- United Kingdom

- /

- Life Sciences

- /

- LSE:ONT

Investors Appear Satisfied With Oxford Nanopore Technologies plc's (LON:ONT) Prospects As Shares Rocket 33%

Despite an already strong run, Oxford Nanopore Technologies plc (LON:ONT) shares have been powering on, with a gain of 33% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

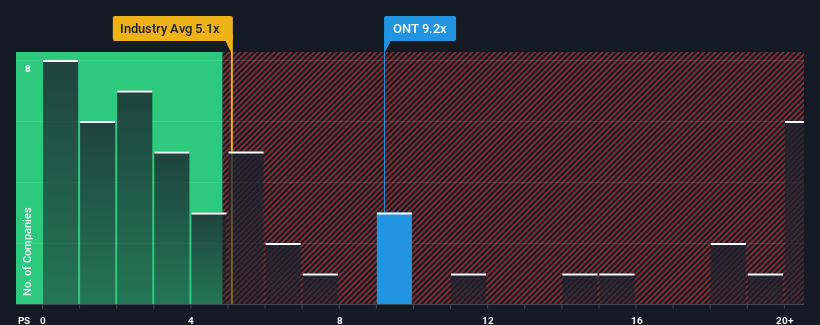

Following the firm bounce in price, Oxford Nanopore Technologies may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.2x, when you consider almost half of the companies in the Life Sciences industry in the United Kingdom have P/S ratios under 4.3x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Oxford Nanopore Technologies

What Does Oxford Nanopore Technologies' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Oxford Nanopore Technologies has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Oxford Nanopore Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Oxford Nanopore Technologies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.4% last year. Pleasingly, revenue has also lifted 35% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 27% per year over the next three years. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader industry.

With this information, we can see why Oxford Nanopore Technologies is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Oxford Nanopore Technologies' P/S?

Oxford Nanopore Technologies' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Oxford Nanopore Technologies shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Oxford Nanopore Technologies.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ONT

Oxford Nanopore Technologies

Engages in the research, development, manufacture, and commercialization of a nanopore based sequencing platform that allows the real-time analysis of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA) in the Americas, Europe, the Middle East, Africa, India, and the Asia Pacific.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives