- United Kingdom

- /

- Machinery

- /

- AIM:JDG

3 UK Stocks That Might Be Undervalued By Up To 47.2%

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China and declining commodity prices impacting major companies. Despite these pressures, some stocks might be undervalued, presenting potential opportunities for investors who are vigilant in identifying companies with strong fundamentals that could weather current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £1.98 | £3.72 | 46.8% |

| Franchise Brands (AIM:FRAN) | £1.445 | £2.63 | 45.1% |

| Tracsis (AIM:TRCS) | £5.50 | £9.97 | 44.8% |

| Redcentric (AIM:RCN) | £1.2925 | £2.43 | 46.8% |

| Mpac Group (AIM:MPAC) | £4.725 | £9.04 | 47.8% |

| Videndum (LSE:VID) | £2.45 | £4.54 | 46% |

| Foxtons Group (LSE:FOXT) | £0.636 | £1.20 | 47.2% |

| SysGroup (AIM:SYS) | £0.325 | £0.65 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.191 | £0.37 | 48.2% |

| Genel Energy (LSE:GENL) | £0.763 | £1.49 | 48.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Judges Scientific (AIM:JDG)

Overview: Judges Scientific plc designs, manufactures, and sells scientific instruments with a market cap of £640.22 million.

Operations: The company generates revenue from two main segments: Vacuum (£65.40 million) and Materials Sciences (£70.20 million).

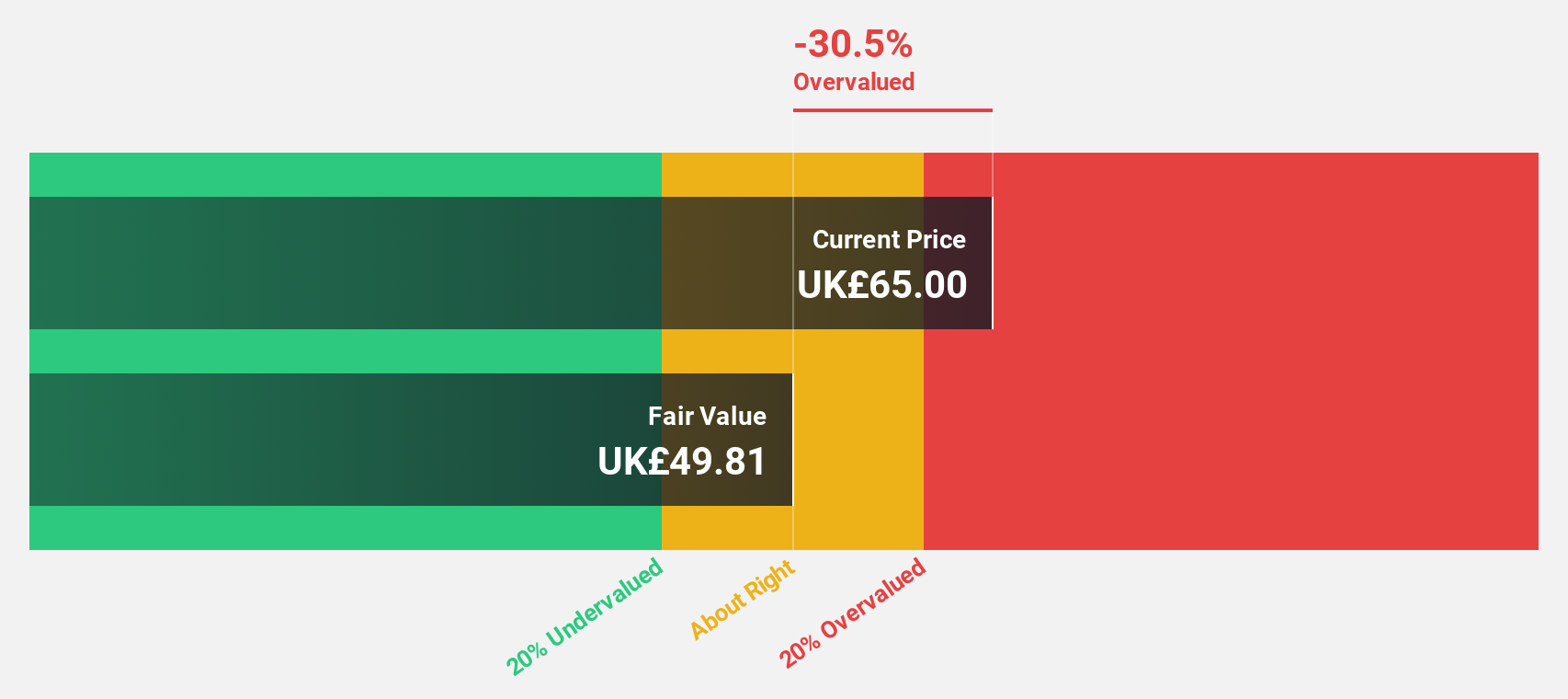

Estimated Discount To Fair Value: 10.8%

Judges Scientific reported a net income increase to £4.2 million for H1 2024, up from £1 million the previous year, with earnings per share also rising significantly. Despite high debt levels and recent insider selling, its earnings growth is forecast at 23% annually—outpacing the UK market's 14.2%. Trading at £96.4, it is undervalued based on discounted cash flow analysis by approximately 10.8%, with analysts predicting a potential stock price rise of 26%.

