The CEO of ImmuPharma plc (LON:IMM) is Dimitri Dimitriou, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for ImmuPharma

How Does Total Compensation For Dimitri Dimitriou Compare With Other Companies In The Industry?

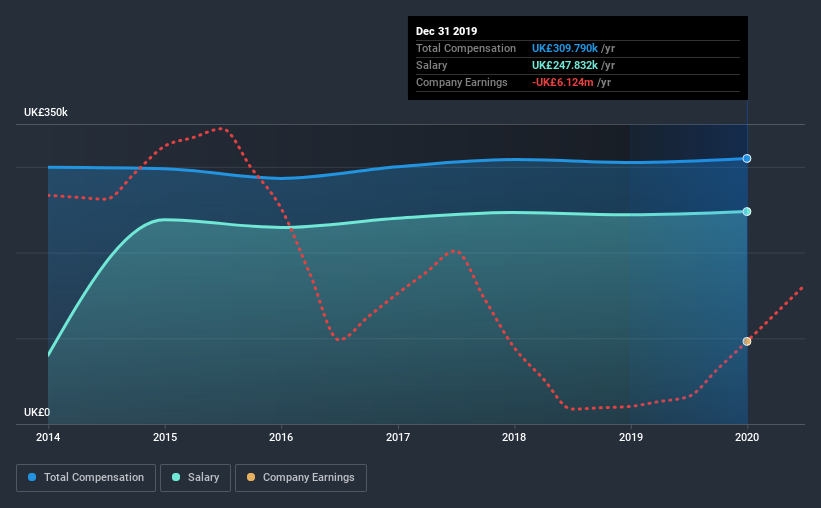

Our data indicates that ImmuPharma plc has a market capitalization of UK£34m, and total annual CEO compensation was reported as UK£310k for the year to December 2019. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at UK£247.8k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below UK£150m, reported a median total CEO compensation of UK£238k. This suggests that Dimitri Dimitriou is paid more than the median for the industry. What's more, Dimitri Dimitriou holds UK£467k worth of shares in the company in their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | UK£248k | UK£244k | 80% |

| Other | UK£62k | UK£61k | 20% |

| Total Compensation | UK£310k | UK£305k | 100% |

On an industry level, around 44% of total compensation represents salary and 56% is other remuneration. ImmuPharma is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at ImmuPharma plc's Growth Numbers

ImmuPharma plc's earnings per share (EPS) grew 6.3% per year over the last three years. It achieved revenue growth of 544% over the last year.

It's hard to interpret the strong revenue growth as anything other than a positive. With that in mind, the modestly improving EPS seems positive. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has ImmuPharma plc Been A Good Investment?

With a three year total loss of 90% for the shareholders, ImmuPharma plc would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Dimitri is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. And the situation doesn't look all that good when you see Dimitri is remunerated higher than the industry average. Taking all this into account, it could be hard to get shareholder support for giving Dimitri a raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 6 warning signs for ImmuPharma (2 don't sit too well with us!) that you should be aware of before investing here.

Switching gears from ImmuPharma, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading ImmuPharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:IMM

ImmuPharma

A biopharmaceutical company, discovers and develops peptide-based therapeutics in the United Kingdom.

Adequate balance sheet slight.

Market Insights

Community Narratives