- United Kingdom

- /

- Professional Services

- /

- AIM:GATC

Gattaca Leads The Charge With 2 Other UK Penny Stocks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over China's economic recovery and its impact on global trade. In light of such market conditions, investors may find value in exploring penny stocks, which often represent smaller or newer companies with potential for growth at lower price points. While the term "penny stocks" might seem outdated, these investments can still offer opportunities for those seeking strong financial health and resilience in their portfolios.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.09 | £93.02M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.825 | £182.42M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.292 | £199.26M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.39 | £177.02M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.458 | $266.25M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.12 | £84.82M | ★★★★★★ |

Click here to see the full list of 468 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gattaca (AIM:GATC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gattaca plc is a human capital resources company offering contract and permanent recruitment services across private and public sectors, with a market cap of £26.80 million.

Operations: The company's revenue is primarily derived from its Infrastructure segment (£149.25 million), followed by Defence (£92.08 million), Energy (£37.79 million), Mobility (£33.42 million), Technology, Media & Telecoms (£31.63 million), and International operations (£3.28 million).

Market Cap: £26.8M

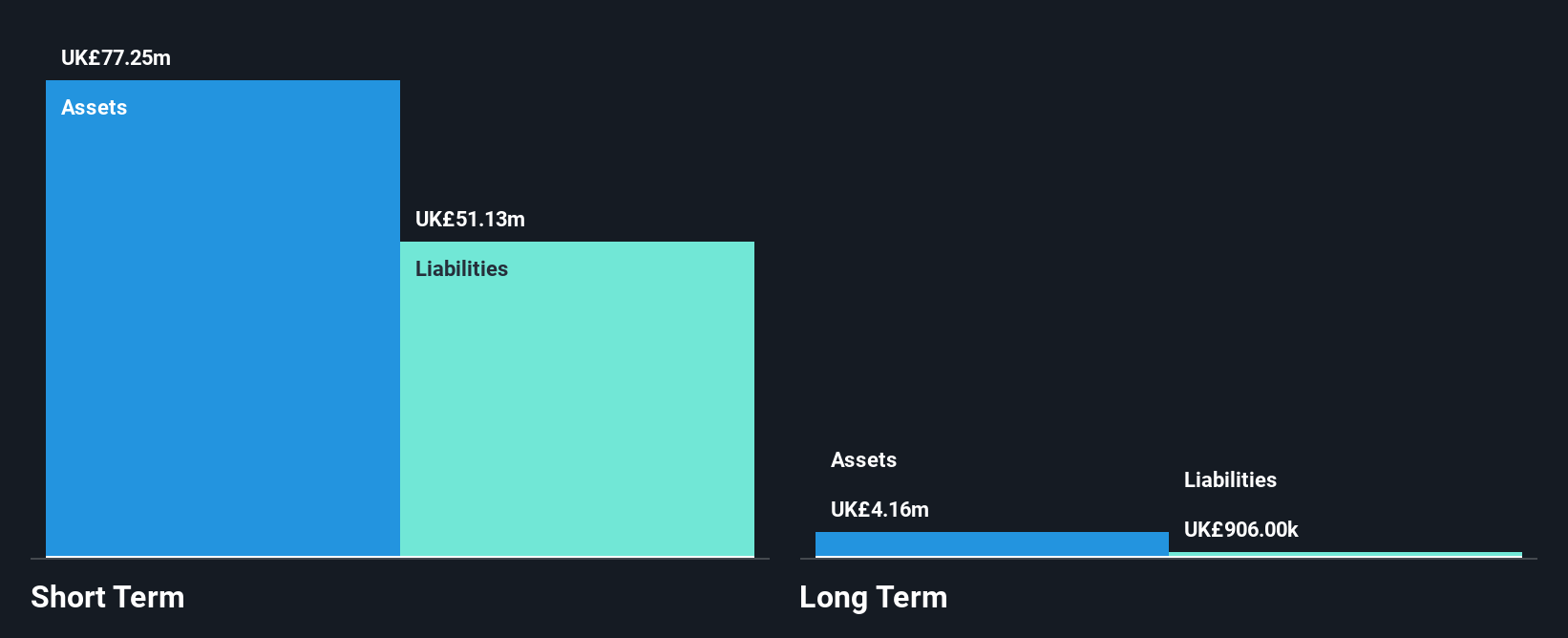

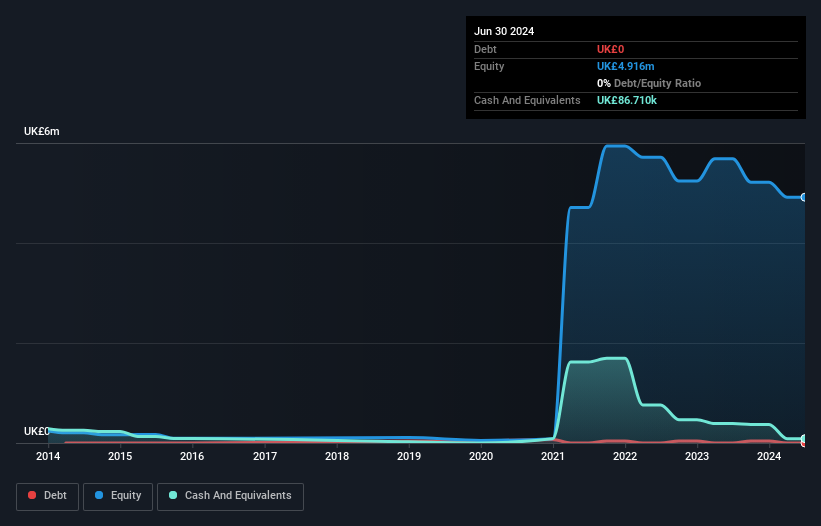

Gattaca plc, with a market cap of £26.80 million, operates without debt, providing some financial stability. Despite this, its recent earnings report highlighted challenges such as a significant drop in net income to £0.186 million from £1.23 million the previous year and declining profit margins (0.2% from 0.9%). Revenue grew modestly to £389.53 million, driven by segments like Infrastructure and Defence. However, negative earnings growth (-77.3%) poses concerns about its competitiveness within the industry despite stable weekly volatility and no shareholder dilution over the past year suggesting some resilience amid financial pressures.

- Get an in-depth perspective on Gattaca's performance by reading our balance sheet health report here.

- Gain insights into Gattaca's outlook and expected performance with our report on the company's earnings estimates.

