- United Kingdom

- /

- Software

- /

- AIM:IQG

Three UK Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

The market has been flat over the last week but is up 6.7% over the past year, with earnings expected to grow by 15% per annum over the next few years. In this context, identifying growth companies with high insider ownership can be particularly appealing as it often signals strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Energean (LSE:ENOG) | 10.6% | 30.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.8% | 27.9% |

| Facilities by ADF (AIM:ADF) | 22.7% | 144.7% |

| Judges Scientific (AIM:JDG) | 11.9% | 21.2% |

| Belluscura (AIM:BELL) | 36.3% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| IQGeo Group (AIM:IQG) | 13% | 63.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: The company's revenue segment includes Healthcare Software, which generated $189.27 million.

Insider Ownership: 16.5%

Craneware is a growth company with high insider ownership, showing substantial earnings growth of 26.8% over the past year and forecasted to grow at 25.6% per year, outpacing the UK market. Despite a lower forecasted Return on Equity (12.2%), its revenue is expected to grow faster than the market at 8.2%. Recent buybacks and strategic collaborations with Microsoft enhance its technological capabilities and market reach, further supporting its growth trajectory.

- Get an in-depth perspective on Craneware's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Craneware's shares may be trading at a premium.

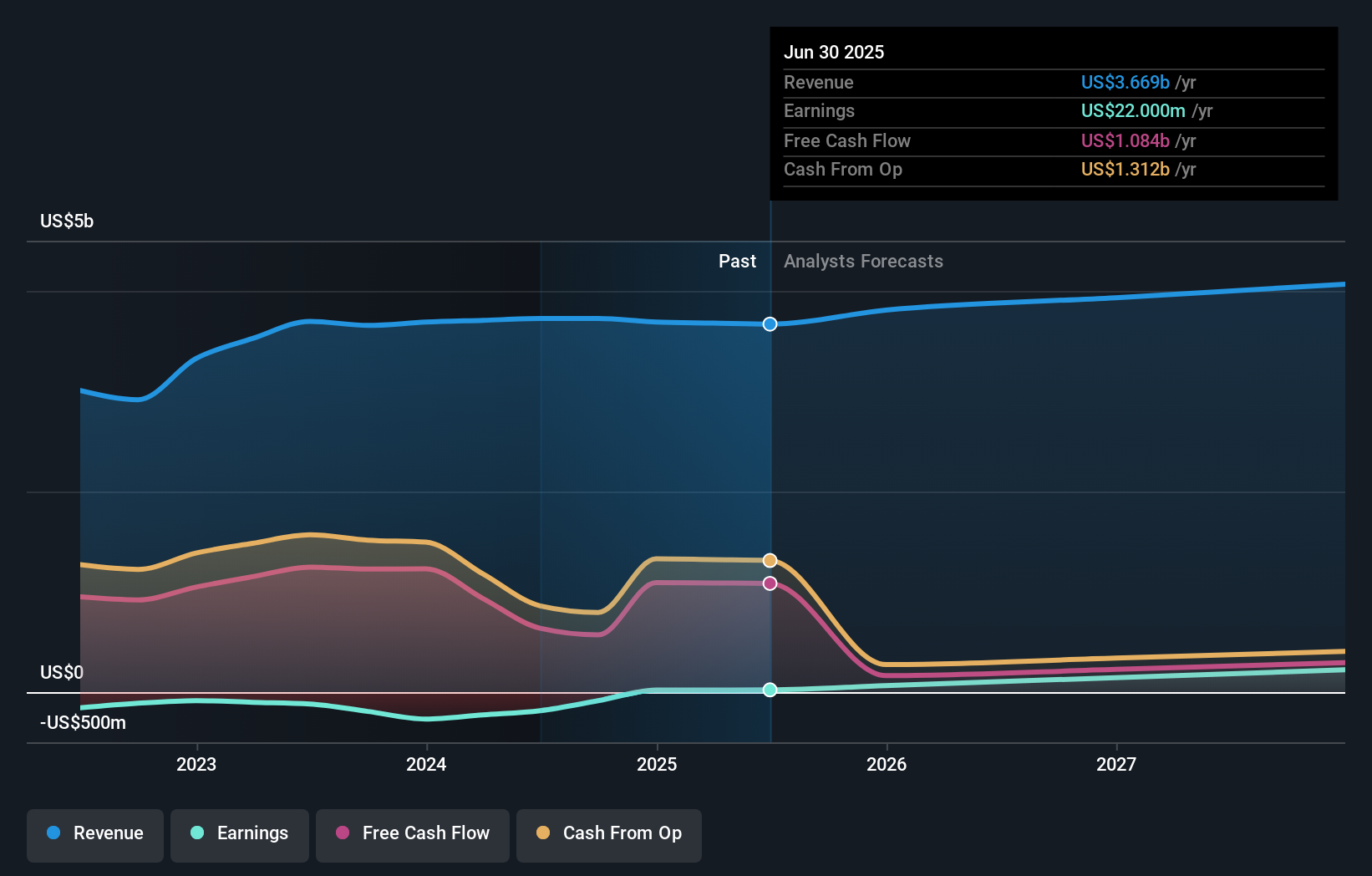

IQGeo Group (AIM:IQG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: IQGeo Group plc, with a market cap of £31.00 million, provides geospatial software solutions for telecom and utility network operators across the United Kingdom, the United States, Canada, Belgium, Germany, Japan, Malaysia, and other international markets.

Operations: Revenue from geospatial software solutions for telecom and utility network operators amounts to £44.49 million.

Insider Ownership: 13%

IQGeo Group, recently acquired by Geologist Bidco Limited, has seen its shares delisted from AIM. Despite shareholder dilution in the past year, IQGeo's earnings are forecast to grow significantly at 63.61% per year, outpacing the UK market average. Revenue growth is also expected to exceed the market rate at 11.5% annually. The company's Return on Equity is projected to be high at 21.5% in three years, indicating strong future profitability potential.

- Click to explore a detailed breakdown of our findings in IQGeo Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that IQGeo Group is priced higher than what may be justified by its financials.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.79 billion, provides workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: Revenue segments (in millions of $) include Worka: $400.56 million, Americas: $1.29 billion, Asia Pacific: $341.30 million, and Europe, Middle East and Africa (EMEA): $1.69 billion.

Insider Ownership: 25.2%

International Workplace Group (IWG) is forecast to become profitable within the next three years, with earnings expected to grow by 115.58% annually. Despite a share price decline of 50% over five years, insiders have shown confidence through recent purchases. Revenue growth is projected at 8.9% per year, outpacing the UK market average of 3.8%. Activist investor Buckley Capital Management has urged IWG to initiate a share buyback and consider a US listing to unlock shareholder value further.

- Dive into the specifics of International Workplace Group here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that International Workplace Group is trading behind its estimated value.

Make It Happen

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 67 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IQG

IQGeo Group

IQGeo Group plc, together with its subsidiaries, delivers geospatial software solutions for the telecoms and utility network operators in the United Kingdom, the United States, Canada, Belgium, Germany, Japan, Malaysia, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives