- United Kingdom

- /

- Software

- /

- AIM:EXR

ENGAGE XR Holdings And 2 Other Promising Penny Stocks On The UK Exchange

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 closing lower due to weak trade data from China, highlighting ongoing global economic challenges. Despite these broader market conditions, there remains interest in niche investment areas like penny stocks, which can offer unique opportunities for those willing to explore beyond established names. Penny stocks, often representing smaller or newer companies, may still present value and growth potential when backed by solid financials; this article will explore a selection of such stocks that stand out for their resilience and promise.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.28 | £859.14M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.23 | £159.09M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.67 | £89.06M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.315 | £329.7M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ★★★★★★ |

| QinetiQ Group (LSE:QQ.) | £3.696 | £2.06B | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ENGAGE XR Holdings (AIM:EXR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ENGAGE XR Holdings plc is a virtual reality software company focused on the education and corporate training sectors globally, with a market cap of £6.56 million.

Operations: The company's revenue is derived entirely from its Internet Information Providers segment, amounting to €3.82 million.

Market Cap: £6.56M

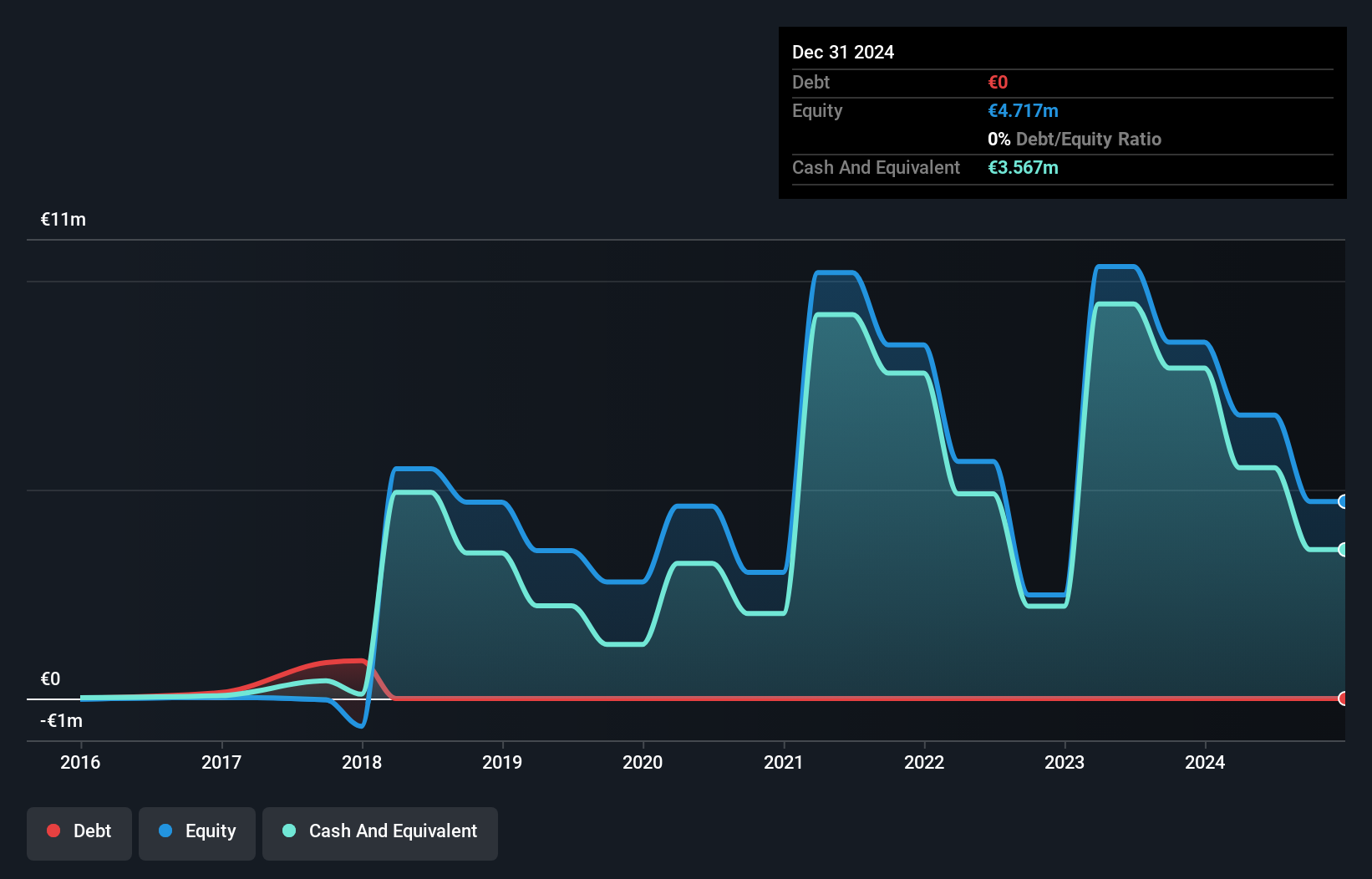

ENGAGE XR Holdings, with a market cap of £6.56 million, is showcasing its ENGAGE platform at the LEAP 2025 Tech Conference in Riyadh alongside PwC Middle East, highlighting strategic regional growth opportunities. Although unprofitable with a negative return on equity and declining earnings over five years, it remains debt-free and has sufficient cash runway for over a year. The company expects €3.4 million in revenue for 2024 with increased recurring revenues. Despite high volatility and lack of meaningful revenue, its seasoned management team provides stability amid challenges in the competitive VR/AR training sector.

- Take a closer look at ENGAGE XR Holdings' potential here in our financial health report.

- Explore historical data to track ENGAGE XR Holdings' performance over time in our past results report.

IG Design Group (AIM:IGR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IG Design Group plc is involved in the design, production, and distribution of celebrations, craft and creative play, stationery, gifting, and not for resale consumable products across the Americas, the United Kingdom, Netherlands, and internationally with a market cap of £55.74 million.

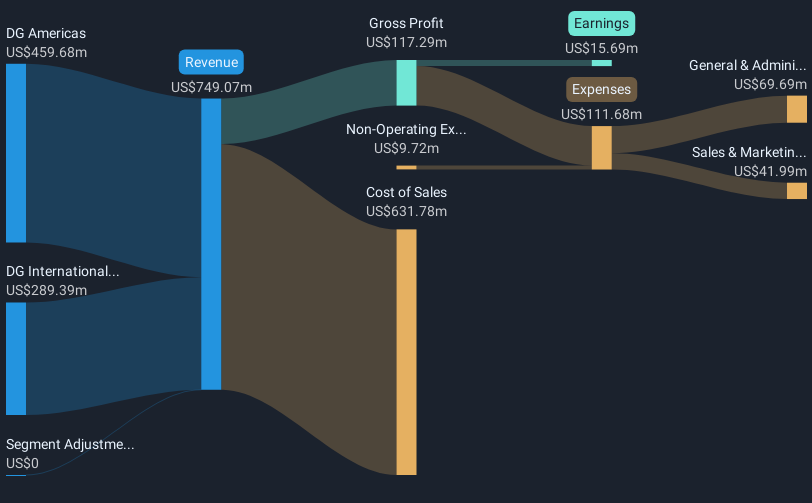

Operations: The company generates revenue from DG Americas, contributing $459.68 million, and DG International, which accounts for $289.39 million.

Market Cap: £55.74M

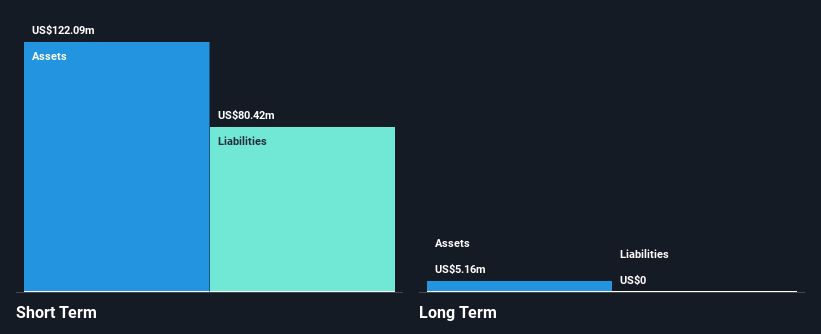

IG Design Group, with a market cap of £55.74 million, faces challenges typical of penny stocks, including high volatility and declining earnings over the past five years. Recent guidance indicates expected revenue declines for both DG Americas and DG International divisions. Despite a large one-off loss impacting recent financials, the company has become profitable this year and maintains a strong balance sheet with short-term assets exceeding liabilities. IG Design's debt is well covered by operating cash flow, showing financial resilience despite earnings pressure. Leadership changes aim to bolster strategic direction amid ongoing market complexities.

- Jump into the full analysis health report here for a deeper understanding of IG Design Group.

- Learn about IG Design Group's future growth trajectory here.

Aseana Properties (LSE:ASPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aseana Properties Limited is an investment holding company engaged in property development activities in Malaysia, with a market cap of $10.39 million.

Operations: Aseana Properties Limited does not have any reported revenue segments.

Market Cap: $10.39M

Aseana Properties, with a market cap of US$10.39 million, is navigating the challenges of being pre-revenue while focusing on property development in Malaysia. The company recently appointed Leong Kheng Cheong as CEO and board director, bringing extensive financial leadership experience to guide strategic growth. Aseana's short-term assets significantly exceed its liabilities, providing some financial stability despite having a high net debt to equity ratio of 56.3%. The company has undertaken a follow-on equity offering worth US$5.45 million to bolster its capital position amid ongoing efforts to reduce losses by 15.7% annually over the past five years.

- Get an in-depth perspective on Aseana Properties' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Aseana Properties' track record.

Taking Advantage

- Discover the full array of 443 UK Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENGAGE XR Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EXR

ENGAGE XR Holdings

Engages in the development of the educational virtual reality platform.

Undervalued with moderate risk.

Market Insights

Community Narratives