- United Kingdom

- /

- Life Sciences

- /

- AIM:C4XD

Here's Why We're Watching C4X Discovery Holdings' (LON:C4XD) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for C4X Discovery Holdings (LON:C4XD) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for C4X Discovery Holdings

How Long Is C4X Discovery Holdings' Cash Runway?

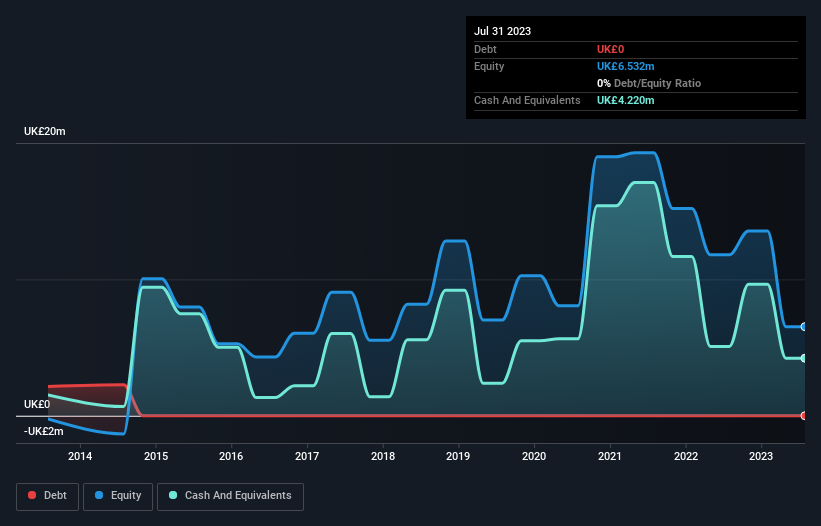

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When C4X Discovery Holdings last reported its balance sheet in July 2023, it had zero debt and cash worth UK£4.2m. In the last year, its cash burn was UK£6.0m. That means it had a cash runway of around 8 months as of July 2023. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. The image below shows how its cash balance has been changing over the last few years.

How Well Is C4X Discovery Holdings Growing?

It was fairly positive to see that C4X Discovery Holdings reduced its cash burn by 50% during the last year. Unfortunately, however, operating revenue declined by 37% during the period. Considering both these factors, we're not particularly excited by its growth profile. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can C4X Discovery Holdings Raise More Cash Easily?

Given C4X Discovery Holdings' revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of UK£29m, C4X Discovery Holdings' UK£6.0m in cash burn equates to about 21% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is C4X Discovery Holdings' Cash Burn Situation?

On this analysis of C4X Discovery Holdings' cash burn, we think its cash burn reduction was reassuring, while its falling revenue has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for C4X Discovery Holdings (3 are significant!) that you should be aware of before investing here.

Of course C4X Discovery Holdings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:C4XD

C4X Discovery Holdings

C4X Discovery Holdings plc operates as drug discovery company in the United Kingdom.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives