- United Kingdom

- /

- Pharma

- /

- AIM:STX

Further weakness as Shield Therapeutics (LON:STX) drops 11% this week, taking three-year losses to 88%

As an investor, mistakes are inevitable. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Shield Therapeutics plc (LON:STX), who have seen the share price tank a massive 89% over a three year period. That'd be enough to cause even the strongest minds some disquiet. The last week also saw the share price slip down another 11%. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Shield Therapeutics has shed UK£5.9m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Shield Therapeutics

Shield Therapeutics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Shield Therapeutics saw its revenue shrink by 34% per year. That's definitely a weaker result than most pre-profit companies report. And as you might expect the share price has been weak too, dropping at a rate of 24% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. There is a good reason that investors often describe buying a sharply falling stock price as 'trying to catch a falling knife'. Think about it.

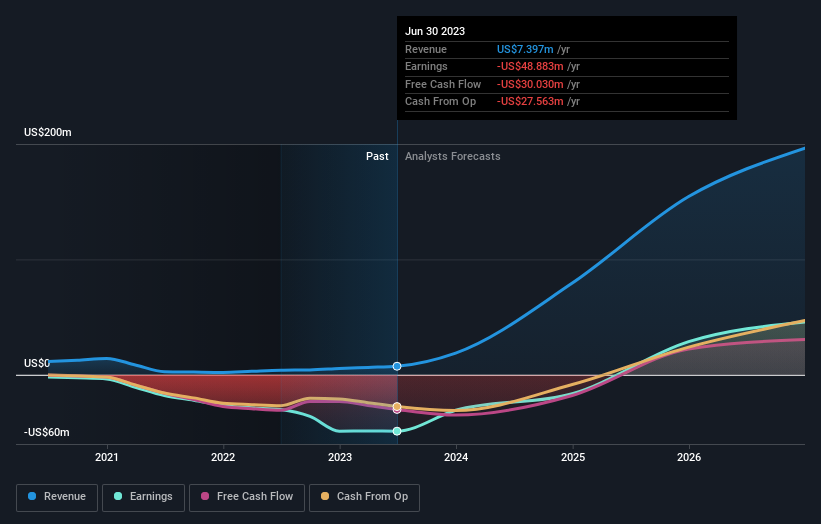

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Shield Therapeutics in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Shield Therapeutics shareholders are down 6.9% for the year. Unfortunately, that's worse than the broader market decline of 1.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Shield Therapeutics (1 is a bit concerning!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STX

Shield Therapeutics

A commercial stage specialty pharmaceutical company, focuses on development and commercialization of clinical-stage pharmaceuticals to treat unmet medical needs.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives