- United Kingdom

- /

- Hospitality

- /

- LSE:EVOK

3 UK Growth Stocks With Up To 25% Insider Ownership

Reviewed by Simply Wall St

The United Kingdom's stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, which is impacting companies closely tied to its economic performance. In such uncertain times, identifying growth companies with high insider ownership can be particularly appealing as it often suggests strong alignment between management and shareholder interests, potentially offering resilience amidst broader market challenges.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.8% | 55.7% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 93.9% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 21.5% |

| Foresight Group Holdings (LSE:FSG) | 34.2% | 23.5% |

| Facilities by ADF (AIM:ADF) | 13.1% | 190% |

| Judges Scientific (AIM:JDG) | 10.6% | 29.4% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 26.4% |

| PensionBee Group (LSE:PBEE) | 38.8% | 67.1% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, with a market cap of £272.18 million, offers online betting and gaming products and solutions across the United Kingdom, Ireland, Italy, Spain, and internationally.

Operations: The company's revenue segments include £514 million from Retail, £661.20 million from UK&I Online, and £516.10 million from International operations.

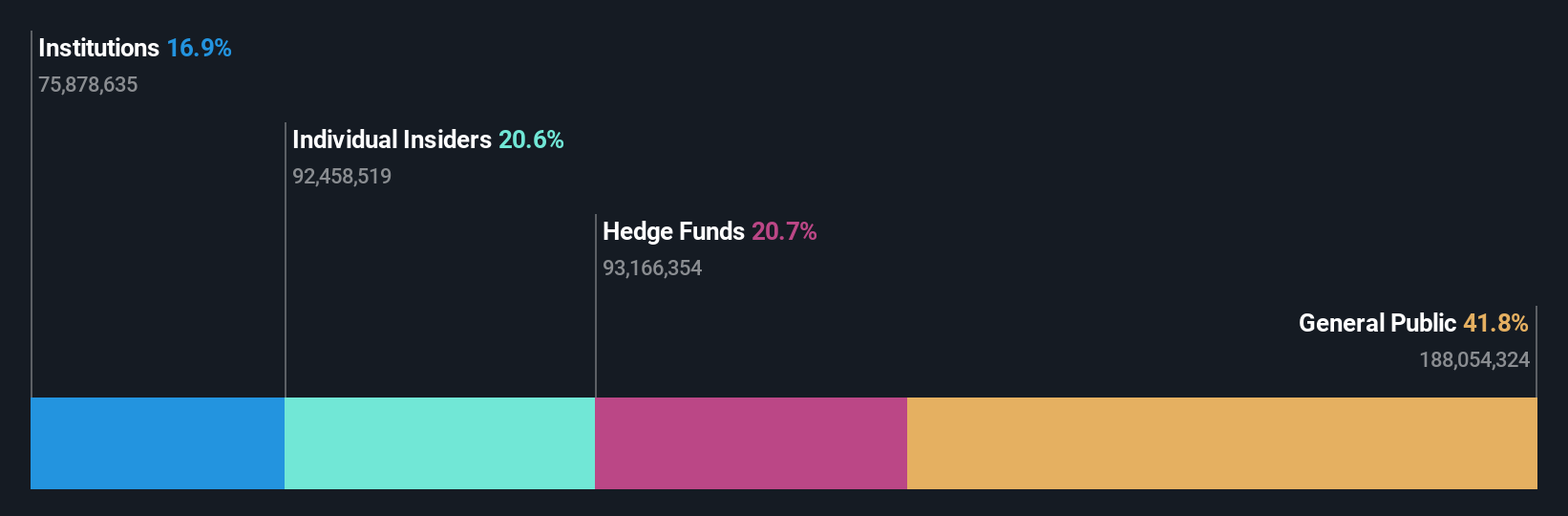

Insider Ownership: 20.5%

Evoke plc, trading significantly below its estimated fair value, reported a £417 million revenue for Q3 2024, marking its first year-over-year growth since early 2022. Despite high share price volatility and negative shareholders' equity, Evoke is expected to become profitable within three years with earnings forecasted to grow substantially. Revenue growth is projected at 5.8% annually, surpassing the UK market average. However, interest payments remain poorly covered by earnings.

- Dive into the specifics of Evoke here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Evoke's share price might be too pessimistic.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific regions and has a market cap of approximately £1.58 billion.

Operations: The company's revenue segments include $402.15 million from Worka, $1.30 billion from the Americas, $343.01 million from Asia Pacific, and $1.69 billion from Europe, the Middle East, and Africa (EMEA).

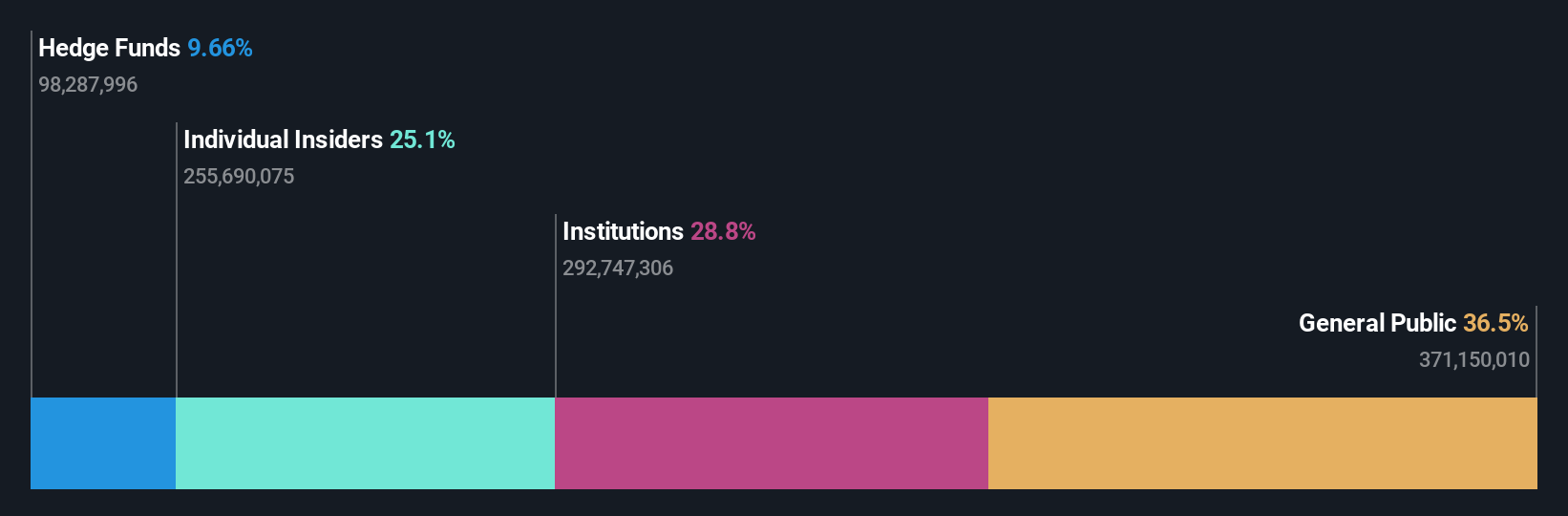

Insider Ownership: 25.2%

International Workplace Group plc shows potential as a growth-focused entity with high insider ownership, evidenced by more shares bought than sold recently. Despite slower revenue growth forecasts of 3.2% annually compared to the UK market, its earnings are projected to grow significantly at 118.77% per year, with profitability expected within three years. The company trades at good value relative to peers, and analysts anticipate a 46.3% stock price increase amidst recent board changes effective December 31, 2024.

- Navigate through the intricacies of International Workplace Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates International Workplace Group may be undervalued.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBC Bank Group PLC operates through its subsidiaries to offer banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market cap of £1.72 billion.

Operations: The company's revenue segments include banking, leasing, insurance, brokerage, and card processing services provided to both corporate and individual clients across Georgia, Azerbaijan, and Uzbekistan.

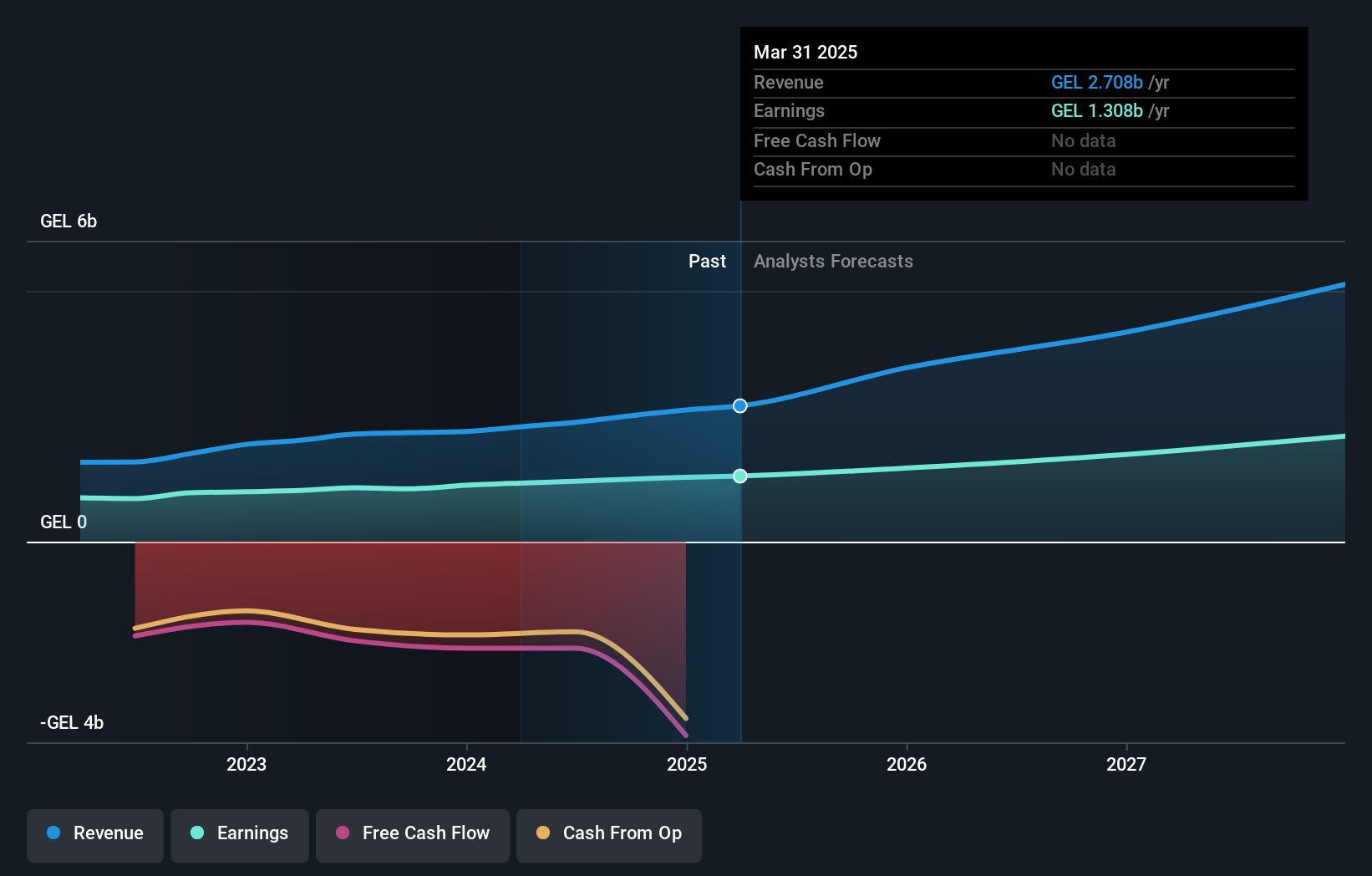

Insider Ownership: 17.5%

TBC Bank Group demonstrates growth potential with high insider ownership, as insiders have been net buyers in recent months. The company's earnings grew by 18.1% last year, and future revenue is projected to increase by 20.5% annually, outpacing the UK market. Despite a high level of bad loans at 2.1%, TBC's return on equity is expected to reach a robust 25.3%. Recent earnings reports show improved net income and interest income year-over-year.

- Click here to discover the nuances of TBC Bank Group with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that TBC Bank Group is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Dive into all 65 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Evoke, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Evoke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EVOK

Evoke

Operates as a betting and gaming company in the United Kingdom, Italy, Spain, Romania, Denmark, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives