- United Kingdom

- /

- Capital Markets

- /

- AIM:MANO

Discover UK Penny Stocks: 3 Picks Under £40M Market Cap

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market conditions, investors often find opportunities in lesser-known segments like penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer significant growth potential when supported by robust financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.45 | £11.31M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.64 | £529.41M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.07 | £167.23M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.885 | £13.36M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.68 | $395.3M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.39 | £241.78M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.60 | £93.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £178.75M | ✅ 4 ⚠️ 2 View Analysis > |

| ME Group International (LSE:MEGP) | £1.564 | £590.76M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Manolete Partners (AIM:MANO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Manolete Partners Plc is an insolvency litigation financing company operating in the United Kingdom with a market cap of £39.43 million.

Operations: The company's revenue is derived from unclassified services, totaling £30.48 million.

Market Cap: £39.43M

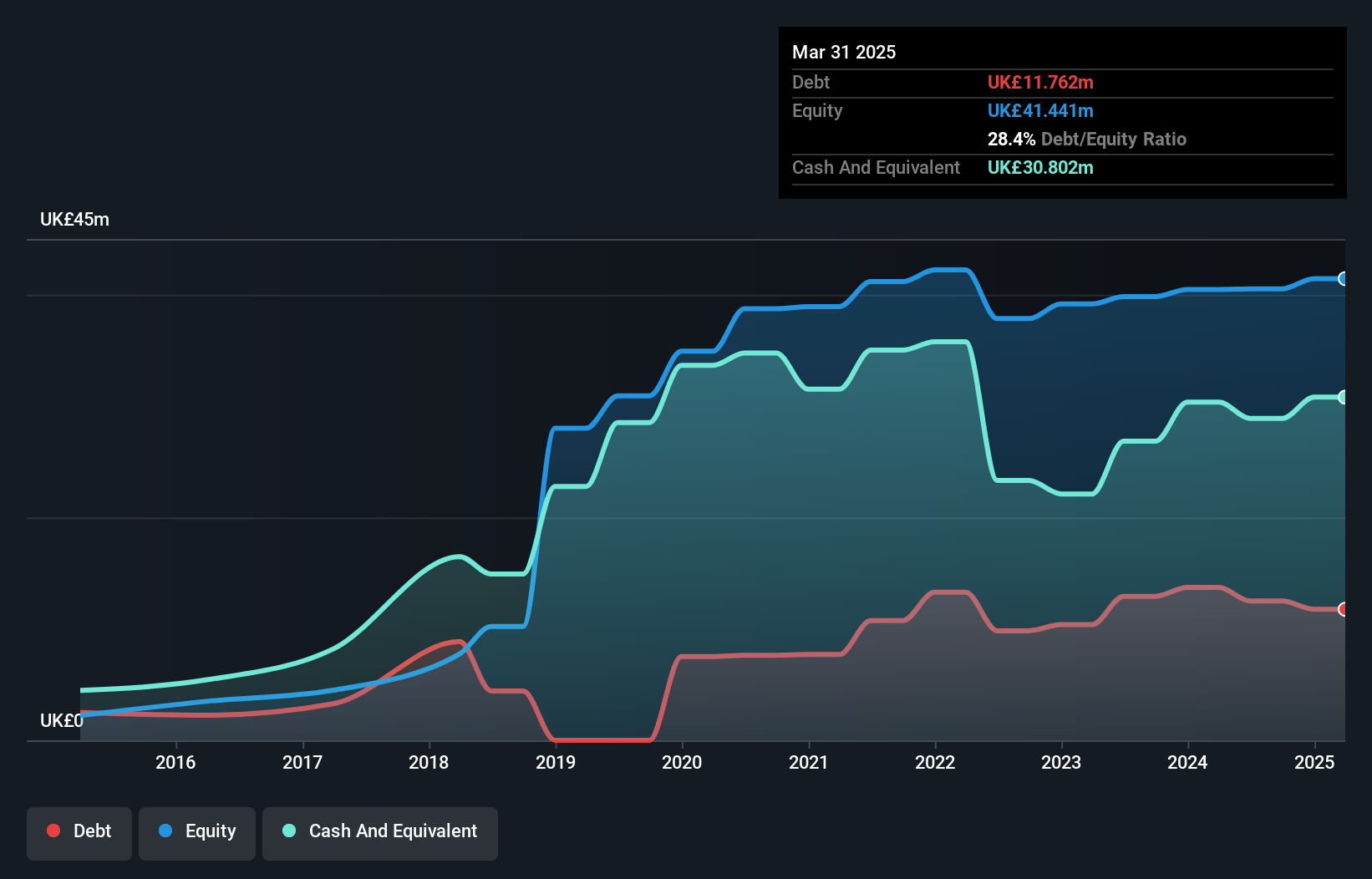

Manolete Partners Plc, with a market cap of £39.43 million, faces challenges as its earnings have declined by 53.3% annually over the past five years and recent half-year results show a net loss of £0.476 million. Despite stable weekly volatility and high-quality earnings, the company struggles with profitability as its net profit margins decreased from 3.5% to 2.9%. Although short-term assets exceed liabilities and debt is well-covered by cash flow, Manolete's return on equity remains low at 2.2%. The appointment of a new CFO could potentially bring strategic financial insights to address these issues.

- Navigate through the intricacies of Manolete Partners with our comprehensive balance sheet health report here.

- Assess Manolete Partners' future earnings estimates with our detailed growth reports.

Virgin Wines UK (AIM:VINO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Virgin Wines UK PLC is a direct-to-consumer online wine retailer in the United Kingdom with a market cap of £25.35 million.

Operations: The company's revenue is derived from the sale of alcohol, totaling £59.02 million.

Market Cap: £25.35M

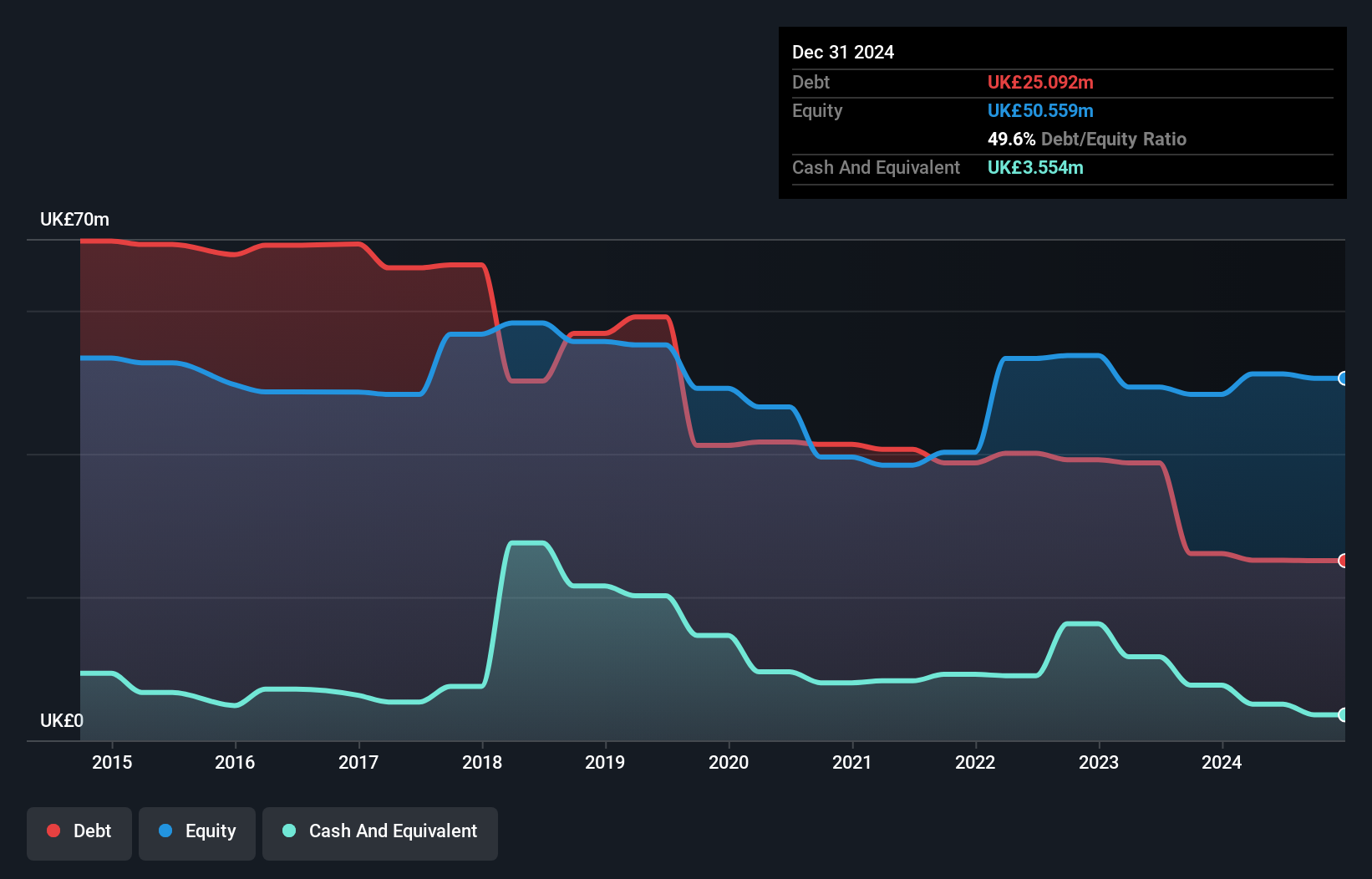

Virgin Wines UK PLC, with a market cap of £25.35 million, trades significantly below its estimated fair value while maintaining stable weekly volatility. Despite being debt-free and having short-term assets exceeding both short and long-term liabilities, the company faces challenges with declining earnings projected to continue over the next three years. Recent annual results show stagnant sales at £59.02 million and a slight decrease in net income to £1.3 million from last year’s figures. Although revenue growth is forecasted at 9.14% annually, past profit margins have slightly decreased, reflecting ongoing profitability concerns in a competitive market environment.

- Click here and access our complete financial health analysis report to understand the dynamics of Virgin Wines UK.

- Learn about Virgin Wines UK's future growth trajectory here.

London & Associated Properties (LSE:LAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: London & Associated Properties PLC (LSE:LAS) is a main market listed company that invests in and manages UK industrial and retail properties, with a market cap of £3.41 million.

Operations: The company's revenue segments are comprised of LAP generating £2.52 million, Dragon contributing £0.15 million, and Bisichi providing £53.63 million.

Market Cap: £3.41M

London & Associated Properties, with a market cap of £3.41 million, is navigating the challenges typical of penny stocks. The company is unprofitable but has managed to reduce its debt to equity ratio from 89.5% to 51.2% over five years, indicating improved financial management. Despite high share price volatility and negative return on equity (-5.37%), LAS has a positive cash flow runway for over three years and reduced losses by 25.6% annually over the past five years, showing potential resilience in its operations amidst industry pressures and financial constraints.

- Click here to discover the nuances of London & Associated Properties with our detailed analytical financial health report.

- Examine London & Associated Properties' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Get an in-depth perspective on all 298 UK Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MANO

Manolete Partners

Operates as an insolvency litigation financing company in the United Kingdom.

High growth potential with proven track record.

Market Insights

Community Narratives