- United Kingdom

- /

- Pharma

- /

- LSE:GSK

GSK (LSE:GSK) Sees 6% Share Price Decline Over The Last Quarter

Reviewed by Simply Wall St

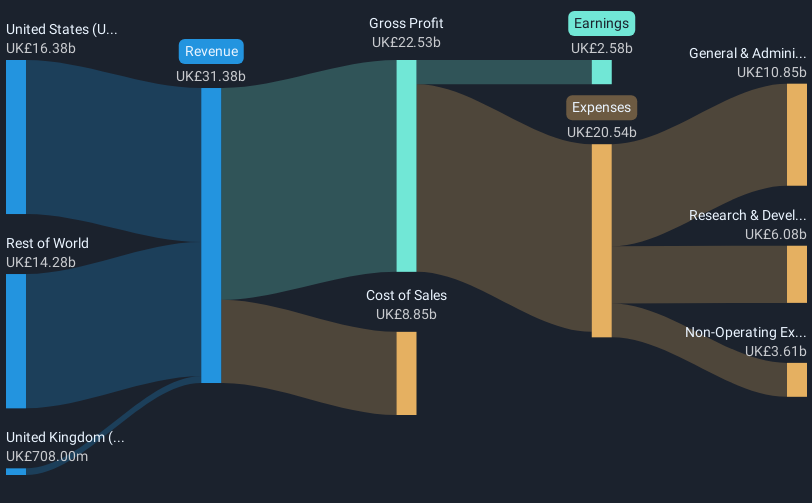

GSK (LSE:GSK) recently announced the FDA approval of Blujepa, a first-in-class antibiotic for urinary tract infections, and the EMA's acceptance of an application for Nucala's expanded use. Despite these positive developments, the company's share price experienced a 6% decline over the last quarter. This movement occurred amid broader market volatility, where major indices faced notable declines, though recently improved following a pause on tariffs. GSK's earnings report revealed a decline in net income, which might have weighed on investor sentiment, overshadowing the impact of new product approvals and regulatory progress.

We've discovered 4 possible red flags for GSK that you should be aware of before investing here.

The recent FDA approval for Blujepa and EMA's acceptance of the expanded use application for Nucala could signal significant future potential for GSK's revenue and earnings. With these approvals, the company may strengthen its portfolio, enhancing investor confidence in projected future growth. In the longer-term context, GSK's total shareholder return, including dividends and share price movement, experienced a marginal 0.05% decline over the past five years. This performance indicates challenges in maintaining positive returns, despite positive developments, such as those recently announced.

Comparatively, GSK underperformed the UK market's 3% decline and the UK Pharmaceuticals industry's 4.8% dip over the last year, highlighting industry-wide pressures. Analysts forecast revenue growth, but recent underperformance suggests potential risks in aligning with optimistic estimates. The analyst consensus price target of £17.08, which is 16.1% higher than the current share price of £14.34, suggests room for upside if upcoming product approvals and market conditions materialize as expected. Investors should consider these factors in relation to the company's current valuation and future expectations.

Explore GSK's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GSK

GSK

Engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives