- United Kingdom

- /

- Pharma

- /

- AIM:STX

Shield Therapeutics plc's (LON:STX) Shares Leap 44% Yet They're Still Not Telling The Full Story

Despite an already strong run, Shield Therapeutics plc (LON:STX) shares have been powering on, with a gain of 44% in the last thirty days. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 77% share price drop in the last twelve months.

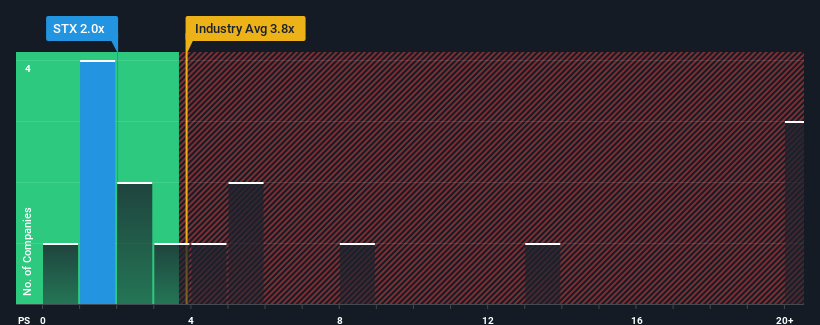

Even after such a large jump in price, Shield Therapeutics' price-to-sales (or "P/S") ratio of 2x might still make it look like a buy right now compared to the Pharmaceuticals industry in the United Kingdom, where around half of the companies have P/S ratios above 3.9x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shield Therapeutics

What Does Shield Therapeutics' Recent Performance Look Like?

Recent times have been advantageous for Shield Therapeutics as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shield Therapeutics.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Shield Therapeutics would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 138% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 7.9% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 155% over the next year. With the industry only predicted to deliver 8.4%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Shield Therapeutics' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Shield Therapeutics' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Shield Therapeutics currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Shield Therapeutics is showing 4 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Shield Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:STX

Shield Therapeutics

A commercial stage specialty pharmaceutical company, focuses on commercialization of pharmaceuticals to treat unmet medical needs.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives