- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

We Think The Compensation For The Property Franchise Group PLC's (LON:TPFG) CEO Looks About Right

Key Insights

- Property Franchise Group's Annual General Meeting to take place on 7th of June

- Salary of UK£282.0k is part of CEO Gareth Samples's total remuneration

- The overall pay is comparable to the industry average

- Over the past three years, Property Franchise Group's EPS fell by 6.5% and over the past three years, the total shareholder return was 63%

Despite strong share price growth of 63% for The Property Franchise Group PLC (LON:TPFG) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 7th of June may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for Property Franchise Group

Comparing The Property Franchise Group PLC's CEO Compensation With The Industry

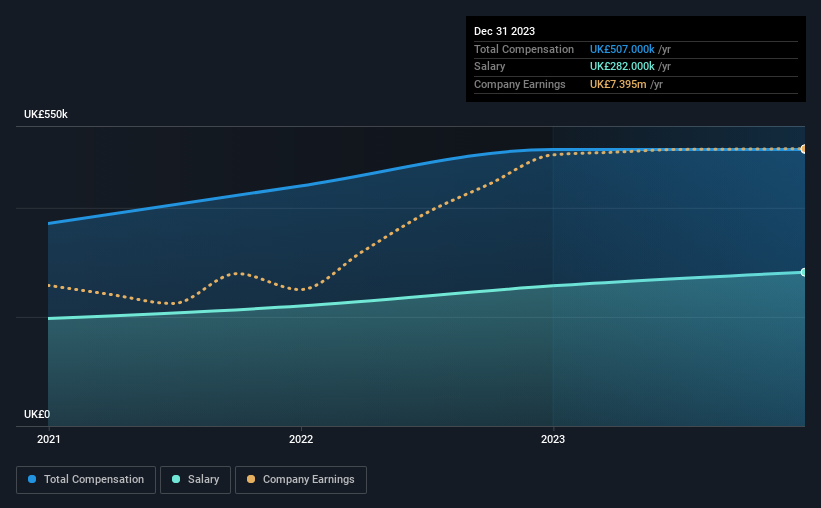

Our data indicates that The Property Franchise Group PLC has a market capitalization of UK£252m, and total annual CEO compensation was reported as UK£507k for the year to December 2023. There was no change in the compensation compared to last year. We note that the salary of UK£282.0k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the British Real Estate industry with market capitalizations ranging from UK£157m to UK£628m, the reported median CEO total compensation was UK£657k. This suggests that Property Franchise Group remunerates its CEO largely in line with the industry average. What's more, Gareth Samples holds UK£575k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | UK£282k | UK£257k | 56% |

| Other | UK£225k | UK£250k | 44% |

| Total Compensation | UK£507k | UK£507k | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. Property Franchise Group pays a modest slice of remuneration through salary, as compared to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at The Property Franchise Group PLC's Growth Numbers

The Property Franchise Group PLC has reduced its earnings per share by 6.5% a year over the last three years. In the last year, its revenue changed by just 0.4%.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue is seriously uninspiring. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has The Property Franchise Group PLC Been A Good Investment?

Most shareholders would probably be pleased with The Property Franchise Group PLC for providing a total return of 63% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Property Franchise Group you should be aware of, and 1 of them can't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TPFG

Property Franchise Group

Engages in residential property franchise, and licensing and financial services businesses in the United Kingdom.

Solid track record average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion