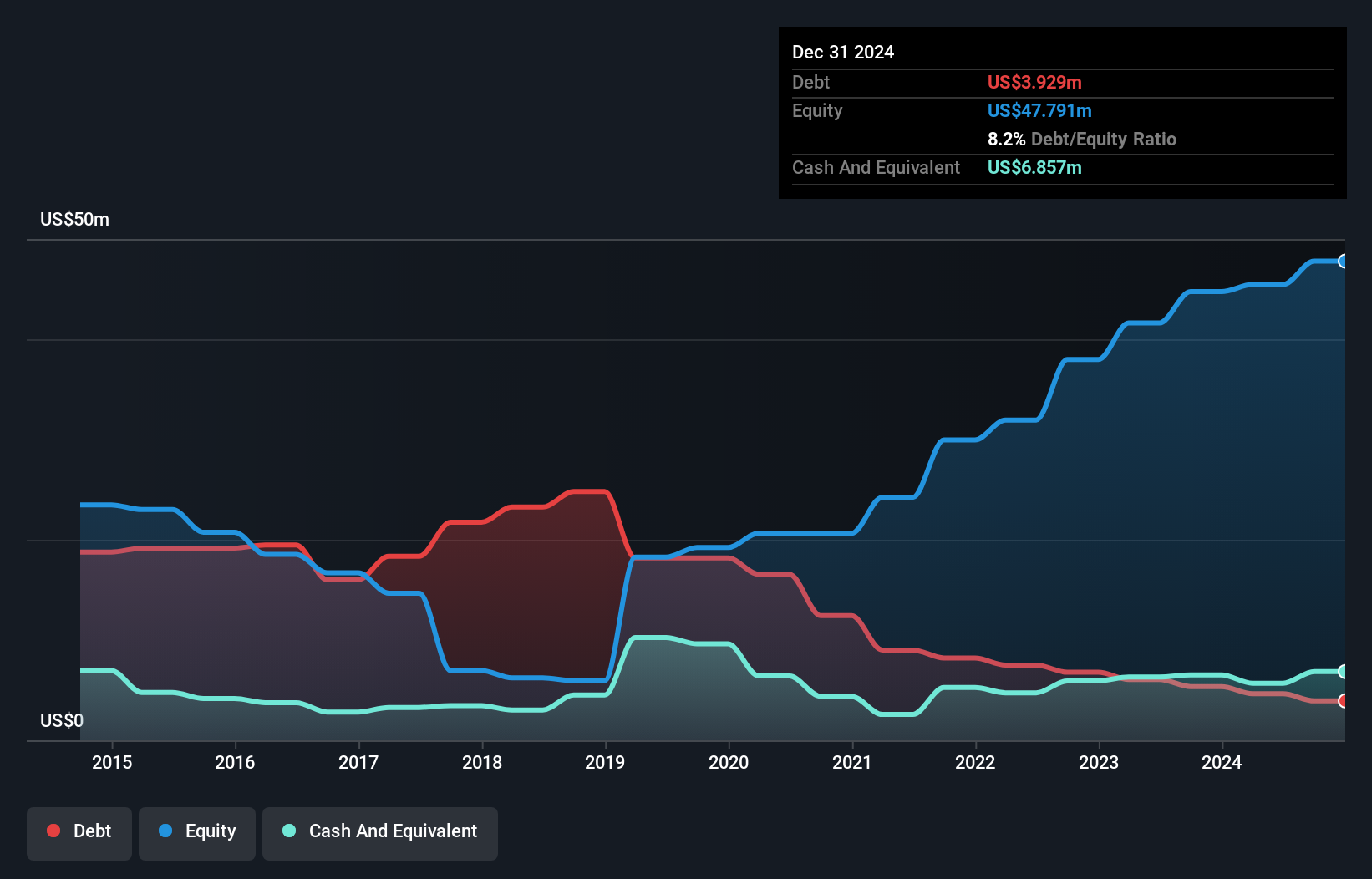

Iofina plc, with a market cap of £36.45 million, is focused on iodine production from oil and gas operations. The company has demonstrated financial stability with interest payments well covered by EBIT and a reduction in its debt-to-equity ratio over the past five years. Iofina's recent operational expansions include commissioning the IO#10 plant and planning for IO#11, expected to enhance iodine output significantly. Despite stable revenue growth, recent earnings have declined sharply compared to last year due to lower profit margins. However, the company's seasoned management team continues to drive strategic growth initiatives in core areas like Oklahoma.

- Dive into the specifics of Iofina here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Iofina's future.

Synectics (AIM:SNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Synectics plc designs, integrates, and supports security and surveillance systems both in the United Kingdom and internationally, with a market cap of £52.36 million.

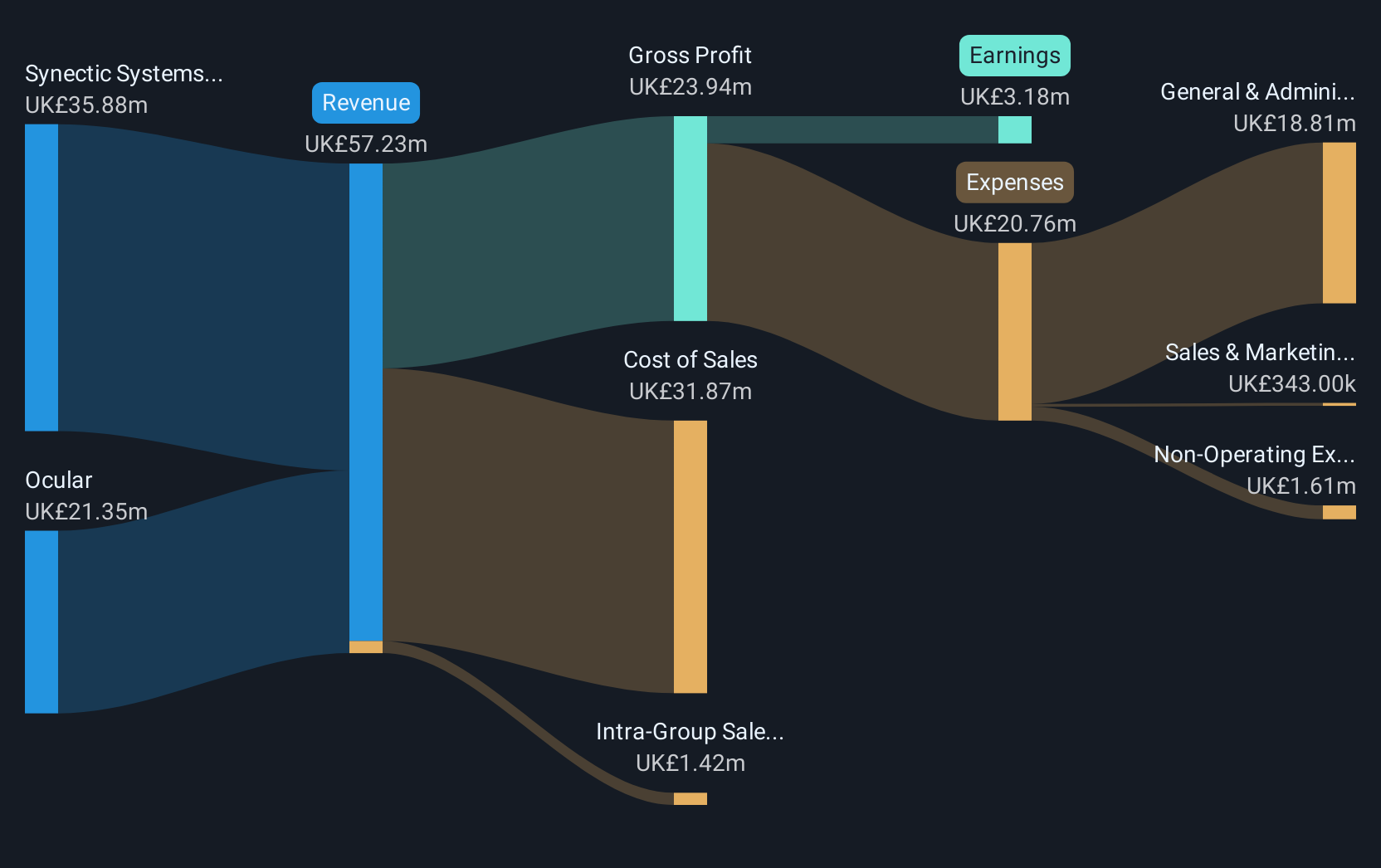

Operations: The company generates its revenue from two primary segments: Systems, contributing £35.55 million, and Security, accounting for £19.30 million.

Market Cap: £52.36M

Synectics plc, with a market cap of £52.36 million, has secured several significant contracts across diverse sectors, including gaming and oil and gas. Recent deals include $2.7 million in contracts to deploy its Synergy software in the Philippines and two new agreements with PENN Entertainment Inc., expanding Synectics' presence to 25 locations within their portfolio. The company also announced £2.3 million in contracts for security solutions in Qatar and Brazil's oil projects. Despite low return on equity at 7.6%, Synectics benefits from high-quality earnings, no debt burden, stable short-term asset coverage, and impressive recent earnings growth of 258%.

- Navigate through the intricacies of Synectics with our comprehensive balance sheet health report here.

- Evaluate Synectics' prospects by accessing our earnings growth report.

London & Associated Properties (LSE:LAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: London & Associated Properties is a fully listed property investment company specializing in retail, with a market cap of £9.39 million.

Operations: The company's revenue is derived from three segments: LAP generating £2.62 million, Dragon contributing £0.17 million, and Bisichi accounting for £46.82 million.

Market Cap: £9.39M

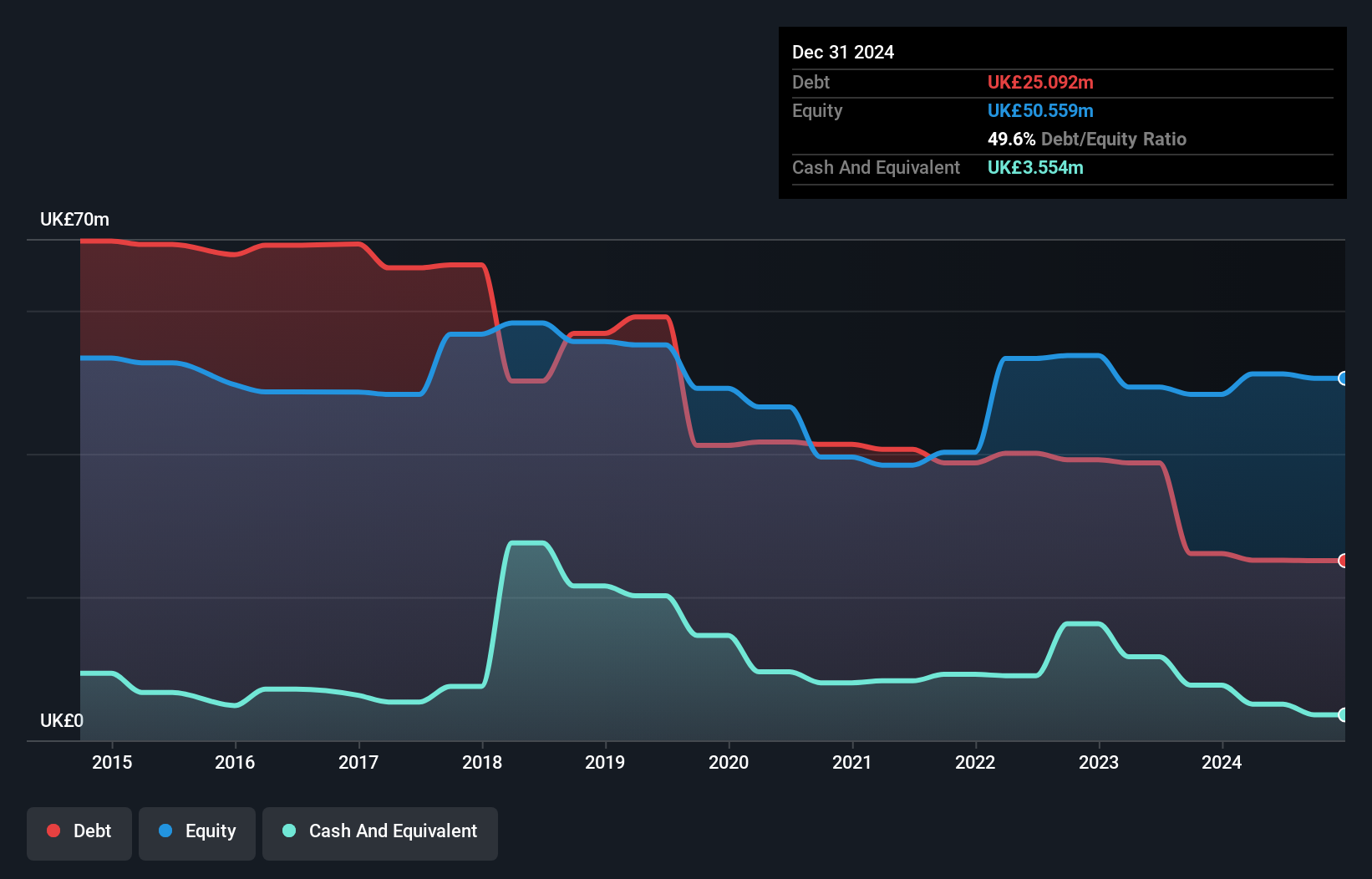

London & Associated Properties, with a market cap of £9.39 million, shows a mixed financial picture. While the company has reduced its debt to equity ratio from 107.1% to 49.2% over five years and maintains a satisfactory net debt to equity ratio of 39.3%, it remains unprofitable with negative return on equity at 3.69%. Earnings have grown annually by 28.8%, yet short-term liabilities exceed assets (£34.8M vs £28M). The board boasts experienced members, but management data is insufficient for evaluation. Despite challenges, LAS trades significantly below estimated fair value and has over three years of cash runway due to positive free cash flow growth.

- Click here and access our complete financial health analysis report to understand the dynamics of London & Associated Properties.

- Assess London & Associated Properties' previous results with our detailed historical performance reports.

Taking Advantage

- Discover the full array of 469 UK Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SNX

Synectics

Engages in the provision of specialist video based electronic surveillance systems and technology for use in security applications, environments, and transport applications in the United Kingdom and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives