- United Kingdom

- /

- Real Estate

- /

- AIM:FLK

Here's Why We Think Fletcher King (LON:FLK) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Fletcher King (LON:FLK), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fletcher King with the means to add long-term value to shareholders.

See our latest analysis for Fletcher King

How Fast Is Fletcher King Growing Its Earnings Per Share?

Over the last three years, Fletcher King has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Fletcher King's EPS shot up from UK£0.016 to UK£0.023; a result that's bound to keep shareholders happy. That's a commendable gain of 40%.

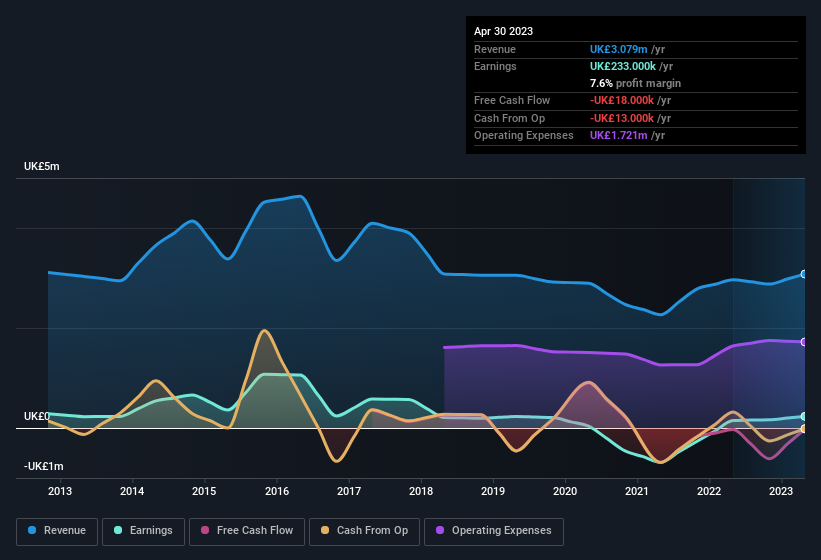

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Fletcher King shareholders is that EBIT margins have grown from 0.2% to 4.8% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Fletcher King is no giant, with a market capitalisation of UK£4.2m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Fletcher King Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations under UK£163m, like Fletcher King, the median CEO pay is around UK£283k.

The Fletcher King CEO received UK£195k in compensation for the year ending April 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Fletcher King To Your Watchlist?

For growth investors, Fletcher King's raw rate of earnings growth is a beacon in the night. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. We think that based on its merits alone, this stock is worth watching into the future. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Fletcher King (at least 3 which don't sit too well with us) , and understanding these should be part of your investment process.

Although Fletcher King certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FLK

Fletcher King

Provides a range of property advice services in the United Kingdom.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives