- United Kingdom

- /

- Pharma

- /

- AIM:STX

Even With A 26% Surge, Cautious Investors Are Not Rewarding Shield Therapeutics plc's (LON:STX) Performance Completely

Shield Therapeutics plc (LON:STX) shareholders have had their patience rewarded with a 26% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

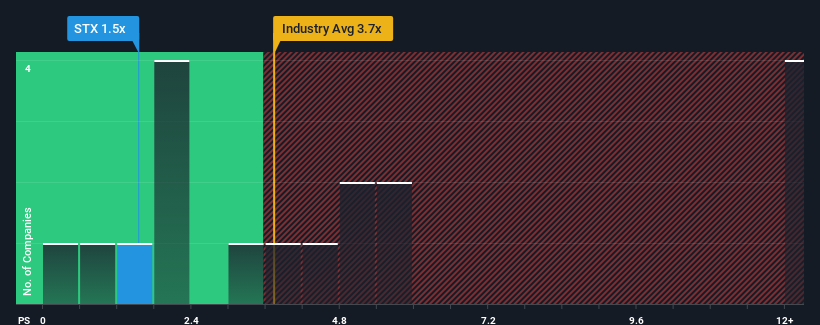

In spite of the firm bounce in price, it would still be understandable if you think Shield Therapeutics is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 1.5x, considering almost half the companies in the United Kingdom's Pharmaceuticals industry have P/S ratios above 3.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Shield Therapeutics

What Does Shield Therapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Shield Therapeutics has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Shield Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Shield Therapeutics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 224%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 151% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.3%, which is noticeably less attractive.

With this information, we find it odd that Shield Therapeutics is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Shield Therapeutics' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Shield Therapeutics' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Shield Therapeutics' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Shield Therapeutics that you need to be mindful of.

If these risks are making you reconsider your opinion on Shield Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STX

Shield Therapeutics

A commercial stage specialty pharmaceutical company, focuses on commercialization of pharmaceuticals to treat unmet medical needs.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives