The CEO of Bioventix PLC (LON:BVXP) is Peter Harrison, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Bioventix.

View our latest analysis for Bioventix

Comparing Bioventix PLC's CEO Compensation With the industry

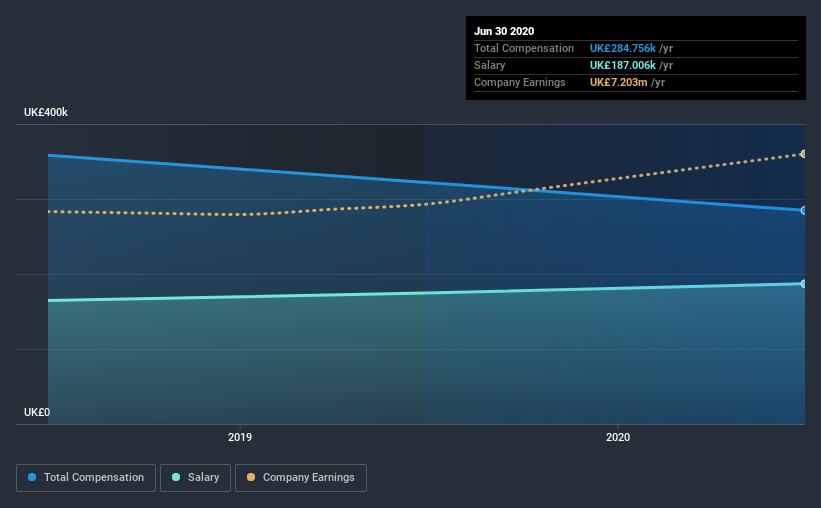

Our data indicates that Bioventix PLC has a market capitalization of UK£219m, and total annual CEO compensation was reported as UK£285k for the year to June 2020. Notably, that's a decrease of 12% over the year before. Notably, the salary which is UK£187.0k, represents most of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between UK£144m and UK£574m, we discovered that the median CEO total compensation of that group was UK£290k. This suggests that Bioventix remunerates its CEO largely in line with the industry average. What's more, Peter Harrison holds UK£18m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£187k | UK£175k | 66% |

| Other | UK£98k | UK£148k | 34% |

| Total Compensation | UK£285k | UK£322k | 100% |

Talking in terms of the industry, salary represented approximately 66% of total compensation out of all the companies we analyzed, while other remuneration made up 34% of the pie. Bioventix is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Bioventix PLC's Growth Numbers

Bioventix PLC's earnings per share (EPS) grew 13% per year over the last three years. Its revenue is up 11% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Bioventix PLC Been A Good Investment?

We think that the total shareholder return of 111%, over three years, would leave most Bioventix PLC shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, Bioventix PLC is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. The company is growing EPS and total shareholder returns have been pleasing. So one could argue that CEO compensation is quite modest, if you consider company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Bioventix.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Bioventix, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bioventix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BVXP

Bioventix

Bioventix PLC creates, manufactures, and supplies sheep monoclonal antibodies (SMAs) for diagnostic applications worldwide.

Flawless balance sheet and fair value.

Market Insights

Community Narratives