- United Kingdom

- /

- Capital Markets

- /

- LSE:LSAA

Discovering UK Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The UK market has been experiencing turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic interdependencies. In such uncertain times, investors often look for opportunities in smaller companies that can offer growth potential at a lower entry cost. Penny stocks, though an older term, still represent these opportunities; when backed by strong financials and fundamentals, they can be worthwhile considerations for those seeking value in under-the-radar companies.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.805 | £463.19M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.984 | £155.22M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £1.898 | £715.19M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.61 | £413.58M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.49 | £66.56M | ★★★★☆☆ |

| Luceco (LSE:LUCE) | £1.16 | £178.91M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.44 | £183.39M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.35 | £333.18M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.07 | £91.42M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.185 | £199.59M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Croma Security Solutions Group (AIM:CSSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Croma Security Solutions Group plc offers security services in the United Kingdom and has a market cap of £11.81 million.

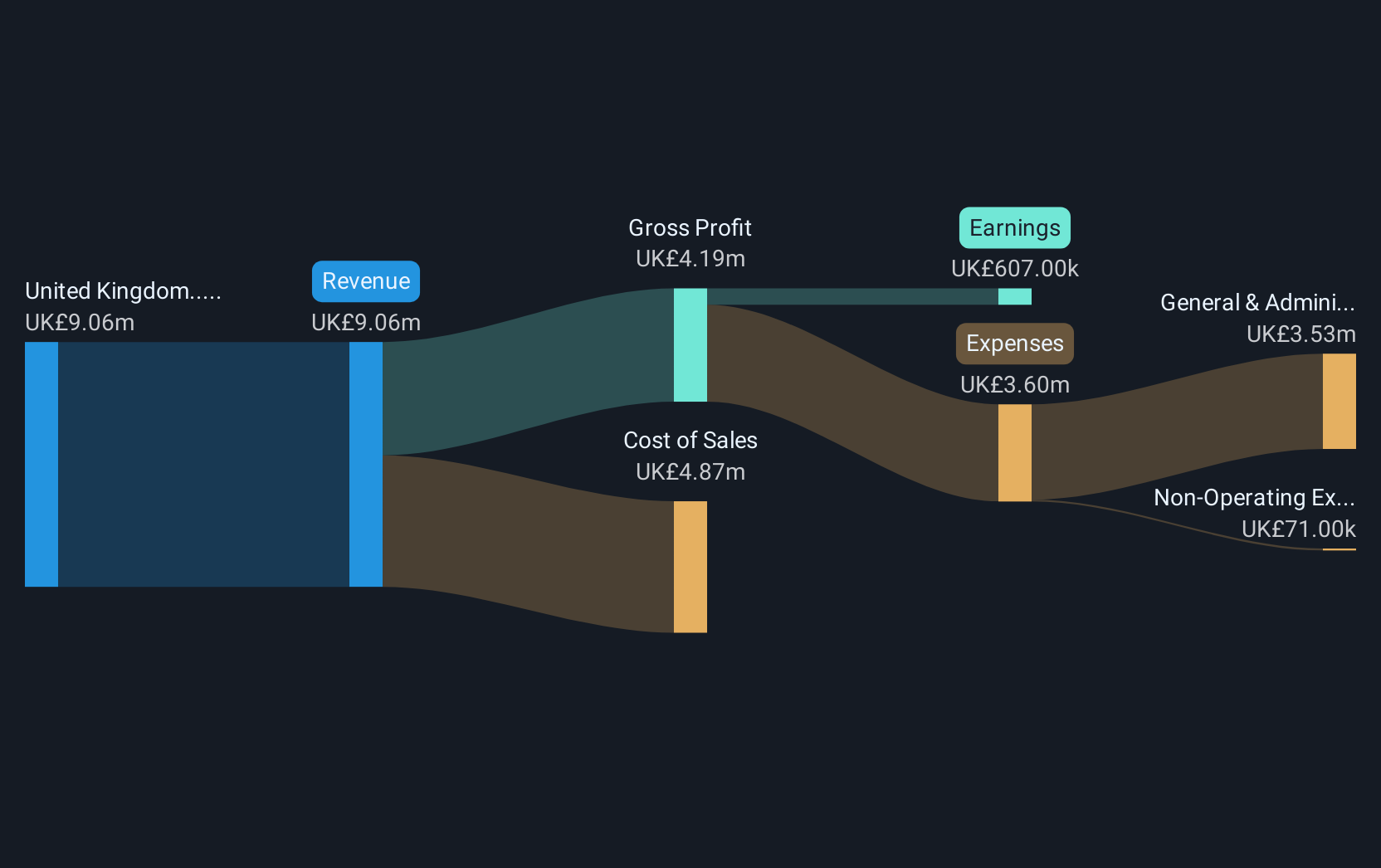

Operations: The company generates revenue through its Croma Locksmiths segment, which accounts for £5.10 million, and its Croma Security Systems segment, including Croma Biometrics, which contributes £3.80 million.

Market Cap: £11.81M

Croma Security Solutions Group plc, with a market cap of £11.81 million, has shown significant earnings growth of 227.1% over the past year, surpassing industry averages. Despite this growth, its Return on Equity remains low at 3.6%, and shareholders have experienced dilution with a 3% increase in shares outstanding. The company is debt-free and boasts high-quality earnings; however, its dividend yield of 2.67% is not well covered by free cash flows. Recent announcements include a final dividend of 2.3 pence per share to be paid in December 2024 following approval at the AGM held earlier that month.

- Navigate through the intricacies of Croma Security Solutions Group with our comprehensive balance sheet health report here.

- Explore Croma Security Solutions Group's analyst forecasts in our growth report.

Aseana Properties (LSE:ASPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aseana Properties Limited is an investment holding company engaged in property development activities in Malaysia, with a market capitalization of $14.79 million.

Operations: No specific revenue segments are reported for the company's activities.

Market Cap: $14.79M

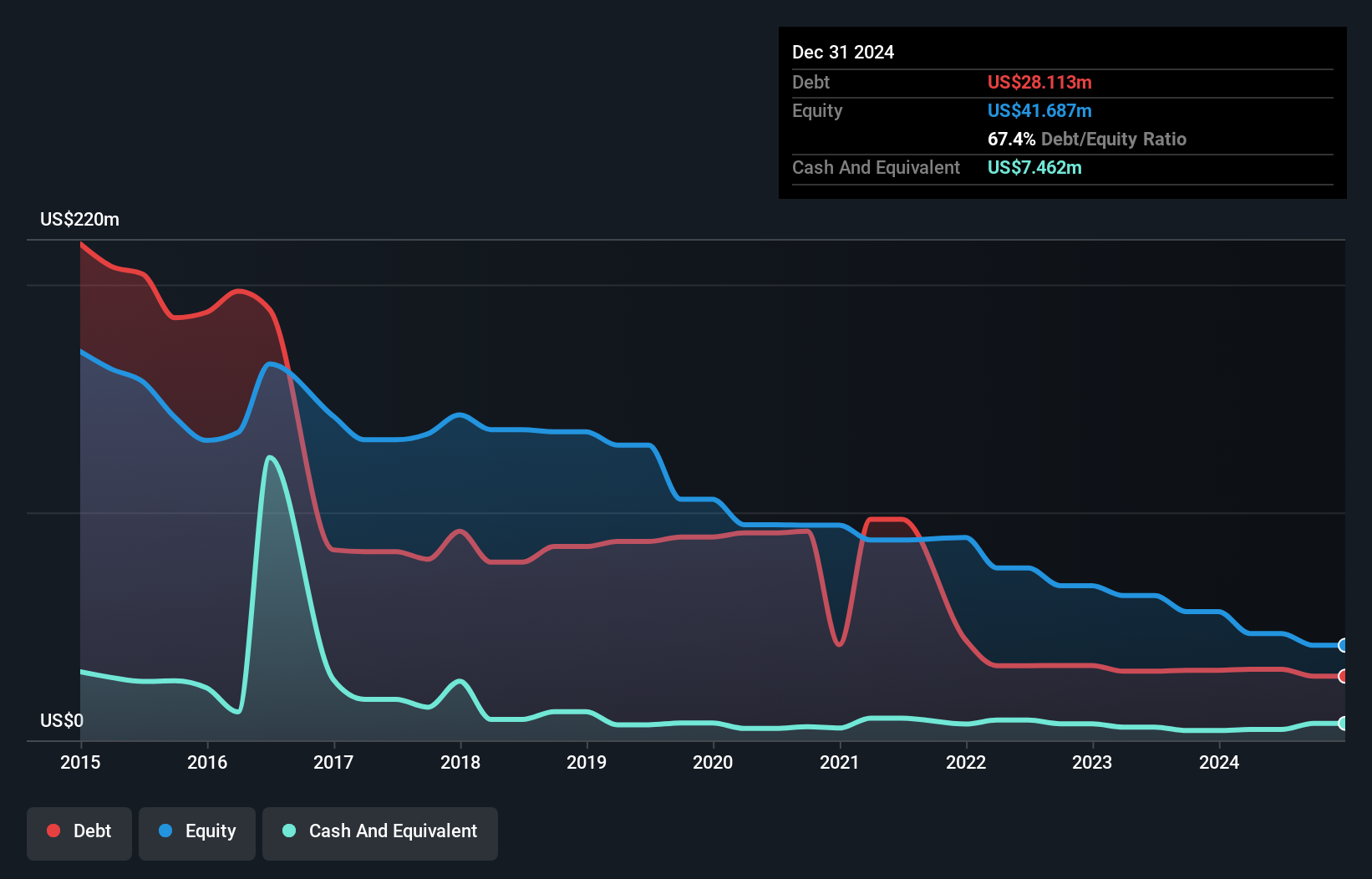

Aseana Properties Limited, with a market capitalization of $14.79 million, is pre-revenue and currently unprofitable. The company has managed to reduce its losses by 15.7% annually over the past five years, despite a high net debt to equity ratio of 56.3%. It maintains sufficient cash runway for over a year based on current free cash flow levels. Recent developments include a follow-on equity offering of $5.45 million and the appointment of Leong Kheng Cheong as CEO, who brings extensive finance and strategic leadership experience from various multinational corporations in Asia.

- Get an in-depth perspective on Aseana Properties' performance by reading our balance sheet health report here.

- Explore historical data to track Aseana Properties' performance over time in our past results report.

Life Settlement Assets (LSE:LSAA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Life Settlement Assets PLC, with a market cap of $84.92 million, is a closed-ended investment trust company that manages investments in whole and fractional interests in life settlement policies primarily issued by U.S. life insurance companies.

Operations: The company's revenue segment consists of $16.68 million from life settlement portfolios.

Market Cap: $84.92M

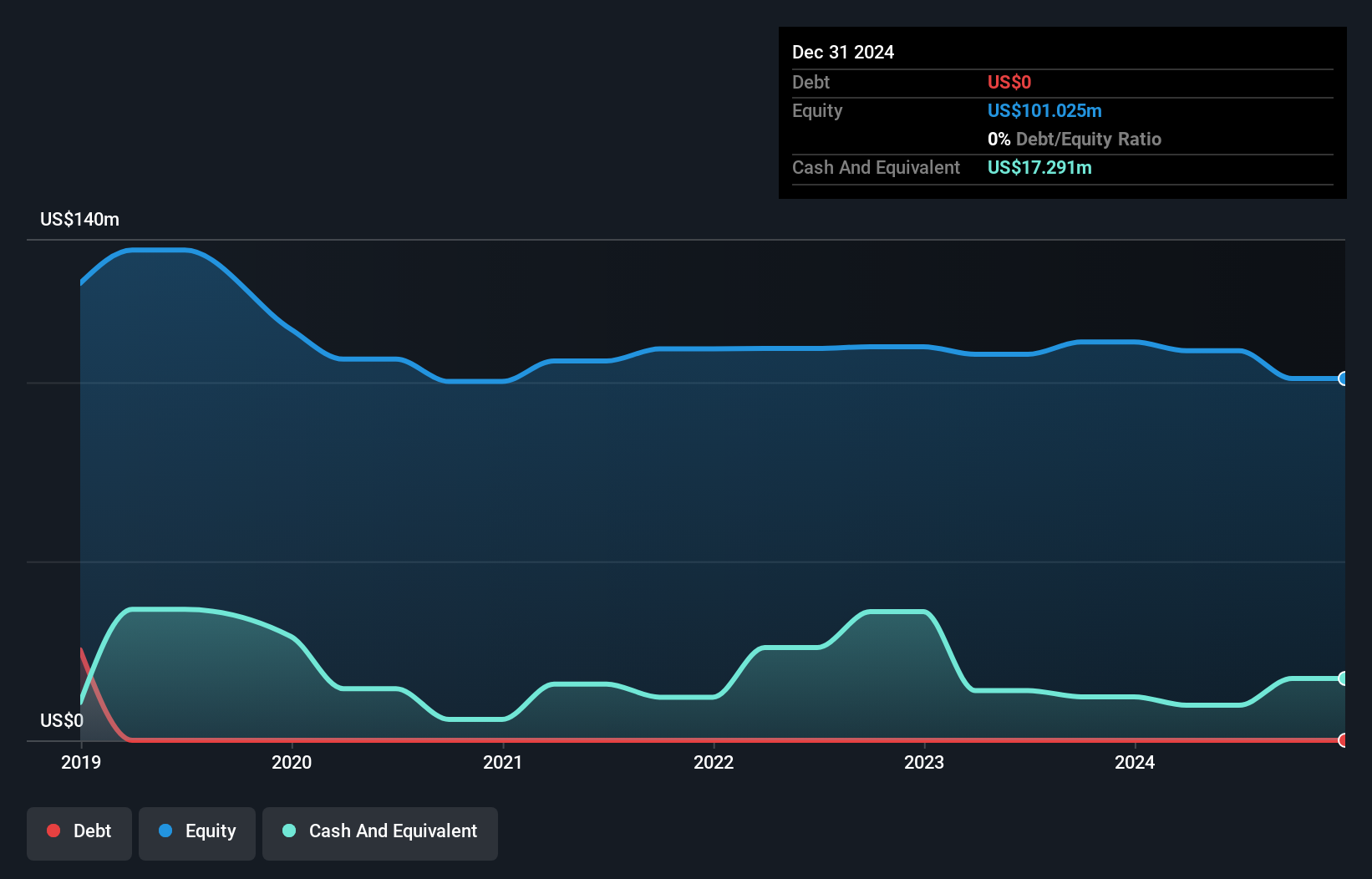

Life Settlement Assets PLC, with a market cap of $84.92 million, shows promising financial metrics for investors interested in penny stocks. The company has demonstrated significant earnings growth over the past year at 410.7%, far surpassing the Capital Markets industry average. It operates debt-free, alleviating concerns over interest coverage and long-term liabilities, while its short-term assets ($42.5M) comfortably exceed short-term liabilities ($2.2M). Despite this growth, LSAA's Return on Equity is low at 6.4%, and its dividend track record remains unstable. The board is experienced with an average tenure of 5.3 years, providing seasoned oversight.

- Take a closer look at Life Settlement Assets' potential here in our financial health report.

- Review our historical performance report to gain insights into Life Settlement Assets' track record.

Taking Advantage

- Unlock our comprehensive list of 463 UK Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSAA

Life Settlement Assets

A closed-ended investment trust company, invests in and manages portfolios of whole and fractional interests in life settlement policies issued by life insurance companies operating primarily in the United States.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives