- United Kingdom

- /

- Life Sciences

- /

- AIM:IXI

If You Like EPS Growth Then Check Out IXICO (LON:IXI) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like IXICO (LON:IXI). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for IXICO

How Fast Is IXICO Growing Its Earnings Per Share?

Over the last three years, IXICO has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, IXICO's EPS soared from UK£0.02 to UK£0.033, in just one year. That's a impressive gain of 62%.

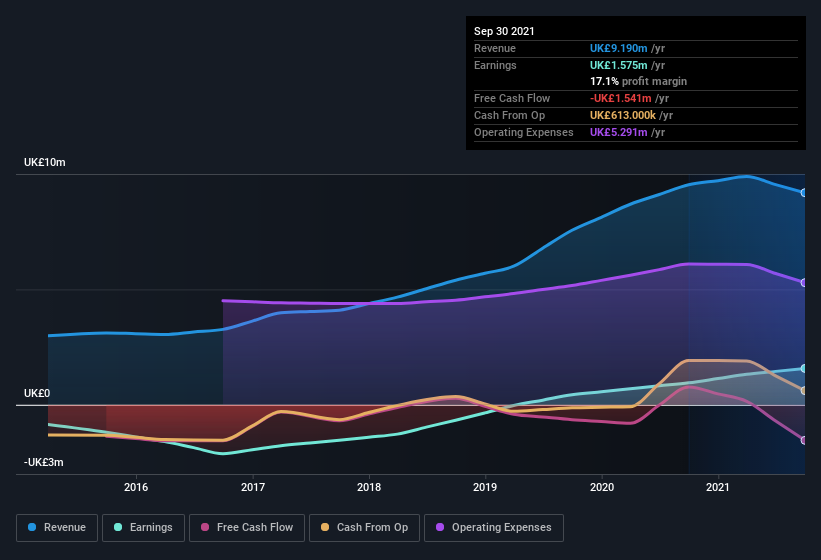

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Unfortunately, IXICO's revenue dropped 3.6% last year, but the silver lining is that EBIT margins improved from 9.0% to 13%. That's not ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since IXICO is no giant, with a market capitalization of UK£21m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are IXICO Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for IXICO shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Senior Independent Director Mark Warne bought UK£8.9k worth of shares at an average price of around UK£0.63.

Should You Add IXICO To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about IXICO's strong EPS growth. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. So on this analysis I believe IXICO is probably worth spending some time on. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for IXICO (1 makes us a bit uncomfortable) you should be aware of.

As a growth investor I do like to see insider buying. But IXICO isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IXI

IXICO

Provides data analytics services to the biopharmaceutical industry in the United Kingdom, Switzerland, the Netherlands, Ireland, rest of Europe, and the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives