- United Kingdom

- /

- Commercial Services

- /

- AIM:FRAN

UK Growth Stocks With Insider Ownership And 45% Earnings Growth

Reviewed by Simply Wall St

In recent weeks, the UK market has faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery and its impact on global trade. As investors navigate these turbulent conditions, growth companies with high insider ownership can offer a compelling opportunity due to their potential for aligned interests and robust earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Foresight Group Holdings (LSE:FSG) | 35.1% | 26.3% |

| QinetiQ Group (LSE:QQ.) | 13.1% | 27.4% |

| Facilities by ADF (AIM:ADF) | 13.2% | 161.5% |

| Judges Scientific (AIM:JDG) | 10.7% | 24.4% |

| Audioboom Group (AIM:BOOM) | 15.6% | 59.3% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.7% | 21.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Getech Group (AIM:GTC) | 11.6% | 114.5% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 116.2% |

Let's dive into some prime choices out of the screener.

Franchise Brands (AIM:FRAN)

Simply Wall St Growth Rating: ★★★★☆☆

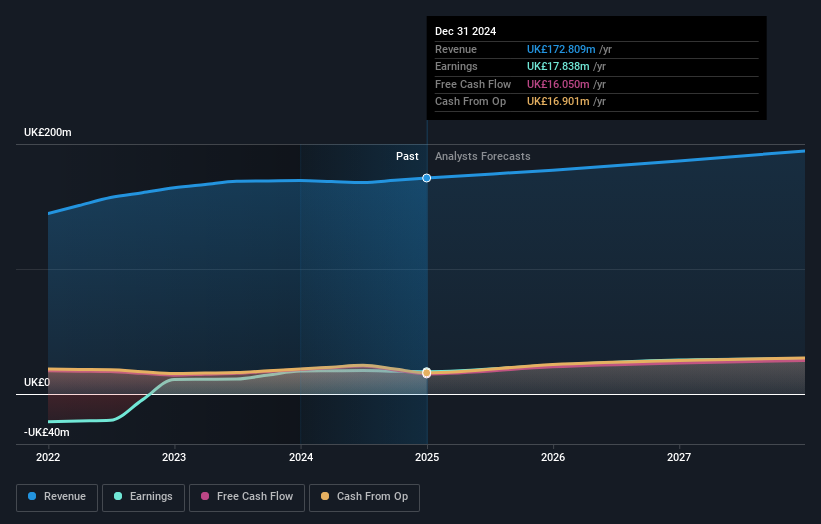

Overview: Franchise Brands plc operates through its subsidiaries in franchising and related activities across the United Kingdom, Ireland, North America, and Continental Europe with a market capitalization of £268.59 million.

Operations: The company's revenue is primarily derived from its Pirtek segment (£63.91 million), Water & Waste Services (£46.05 million), Filta International (£25.60 million), B2C Division (£5.75 million), and Azura (£0.81 million).

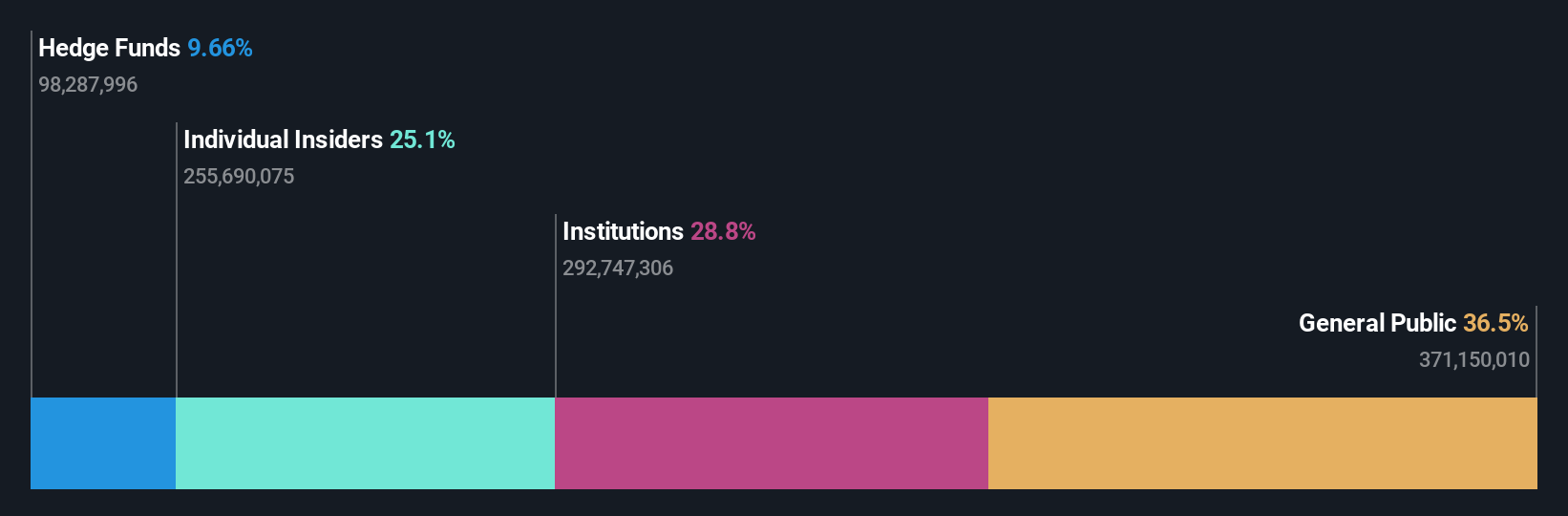

Insider Ownership: 22.6%

Earnings Growth Forecast: 29.4% p.a.

Franchise Brands is trading at 43.5% below its estimated fair value, with earnings expected to grow significantly over the next three years, outpacing the UK market. Recent insider buying indicates confidence in its growth prospects. The company reported a strong increase in net income and sales for 2024, alongside strategic leadership changes to support its One Franchise Brands initiative aimed at boosting integration and operational efficiency.

- Get an in-depth perspective on Franchise Brands' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Franchise Brands is priced higher than what may be justified by its financials.

Nichols (AIM:NICL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nichols plc, with a market cap of £447.50 million, supplies soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom, the Middle East, Africa, and internationally.

Operations: The company's revenue segments consist of £132.82 million from Packaged and £39.99 million from Out of Home sales.

Insider Ownership: 27.7%

Earnings Growth Forecast: 14.8% p.a.

Nichols plc, with substantial insider ownership, is trading 33.2% below its estimated fair value. Earnings are forecast to grow at 14.8% annually, outpacing the UK market's growth rate. Despite a recent dip in net income to £17.84 million for 2024, the company increased its dividend due to strong cash generation. Recent executive changes include appointing Alan Williams as Non-Executive Director and addressing leadership continuity following the passing of CFO Richard Newman.

- Click here to discover the nuances of Nichols with our detailed analytical future growth report.

- Our valuation report here indicates Nichols may be overvalued.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of £1.83 billion.

Operations: The company's revenue segments include $1.29 billion from the Americas, $334 million from the Asia Pacific, $389 million from Digital and Professional Services, and $1.67 billion from Europe, the Middle East, and Africa (EMEA).

Insider Ownership: 25.5%

Earnings Growth Forecast: 45.4% p.a.

International Workplace Group shows strong growth potential, with earnings forecast to grow significantly at 45.4% annually, surpassing the UK market average. Insider activity is positive, with more shares bought than sold recently. The company became profitable this year and has initiated a $50 million share buyback program to reduce share capital. Recent expansions include new Spaces centers in Sundbyberg and Malmö, enhancing its global network of flexible office solutions under various brands like Regus and Spaces.

- Delve into the full analysis future growth report here for a deeper understanding of International Workplace Group.

- The analysis detailed in our International Workplace Group valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Dive into all 62 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRAN

Franchise Brands

Through its subsidiaries, engages in franchising and related activities in the United Kingdom, Ireland, North America, and Continental Europe.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives