- United Kingdom

- /

- Specialty Stores

- /

- AIM:VIC

European Undervalued Small Caps With Insider Action In May 2025

Reviewed by Simply Wall St

In May 2025, European markets have shown resilience, with the pan-European STOXX Europe 600 Index rising by 2.10% amid improved sentiment following a de-escalation in U.S.-China trade tensions. As major indices across Germany, France, Italy, and the UK also gained ground, investors are increasingly focused on identifying small-cap stocks that may be poised to benefit from these broader market movements. In this context of renewed optimism and economic growth indicators, a good stock is often characterized by strong fundamentals and potential for growth within its sector.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Savills | 24.6x | 0.5x | 41.24% | ★★★★☆☆ |

| FRP Advisory Group | 11.7x | 2.1x | 19.48% | ★★★★☆☆ |

| Tristel | 30.3x | 4.3x | 4.53% | ★★★★☆☆ |

| Cloetta | 15.5x | 1.1x | 45.81% | ★★★★☆☆ |

| SmartCraft | 41.3x | 7.4x | 34.63% | ★★★★☆☆ |

| AKVA group | 15.5x | 0.7x | 46.69% | ★★★★☆☆ |

| Italmobiliare | 11.7x | 1.5x | -212.09% | ★★★☆☆☆ |

| Close Brothers Group | NA | 0.6x | 0.48% | ★★★☆☆☆ |

| Eastnine | 18.3x | 8.8x | 39.80% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 43.26% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Property Franchise Group (AIM:TPFG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Property Franchise Group operates in the real estate sector, focusing on licensing, financial services, and property franchising, with a market cap of approximately £0.1 billion.

Operations: The company generates revenue primarily from property franchising (£40.90 million), financial services (£19.20 million), and licensing (£7.21 million). The gross profit margin has shown a decreasing trend, dropping from 91.72% in June 2014 to 66.81% by December 2024, indicating changes in cost structures over time.

PE: 30.0x

Property Franchise Group, a smaller company in Europe, shows potential for those eyeing growth. Their earnings are set to grow annually by 26.35%, although profit margins have dipped from 27.1% to 15.1%. Recent financials reveal sales of £67.31 million and net income of £10.19 million for 2024, up from the previous year, but earnings per share decreased slightly. Notably, insider confidence is evident with recent share purchases by executives in April 2025, signaling belief in future prospects despite reliance on external borrowing for funding.

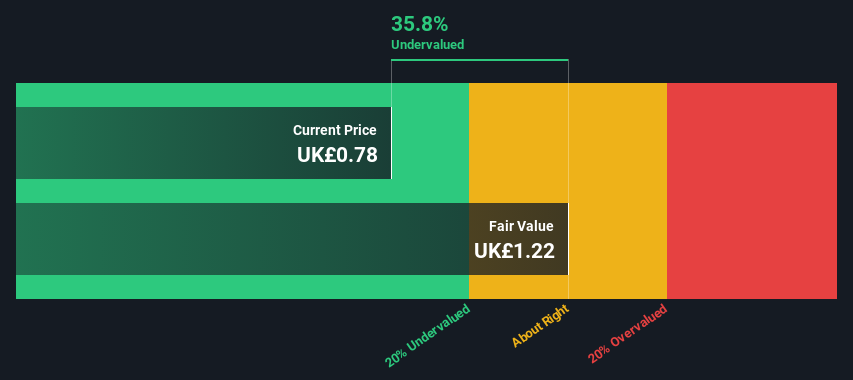

Victorian Plumbing Group (AIM:VIC)

Simply Wall St Value Rating: ★★★☆☆☆

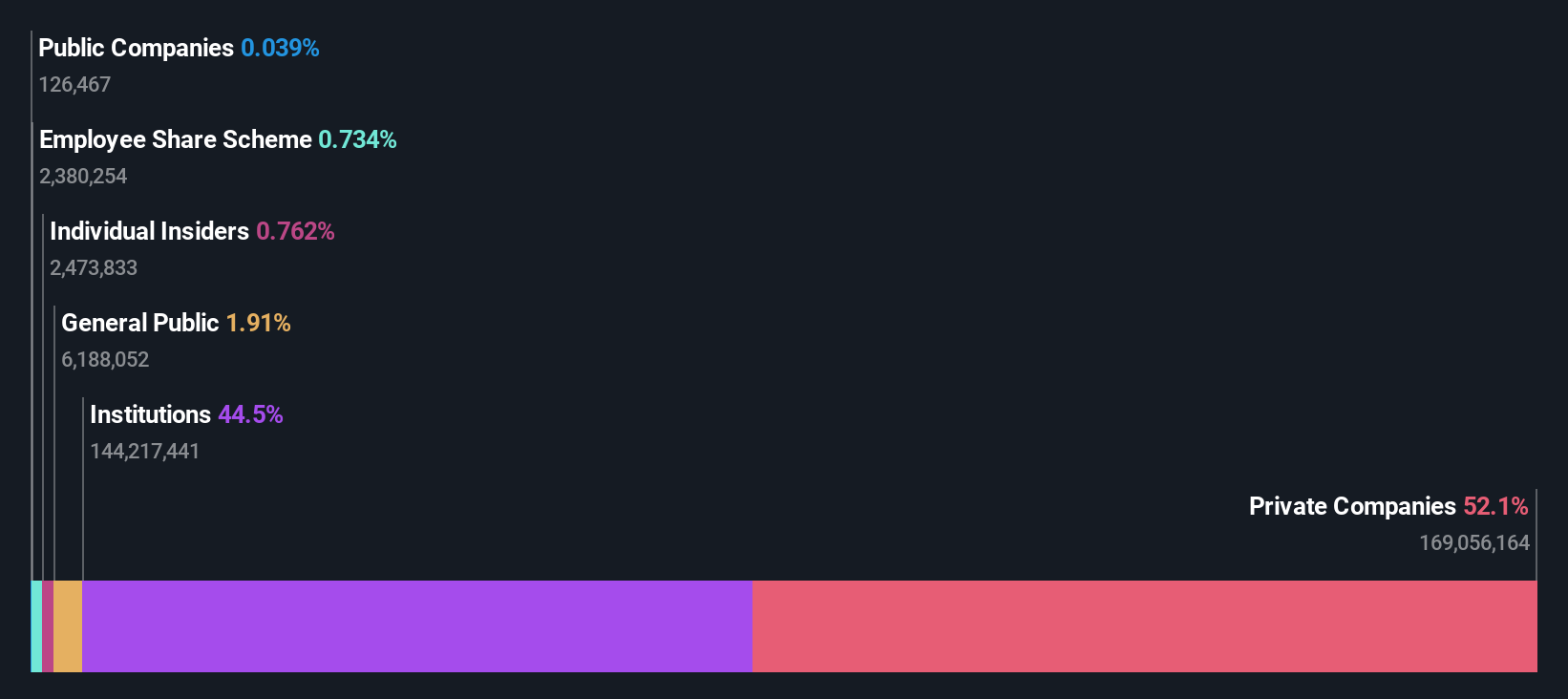

Overview: Victorian Plumbing Group is a UK-based online retailer specializing in bathroom products and accessories, with a market capitalization of approximately £0.5 billion.

Operations: Victorian Plumbing Group generates revenue primarily from sales, with notable costs including COGS and operating expenses. The gross profit margin shows an upward trend, reaching 50.07% by March 2025. Significant expenses include sales and marketing, which consistently account for a substantial portion of operating costs.

PE: 40.3x

Victorian Plumbing Group, a smaller player in Europe's market, recently projected 2025 revenue between £308 million and £313 million. Their half-year sales reached £152.7 million, up from last year's £144.6 million, though net income slightly dipped to £4.1 million. Despite volatile share prices and lower profit margins at 2.2%, earnings per share improved from the previous year. Insider confidence is evident with recent purchases, hinting at potential growth as earnings are forecasted to rise nearly 30% annually.

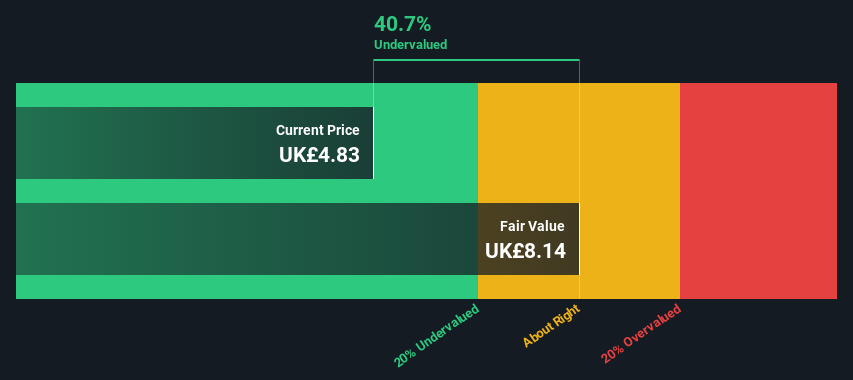

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harworth Group is a UK-based company specializing in the regeneration of brownfield land and property development, with a market cap of approximately £0.54 billion.

Operations: Harworth Group's revenue is primarily driven by the sale of development properties, which generated £140.25 million, followed by income generation and other property activities. The company's gross profit margin has shown variability, reaching 54.39% in recent periods but dropping to lower levels such as 17.11%. Operating expenses have been consistently increasing over time, contributing to fluctuations in net income margins across different periods.

PE: 10.0x

Harworth Group, a smaller player in the European market, has shown impressive growth with sales jumping to £181.59 million from last year's £72.43 million and net income rising to £57.24 million. Despite a dip in profit margins from 52.4% to 31.5%, insider confidence is evident through recent share purchases, hinting at potential value recognition by those within the company. The company also announced an eighth consecutive annual dividend increase of 10%, reflecting consistent shareholder returns amidst its external borrowing reliance for funding.

- Take a closer look at Harworth Group's potential here in our valuation report.

Evaluate Harworth Group's historical performance by accessing our past performance report.

Key Takeaways

- Access the full spectrum of 72 Undervalued European Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VIC

Victorian Plumbing Group

Operates as an online retailer of bathroom products and accessories for B2C and trade customers in the United Kingdom.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion