- United Kingdom

- /

- Pharma

- /

- AIM:POLB

Discover M.T.I Wireless Edge And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China impacting global economic sentiment. Despite these broader market pressures, investors continue to seek opportunities in lesser-known corners of the market. Penny stocks, often representing smaller or newer companies, remain a relevant area for those looking to explore growth potential at lower price points. In this article, we examine three promising UK penny stocks that stand out for their financial resilience and potential upside.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £1.984 | £747.6M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.964 | £152.06M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.895 | £471.86M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.43 | £182.11M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.47 | £66.18M | ★★★★☆☆ |

| Foresight Group Holdings (LSE:FSG) | £3.70 | £423.89M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.206 | £186M | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.42 | £340.14M | ★★★★☆☆ |

| Union Jack Oil (AIM:UJO) | £0.10 | £10.66M | ★★★★★★ |

| RTC Group (AIM:RTC) | £0.95 | £12.93M | ★★★★★★ |

Click here to see the full list of 467 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

M.T.I Wireless Edge (AIM:MWE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: M.T.I Wireless Edge Ltd. designs, develops, manufactures, and markets antennas for both civilian and military sectors with a market cap of £42.67 million.

Operations: The company's revenue is generated from three main segments: Antennas ($13.55 million), Water Solutions ($16.50 million), and Distribution & Consultation ($15.98 million).

Market Cap: £42.67M

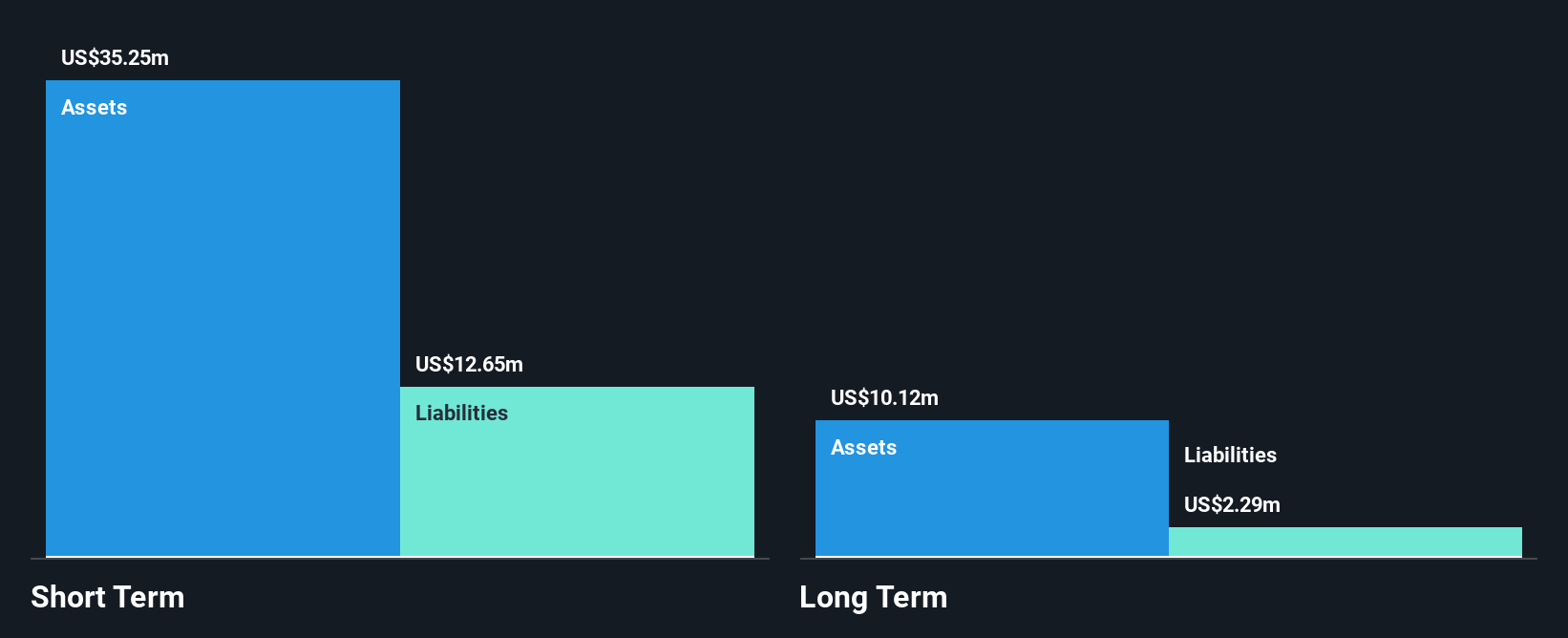

M.T.I Wireless Edge Ltd. presents a compelling case within the penny stock segment, with a market cap of £42.67 million and diversified revenue streams across antennas, water solutions, and distribution & consultation totaling US$46.03 million. The company has demonstrated consistent earnings growth, with a 9.7% increase over the past year surpassing its five-year average of 7.6%. Its financial health is robust; short-term assets exceed liabilities, debt is well-managed by cash flow, and no significant shareholder dilution occurred recently. Despite low return on equity at 15%, M.T.I's valuation appears attractive relative to peers and industry standards.

- Jump into the full analysis health report here for a deeper understanding of M.T.I Wireless Edge.

- Gain insights into M.T.I Wireless Edge's future direction by reviewing our growth report.

Poolbeg Pharma (AIM:POLB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Poolbeg Pharma PLC is a biopharmaceutical company focused on developing and commercializing medicines for unmet medical needs in the United Kingdom, with a market cap of £28 million.

Operations: Poolbeg Pharma PLC has not reported any specific revenue segments.

Market Cap: £28M

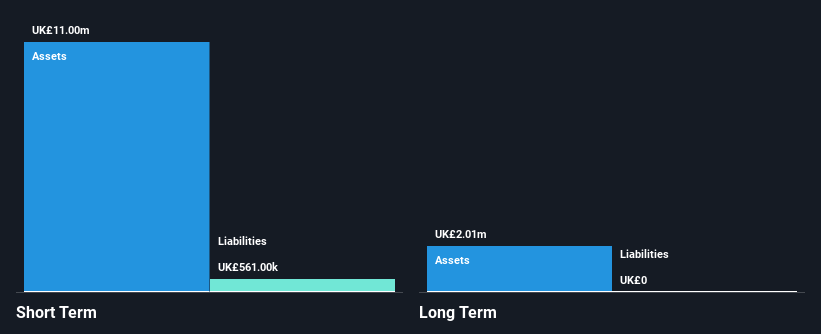

Poolbeg Pharma, with a market cap of £28 million, is pre-revenue and debt-free but faces challenges as it remains unprofitable with earnings forecasted to decline by 17.9% annually over the next three years. The company's short-term assets of £11.0 million comfortably cover its liabilities, providing a cash runway for over a year. Recent developments include non-binding discussions for an acquisition by HOOKIPA Pharma Inc., potentially leading to Poolbeg becoming a private subsidiary and delisting from AIM. Additionally, Poolbeg has strengthened its intellectual property portfolio with new patents in the U.S., enhancing its strategic position in biopharmaceutical innovations.

- Unlock comprehensive insights into our analysis of Poolbeg Pharma stock in this financial health report.

- Explore Poolbeg Pharma's analyst forecasts in our growth report.

THG (LSE:THG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: THG Plc is an e-commerce technology company operating in the United Kingdom, the United States, Europe, and internationally with a market cap of £585.94 million.

Operations: The company's revenue is primarily derived from its segments: THG Beauty (£1.20 billion), THG Ingenuity (£659.71 million), and THG Nutrition (£621.11 million).

Market Cap: £585.94M

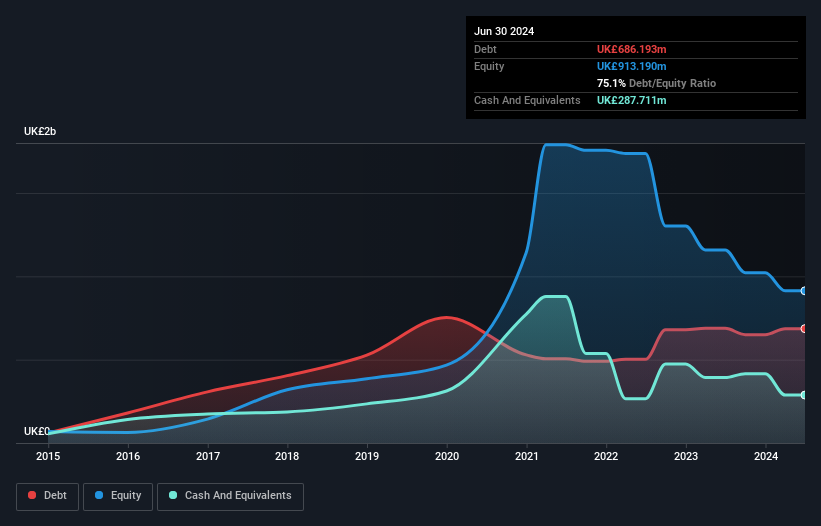

THG Plc, with a market cap of £585.94 million, operates in the e-commerce sector and is currently unprofitable with no profitability forecasted in the next three years. Despite its negative return on equity and increased losses over five years, THG's revenue is projected to grow modestly at 3.56% annually. The company's recent follow-on equity offerings raised significant capital (£100.83 million), potentially bolstering its cash runway for over three years due to positive free cash flow growth of 24.4% per year. However, THG's high volatility and debt levels remain concerns for investors seeking stability in penny stocks.

- Click here to discover the nuances of THG with our detailed analytical financial health report.

- Review our growth performance report to gain insights into THG's future.

Seize The Opportunity

- Unlock more gems! Our UK Penny Stocks screener has unearthed 464 more companies for you to explore.Click here to unveil our expertly curated list of 467 UK Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:POLB

Poolbeg Pharma

Operates as a biopharmaceutical company, engages in the development and commercialization of medicines for unmet medical needs in the United Kingdom.

Flawless balance sheet moderate.

Market Insights

Community Narratives