- According our earnings growth report, there's an indication that Judges Scientific might be ready to expand.

- Click here to discover the nuances of Judges Scientific with our detailed financial health report.

Keywords Studios (AIM:KWS)

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market cap of £1.96 billion.

Operations: The company generates revenue through its segments: Create (€365.56 million), Engage (€180.43 million), and Globalize (€261.61 million).

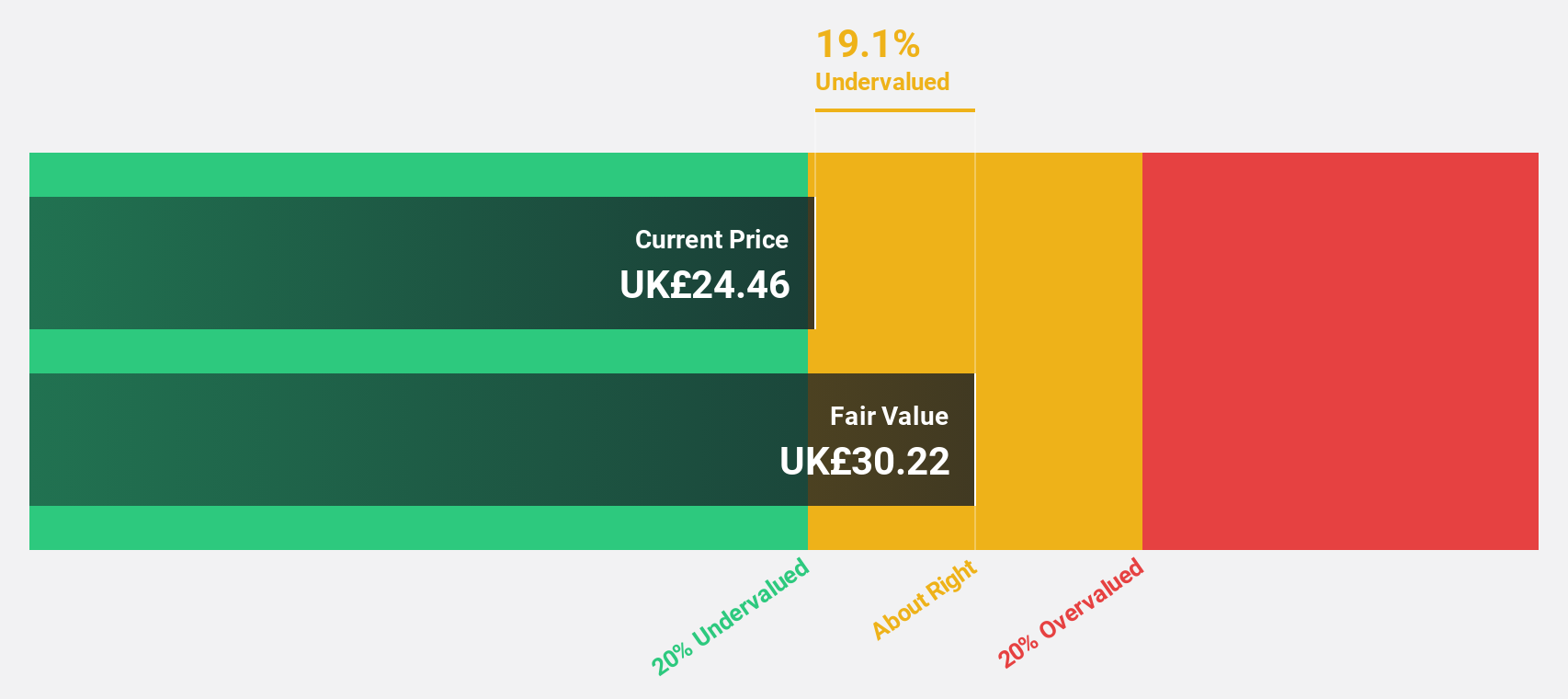

Estimated Discount To Fair Value: 20.1%

Keywords Studios is trading over 20% below its estimated fair value of £30.5, with a current price of £24.38, suggesting it may be undervalued based on discounted cash flow analysis. Despite reporting a net loss of €30.88 million for H1 2024, revenue grew to €440.43 million from €413.27 million year-on-year, and earnings are expected to grow significantly at 59.13% annually as the company aims for profitability within three years amidst faster-than-market revenue growth forecasts.

- In light of our recent growth report, it seems possible that Keywords Studios' financial performance will exceed current levels.

- Get an in-depth perspective on Keywords Studios' balance sheet by reading our health report here.

Foxtons Group (LSE:FOXT)

Overview: Foxtons Group plc is an estate agency offering services to the residential property market in the United Kingdom, with a market cap of £192.99 million.

Operations: The company's revenue is derived from three main segments: Sales (£41.84 million), Lettings (£103.78 million), and Financial Services (£9.10 million).

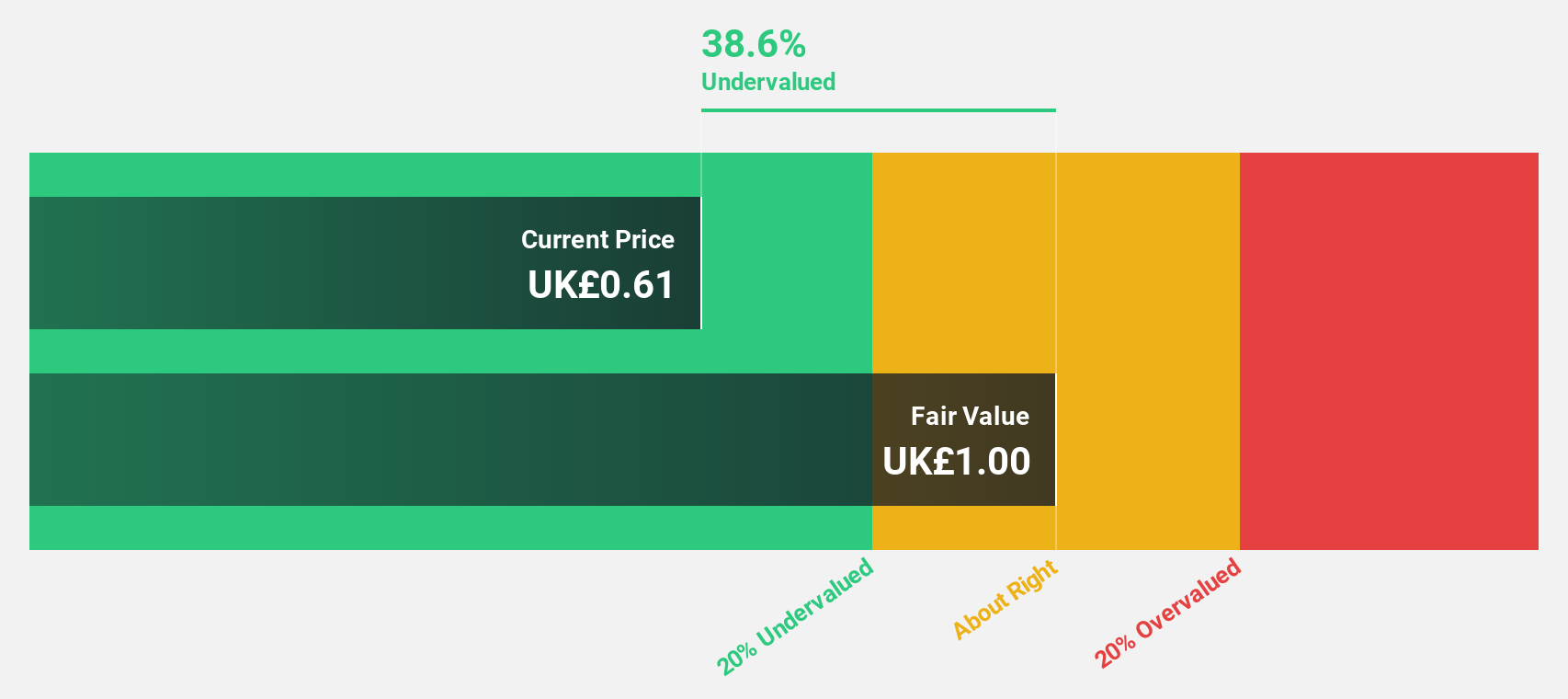

Estimated Discount To Fair Value: 47.2%

Foxtons Group is trading at £0.64, significantly below its estimated fair value of £1.2, indicating it may be undervalued based on discounted cash flow analysis. Recent earnings reports show a rise in net income to £5.89 million for H1 2024 from £4.12 million the previous year, despite profit margins declining to 4.7% from 7.4%. Earnings are expected to grow substantially at 32.14% annually, outpacing the UK market's growth rate forecast of 14.2%.

- Our earnings growth report unveils the potential for significant increases in Foxtons Group's future results.

- Dive into the specifics of Foxtons Group here with our thorough financial health report.

Next Steps

- Navigate through the entire inventory of 59 Undervalued UK Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JDG

Judges Scientific

Designs, manufactures, and sells scientific instruments and services.

Solid track record average dividend payer.

Market Insights

Community Narratives