- United Kingdom

- /

- Life Sciences

- /

- AIM:FAB

We Think Fusion Antibodies (LON:FAB) Can Easily Afford To Drive Business Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Fusion Antibodies (LON:FAB) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Fusion Antibodies

Does Fusion Antibodies Have A Long Cash Runway?

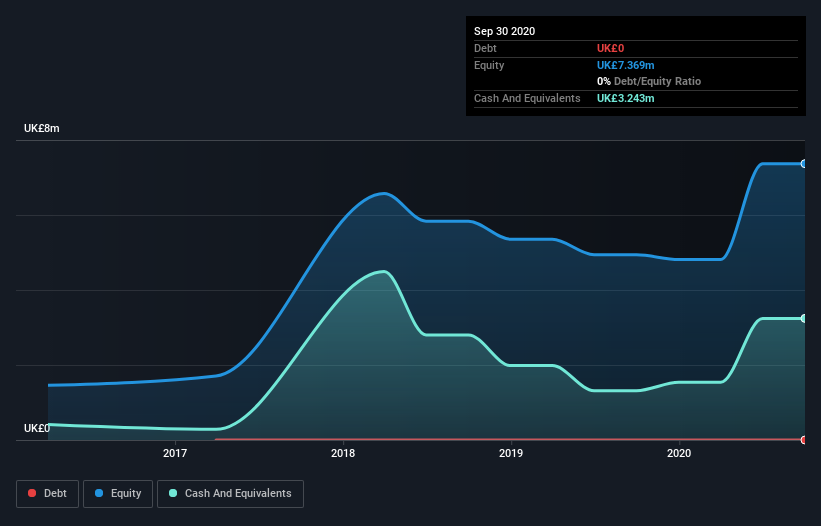

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In September 2020, Fusion Antibodies had UK£3.2m in cash, and was debt-free. Looking at the last year, the company burnt through UK£676k. So it had a cash runway of about 4.8 years from September 2020. A runway of this length affords the company the time and space it needs to develop the business. You can see how its cash balance has changed over time in the image below.

How Well Is Fusion Antibodies Growing?

It was fairly positive to see that Fusion Antibodies reduced its cash burn by 51% during the last year. On top of that, operating revenue was up 23%, making for a heartening combination It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Fusion Antibodies Raise Cash?

While Fusion Antibodies seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of UK£38m, Fusion Antibodies' UK£676k in cash burn equates to about 1.8% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is Fusion Antibodies' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Fusion Antibodies' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even though its revenue growth wasn't quite as impressive, it was still a positive. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Taking a deeper dive, we've spotted 4 warning signs for Fusion Antibodies you should be aware of, and 1 of them can't be ignored.

Of course Fusion Antibodies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Fusion Antibodies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:FAB

Fusion Antibodies

A contract research organization, engages in the research, development, and manufacture of recombinant proteins and antibodies primarily for cancer and infectious diseases in the United Kingdom, the rest of Europe, North America, and internationally.

Flawless balance sheet moderate.

Market Insights

Community Narratives