- United Kingdom

- /

- Pharma

- /

- AIM:STX

Shield Therapeutics (LON:STX) shareholder returns have been splendid, earning 110% in 1 year

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Shield Therapeutics plc (LON:STX) share price has soared 110% in the last 1 year. Most would be very happy with that, especially in just one year! Shareholders are also celebrating an even better 202% rise, over the last three months. Zooming out, the stock is actually down 5.5% in the last three years.

Since it's been a strong week for Shield Therapeutics shareholders, let's have a look at trend of the longer term fundamentals.

Because Shield Therapeutics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Shield Therapeutics saw its revenue grow by 93%. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 110% as we previously mentioned. It's great to see strong revenue growth, but the question is whether it can be sustained. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

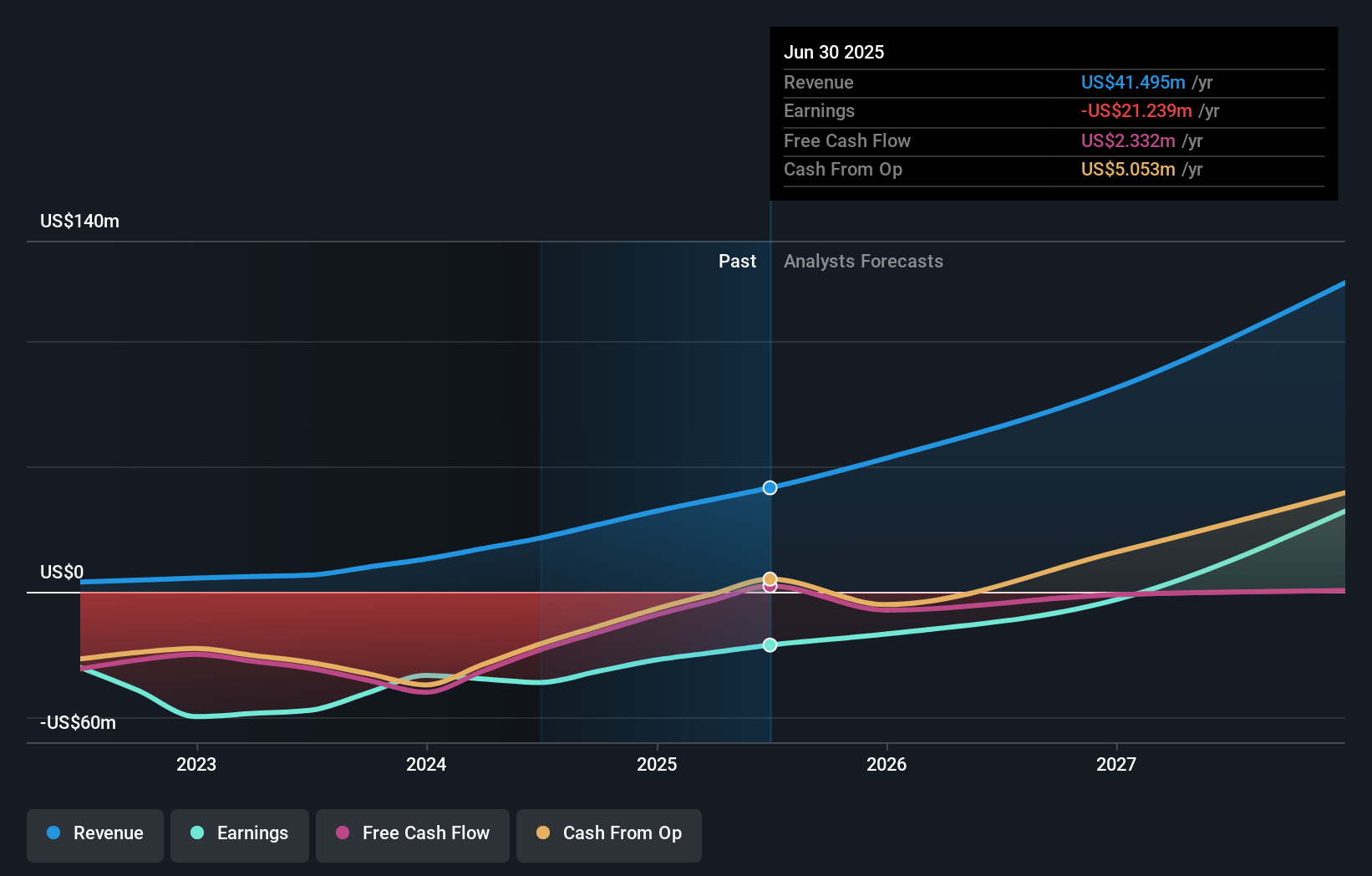

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Shield Therapeutics will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Shield Therapeutics shareholders have received a total shareholder return of 110% over the last year. That certainly beats the loss of about 14% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Shield Therapeutics has 3 warning signs we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STX

Shield Therapeutics

A commercial stage specialty pharmaceutical company, focuses on development and commercialization of clinical-stage pharmaceuticals to treat unmet medical needs.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.