- United Kingdom

- /

- Life Sciences

- /

- AIM:HVO

Improved Revenues Required Before hVIVO plc (LON:HVO) Stock's 26% Jump Looks Justified

The hVIVO plc (LON:HVO) share price has done very well over the last month, posting an excellent gain of 26%. The annual gain comes to 120% following the latest surge, making investors sit up and take notice.

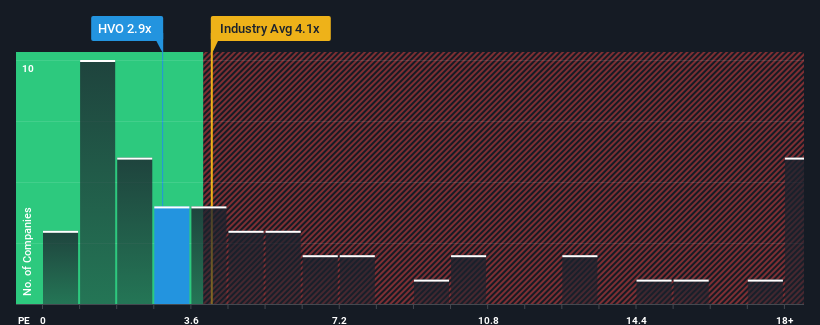

Although its price has surged higher, hVIVO's price-to-sales (or "P/S") ratio of 2.9x might still make it look like a buy right now compared to the Life Sciences industry in the United Kingdom, where around half of the companies have P/S ratios above 4x and even P/S above 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for hVIVO

What Does hVIVO's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, hVIVO has been doing quite well of late. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on hVIVO will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on hVIVO.Is There Any Revenue Growth Forecasted For hVIVO?

There's an inherent assumption that a company should underperform the industry for P/S ratios like hVIVO's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 74%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 5.1% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 21% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why hVIVO's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On hVIVO's P/S

hVIVO's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that hVIVO maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for hVIVO that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HVO

hVIVO

Operates as a pharmaceutical service and contract research company in the United Kingdom, Europe, and North America.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives