Gamma Communications And 2 Other Undiscovered Gems In The UK Market

Reviewed by Simply Wall St

The United Kingdom's stock market has recently been impacted by global economic challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China. In such a volatile environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors seeking opportunities amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.93% | -8.41% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Gamma Communications (AIM:GAMA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gamma Communications plc, along with its subsidiaries, delivers technology-driven communications and software services to businesses of varying sizes across the United Kingdom and Europe, with a market cap of £1.27 billion.

Operations: Gamma Communications generates revenue primarily through its Gamma Business (£373.10 million), European operations (£78.50 million), and Gamma Enterprise (£119.90 million). The company focuses on delivering technology-based communications and software services across the UK and Europe.

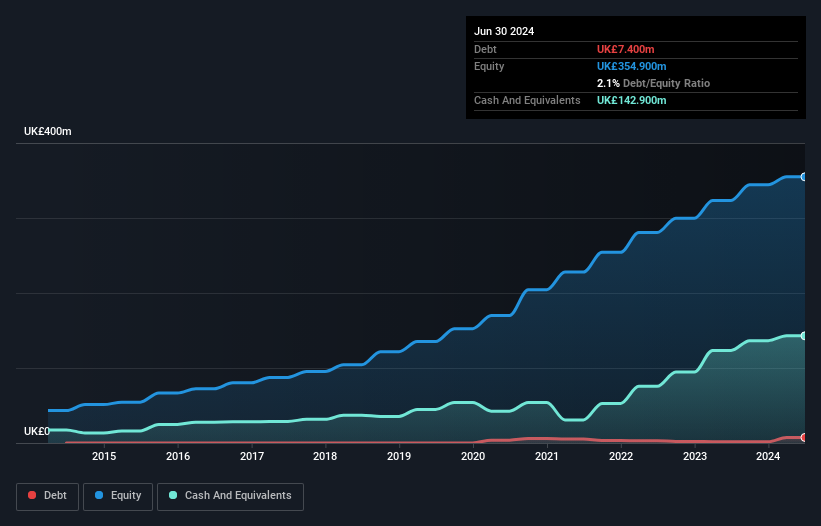

Gamma Communications, a notable player in the UK telecom sector, showcases robust financial health with high-quality earnings and positive free cash flow. Over the past year, its earnings grew by 9.9%, outpacing the industry average of 6.4%. The company trades at 35.5% below its estimated fair value, presenting a potential opportunity for investors seeking undervalued stocks. Despite an increase in debt to equity ratio from 0% to 2.1% over five years, Gamma holds more cash than total debt, suggesting prudent financial management and positioning it well for future growth with forecasted earnings growth of 15.2% annually.

- Click to explore a detailed breakdown of our findings in Gamma Communications' health report.

Understand Gamma Communications' track record by examining our Past report.

Metro Bank Holdings (LSE:MTRO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Metro Bank Holdings PLC is the bank holding company for Metro Bank PLC, offering a range of banking products and services across the United Kingdom, with a market capitalization of £568.67 million.

Operations: Metro Bank Holdings generates revenue primarily through its banking products and services offered in the UK. The company has a market capitalization of £568.67 million.

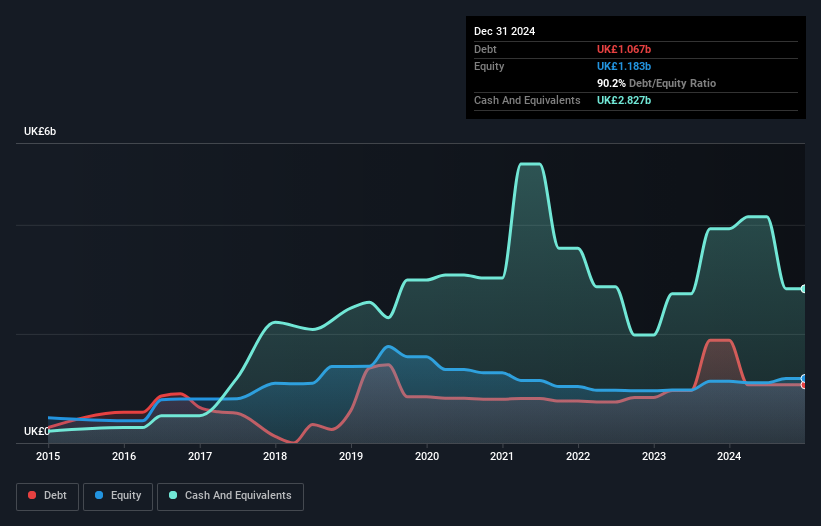

Metro Bank Holdings, a dynamic player in the UK banking sector, boasts total assets of £17.6B and equity of £1.2B. With customer deposits forming 91% of its funding, it enjoys a stable financial foundation. However, it faces challenges with bad loans at 3.7% of total loans and an insufficient allowance for these potential losses at just 45%. Despite a one-off loss impacting recent results by £44M, earnings surged by 44.1% over the past year—well above industry averages—indicating robust operational performance amidst hurdles like high non-performing loans and net interest margin pressures.

Reach (LSE:RCH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reach plc operates as a national and regional commercial news publisher in the United Kingdom and Ireland, with a market cap of £271.47 million.

Operations: Reach generates revenue primarily through advertising and circulation sales. The company's net profit margin was 10.5% last year, reflecting its ability to manage costs effectively while sustaining its revenue streams.

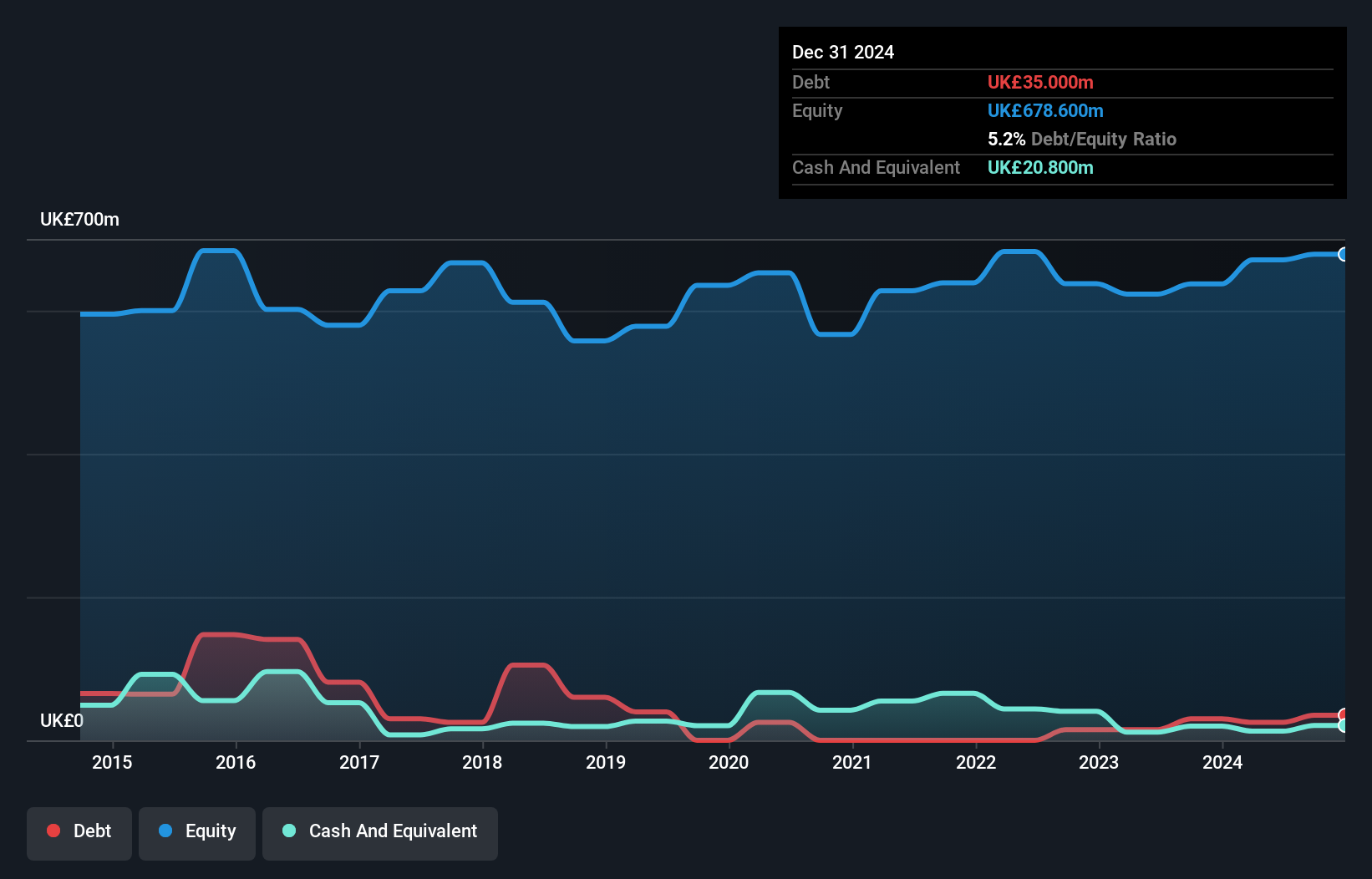

RCH, a smaller player in the UK media landscape, reported a notable net income increase to £53.6M for 2024 from £21.5M the previous year, despite a sales dip to £538.6M from £568.6M. With its P/E ratio at 6.5x, it trades at appealing value compared to the broader UK market's 15.7x average. The company has managed debt effectively, reducing its debt-to-equity ratio from 6.9% to 3.7% over five years and maintaining an interest coverage of 22x through EBIT—indicative of strong financial health amidst industry challenges and volatile share prices recently observed.

- Unlock comprehensive insights into our analysis of Reach stock in this health report.

Explore historical data to track Reach's performance over time in our Past section.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 64 UK Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GAMA

Gamma Communications

Provides technology-based communications and software services to small, medium, and large-sized organizations in the United Kingdom, rest of Europe, and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives