Most Shareholders Will Probably Find That The Compensation For Rightmove plc's (LON:RMV) CEO Is Reasonable

The performance at Rightmove plc (LON:RMV) has been rather lacklustre of late and shareholders may be wondering what CEO Peter Brooks-Johnson is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 07 May 2021. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Rightmove

Comparing Rightmove plc's CEO Compensation With the industry

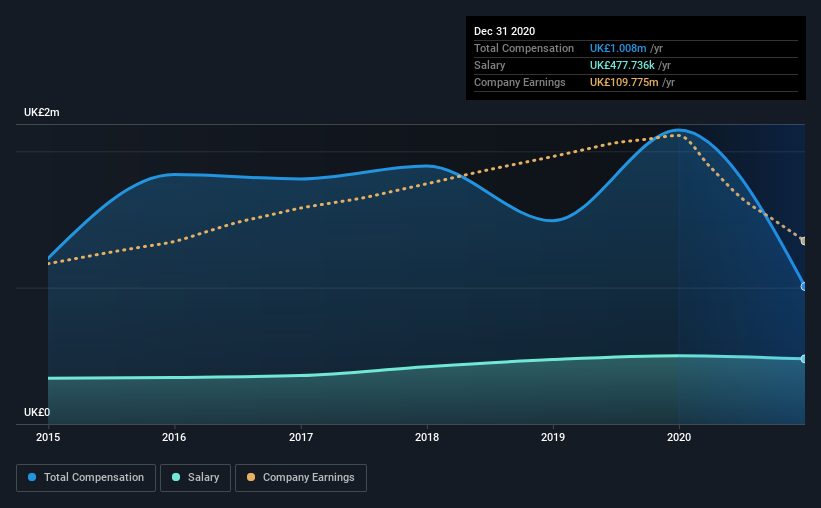

At the time of writing, our data shows that Rightmove plc has a market capitalization of UK£5.3b, and reported total annual CEO compensation of UK£1.0m for the year to December 2020. That's a notable decrease of 53% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at UK£478k.

In comparison with other companies in the industry with market capitalizations ranging from UK£2.9b to UK£8.6b, the reported median CEO total compensation was UK£2.2m. Accordingly, Rightmove pays its CEO under the industry median. What's more, Peter Brooks-Johnson holds UK£12m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£478k | UK£501k | 47% |

| Other | UK£531k | UK£1.7m | 53% |

| Total Compensation | UK£1.0m | UK£2.2m | 100% |

On an industry level, around 47% of total compensation represents salary and 53% is other remuneration. Rightmove is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Rightmove plc's Growth

Over the last three years, Rightmove plc has shrunk its earnings per share by 7.0% per year. It saw its revenue drop 29% over the last year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Rightmove plc Been A Good Investment?

We think that the total shareholder return of 38%, over three years, would leave most Rightmove plc shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Rightmove that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Rightmove, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:RMV

Rightmove

Operates digital property advertising and information portal in the United Kingdom and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026