- United Kingdom

- /

- Life Sciences

- /

- LSE:ONT

Oxford Nanopore Technologies plc's (LON:ONT) Share Price Matching Investor Opinion

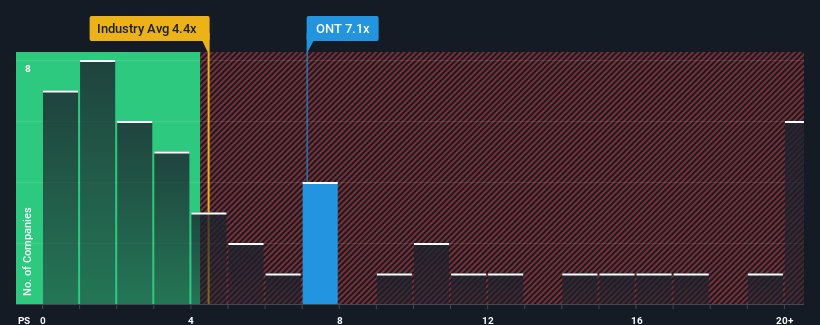

Oxford Nanopore Technologies plc's (LON:ONT) price-to-sales (or "P/S") ratio of 7.1x might make it look like a sell right now compared to the Life Sciences industry in the United Kingdom, where around half of the companies have P/S ratios below 5.5x and even P/S below 2x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Oxford Nanopore Technologies

How Has Oxford Nanopore Technologies Performed Recently?

Oxford Nanopore Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oxford Nanopore Technologies.Is There Enough Revenue Growth Forecasted For Oxford Nanopore Technologies?

In order to justify its P/S ratio, Oxford Nanopore Technologies would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Still, the latest three year period has seen an excellent 49% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 23% each year during the coming three years according to the nine analysts following the company. With the industry only predicted to deliver 11% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Oxford Nanopore Technologies' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Oxford Nanopore Technologies' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Oxford Nanopore Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 3 warning signs for Oxford Nanopore Technologies that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Oxford Nanopore Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ONT

Oxford Nanopore Technologies

Engages in the research, development, manufacture, and commercialization of a nanopore based sequencing platform that allows the real-time analysis of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA) in the Americas, Europe, the Middle East, Africa, India, and the Asia Pacific.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives