- United Kingdom

- /

- Pharma

- /

- LSE:INDV

The Market Lifts Indivior PLC (LON:INDV) Shares 26% But It Can Do More

Indivior PLC (LON:INDV) shares have continued their recent momentum with a 26% gain in the last month alone. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

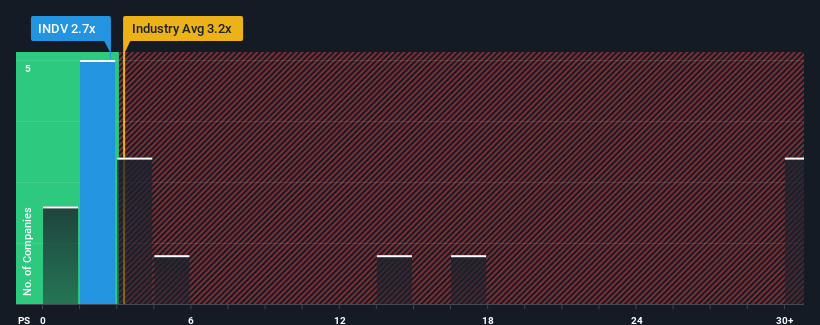

Even after such a large jump in price, Indivior's price-to-sales (or "P/S") ratio of 2.7x might still make it look like a buy right now compared to the Pharmaceuticals industry in the United Kingdom, where around half of the companies have P/S ratios above 3.4x and even P/S above 17x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Indivior

What Does Indivior's Recent Performance Look Like?

Recent times have been advantageous for Indivior as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Indivior's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Indivior's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. The latest three year period has also seen an excellent 69% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 13% per year over the next three years. With the industry only predicted to deliver 7.1% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Indivior's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Indivior's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Indivior's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Indivior is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of Indivior's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:INDV

Indivior

Engages in the development, manufacture, and sale of buprenorphine-based prescription drugs for the treatment of opioid dependence and co-occurring disorders in the United States, the United Kingdom, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives