- United Kingdom

- /

- Biotech

- /

- AIM:AREC

Arecor Therapeutics And 2 Other UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid concerns over China's economic recovery and its impact on global trade. Despite these broader market pressures, investors often seek opportunities in less conventional areas like penny stocks, which can offer unique prospects for growth. While the term "penny stock" may seem outdated, it still signifies a space where smaller or newer companies with robust financials can provide significant potential returns.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £512.74M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.775 | £304.97M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.242 | £135.77M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.865 | £319.86M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.97 | £305.63M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.205 | £191.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.50 | £77.24M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £2.21 | £834.69M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Arecor Therapeutics (AIM:AREC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Arecor Therapeutics plc is a clinical-stage biotechnology company in the United Kingdom that develops innovative medicines to address significant unmet patient needs, with a market cap of £21.14 million.

Operations: The company generates revenue from its biotechnology segment, amounting to £5.05 million.

Market Cap: £21.14M

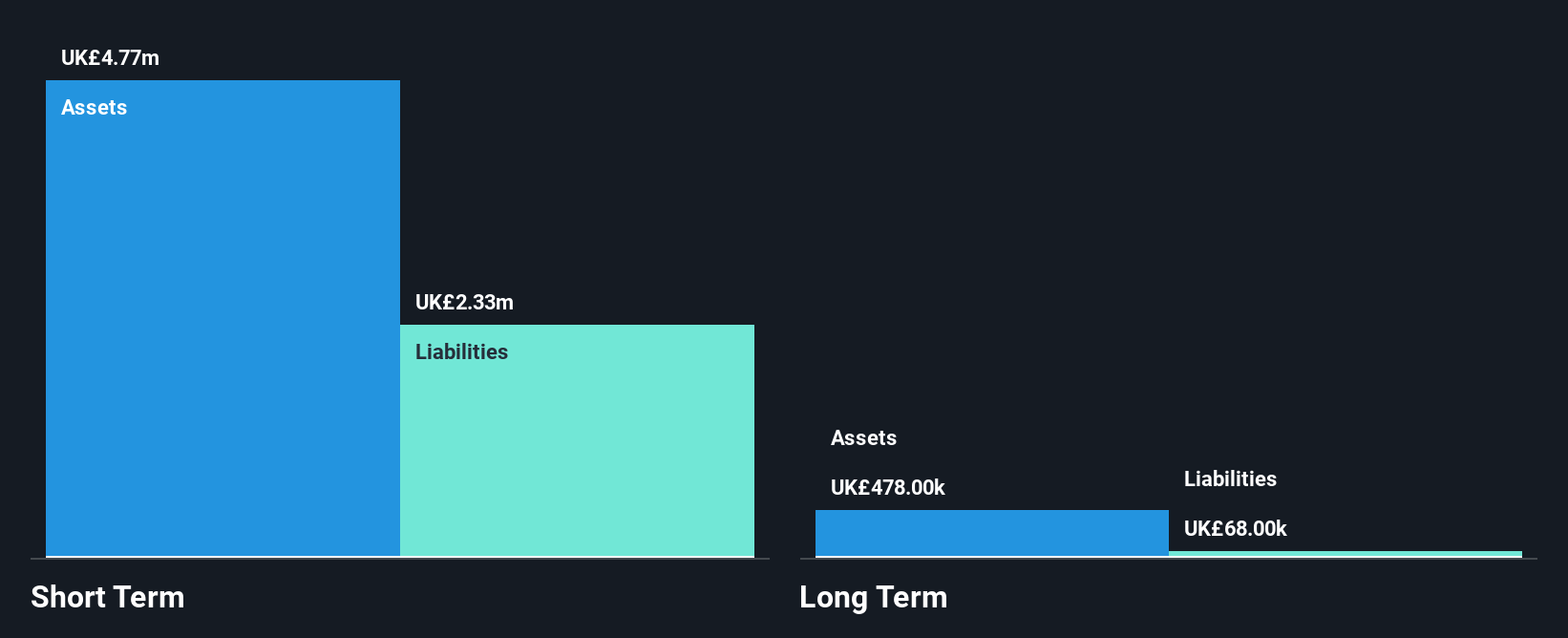

Arecor Therapeutics, with a market cap of £21.14 million and revenue of £5.05 million, is navigating the challenges typical of clinical-stage biotech firms. Despite being debt-free and having short-term assets exceeding liabilities, Arecor faces financial uncertainty with less than a year of cash runway and ongoing unprofitability. Recent developments include the formation of a new Scientific Advisory Board to bolster expertise in drug delivery technologies and a collaboration with Skye Bioscience for formulation development. However, auditor concerns about its ability to continue as a going concern highlight the risks associated with investing in such early-stage ventures.

- Click here to discover the nuances of Arecor Therapeutics with our detailed analytical financial health report.

- Explore Arecor Therapeutics' analyst forecasts in our growth report.

Cora Gold (AIM:CORA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cora Gold Limited, with a market cap of £30.30 million, explores and develops mineral projects in West Africa through its subsidiaries.

Operations: Cora Gold Limited does not report any revenue segments.

Market Cap: £30.3M

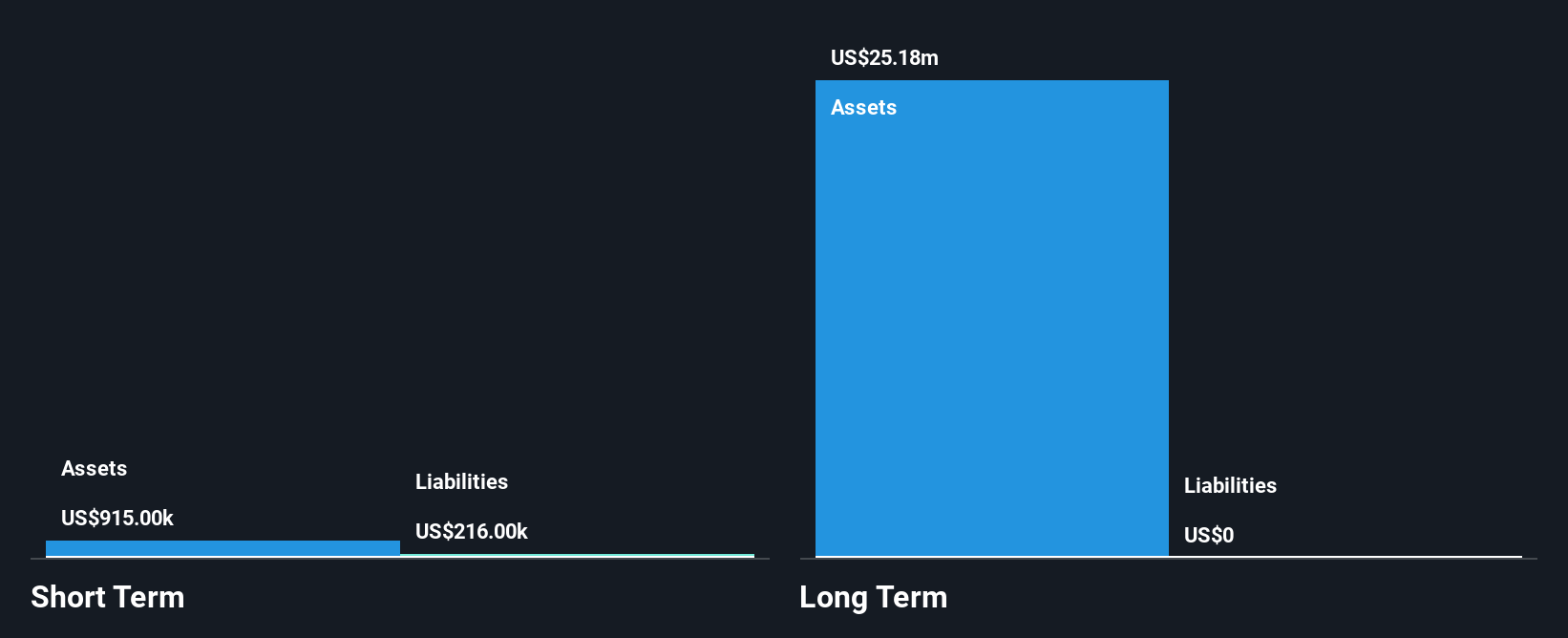

Cora Gold, with a market cap of £30.30 million, is a pre-revenue company focused on optimizing its Sanankoro Gold Project in Mali. Recent metallurgical test work has shown potential for operational efficiencies by integrating a scrubbing circuit upstream of the ball mill, potentially reducing power consumption and operating costs. Despite being unprofitable with losses increasing over five years, Cora's short-term assets exceed liabilities and it remains debt-free. The company recently raised additional capital to extend its cash runway beyond the current 4-7 months estimate, while continuing efforts to enhance project economics through updated feasibility studies.

- Click here and access our complete financial health analysis report to understand the dynamics of Cora Gold.

- Evaluate Cora Gold's historical performance by accessing our past performance report.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Van Elle Holdings plc operates as a geotechnical and ground engineering contractor in the United Kingdom, with a market cap of £42.74 million.

Operations: Van Elle Holdings generates its revenue through three main segments: General Piling (£46.03 million), Specialist Piling & Rail (£46.10 million), and Ground Engineering Services (£38.14 million).

Market Cap: £42.74M

Van Elle Holdings, with a market cap of £42.74 million, has shown mixed performance as a penny stock. While it has become profitable over the past five years with earnings growing annually by 57.4%, recent earnings have declined by 25% compared to industry growth of 11.1%. The company trades at a good value and its debt is well covered by operating cash flow, but net profit margins have decreased from last year. Despite an unstable dividend track record, the Board recommended maintaining the final dividend at 0.8 pence per share for FY2025 amidst challenging market conditions impacting revenue and net income figures.

- Unlock comprehensive insights into our analysis of Van Elle Holdings stock in this financial health report.

- Review our growth performance report to gain insights into Van Elle Holdings' future.

Where To Now?

- Discover the full array of 299 UK Penny Stocks right here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:AREC

Arecor Therapeutics

A clinical stage biotechnology company, develops innovative medicines that address significant unmet patient needs in the United Kingdom.

Adequate balance sheet with low risk.

Market Insights

Community Narratives