- United Kingdom

- /

- Pharma

- /

- AIM:STX

What Does The Future Hold For Shield Therapeutics plc (LON:STX)? These Analysts Have Been Cutting Their Estimates

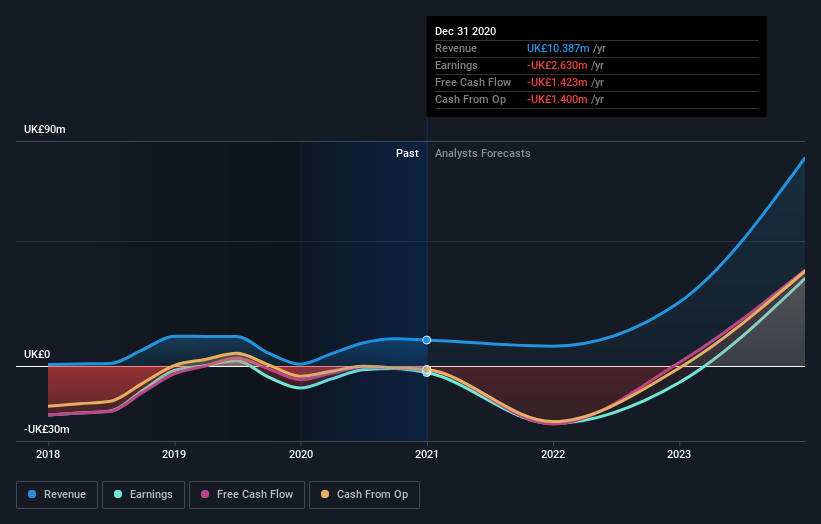

Market forces rained on the parade of Shield Therapeutics plc (LON:STX) shareholders today, when the analysts downgraded their forecasts for this year. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. At UK£0.48, shares are up 4.9% in the past 7 days. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

Following the downgrade, the consensus from four analysts covering Shield Therapeutics is for revenues of UK£7.9m in 2021, implying a concerning 24% decline in sales compared to the last 12 months. Per-share losses are expected to explode, reaching UK£0.12 per share. Yet before this consensus update, the analysts had been forecasting revenues of UK£10m and losses of UK£0.11 per share in 2021. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for Shield Therapeutics

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 24% by the end of 2021. This indicates a significant reduction from annual growth of 55% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.1% annually for the foreseeable future. It's pretty clear that Shield Therapeutics' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Shield Therapeutics. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Shield Therapeutics after today.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Shield Therapeutics' financials, such as a short cash runway. Learn more, and discover the 1 other concern we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Shield Therapeutics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:STX

Shield Therapeutics

A commercial stage specialty pharmaceutical company, focuses on development and commercialization of clinical-stage pharmaceuticals to treat unmet medical needs.

High growth potential moderate.

Similar Companies

Market Insights

Community Narratives