- United Kingdom

- /

- Real Estate

- /

- AIM:FLK

Lacklustre Performance Is Driving Fletcher King Plc's (LON:FLK) 32% Price Drop

The Fletcher King Plc (LON:FLK) share price has fared very poorly over the last month, falling by a substantial 32%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

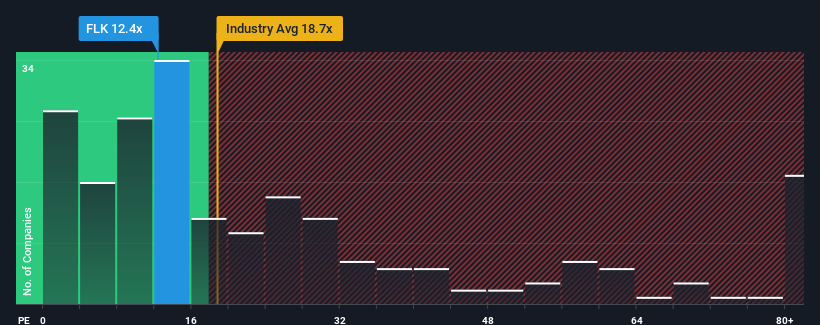

Following the heavy fall in price, Fletcher King may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.4x, since almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 30x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Fletcher King recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Fletcher King

How Is Fletcher King's Growth Trending?

In order to justify its P/E ratio, Fletcher King would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 21% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Fletcher King's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Fletcher King's P/E has taken a tumble along with its share price. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Fletcher King revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Fletcher King (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Fletcher King's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FLK

Fletcher King

Provides a range of property advice services in the United Kingdom.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026