- United Kingdom

- /

- Pharma

- /

- AIM:HCM

Even after rising 8.8% this past week, HUTCHMED (China) (LON:HCM) shareholders are still down 37% over the past three years

HUTCHMED (China) Limited (LON:HCM) shareholders should be happy to see the share price up 18% in the last month. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 37% in the last three years, significantly under-performing the market.

While the stock has risen 8.8% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for HUTCHMED (China)

HUTCHMED (China) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, HUTCHMED (China) saw its revenue grow by 34% per year, compound. That's well above most other pre-profit companies. The share price drop of 11% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It seems likely that actual growth fell short of shareholders' expectations. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

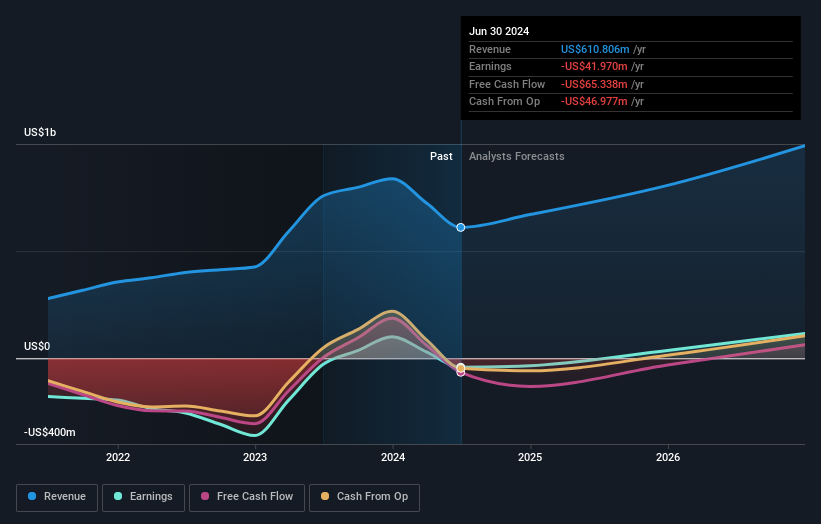

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

HUTCHMED (China) is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for HUTCHMED (China) in this interactive graph of future profit estimates.

A Different Perspective

HUTCHMED (China) shareholders have received returns of 14% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 3%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with HUTCHMED (China) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HUTCHMED (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HCM

HUTCHMED (China)

HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies for cancer and immunological diseases in Hong Kong and internationally.

Reasonable growth potential with adequate balance sheet.