Poolbeg Pharma (AIM:POLB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Poolbeg Pharma PLC is a biopharmaceutical company focused on developing and commercializing medicines for unmet medical needs in the United Kingdom, with a market capitalization of £35.70 million.

Operations: No revenue segments have been reported.

Market Cap: £35.7M

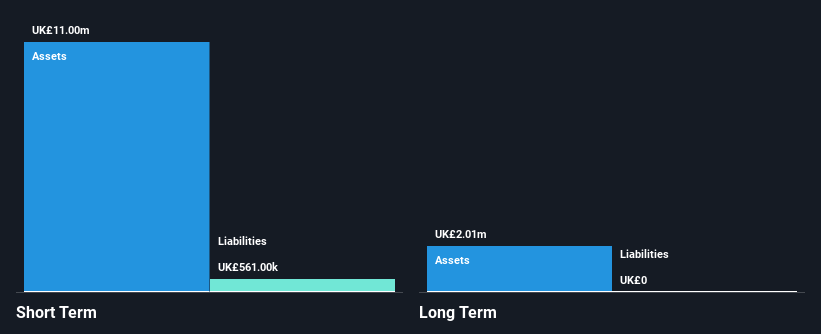

Poolbeg Pharma, with a market cap of £35.70 million, remains pre-revenue and unprofitable but has no debt and sufficient cash runway for over a year. The company's recent U.S. patent grant for POLB 001 enhances its intellectual property portfolio, potentially increasing its attractiveness to partners in the biotech sector. Despite an experienced board, Poolbeg's management team is relatively new, which could impact strategic execution. The company reported a net loss of £2.26 million for the half-year ending June 2024, reflecting ongoing financial challenges as it continues to develop treatments targeting severe influenza and cytokine release syndromes.

- Click here to discover the nuances of Poolbeg Pharma with our detailed analytical financial health report.

- Learn about Poolbeg Pharma's future growth trajectory here.

African Pioneer (LSE:AFP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: African Pioneer PLC, with a market cap of £3.43 million, explores and develops base metals projects in Zambia, Namibia, and Botswana.

Operations: There are no reported revenue segments for the company.

Market Cap: £3.43M

African Pioneer PLC, with a market cap of £3.43 million, is pre-revenue and unprofitable, reporting a net loss of £0.32 million for the half-year ending June 2024. The company remains debt-free but faces challenges with short-term liabilities exceeding its assets (£111.5K vs £577.5K). Despite stable weekly volatility at 4%, African Pioneer has seen losses increase by over 50% annually over the past five years. While it has raised additional capital to extend its cash runway beyond four months, the lack of seasoned management and board experience may affect strategic direction in exploring base metals projects in Africa.

- Jump into the full analysis health report here for a deeper understanding of African Pioneer.

- Review our historical performance report to gain insights into African Pioneer's track record.

Where To Now?

- Investigate our full lineup of 468 UK Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GATC

Gattaca

A human capital resources company, provides contract and permanent recruitment services in the private and public sectors.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives