- United Kingdom

- /

- Media

- /

- LSE:FUTR

Future plc (LON:FUTR) Shares Fly 71% But Investors Aren't Buying For Growth

Future plc (LON:FUTR) shareholders would be excited to see that the share price has had a great month, posting a 71% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 34%.

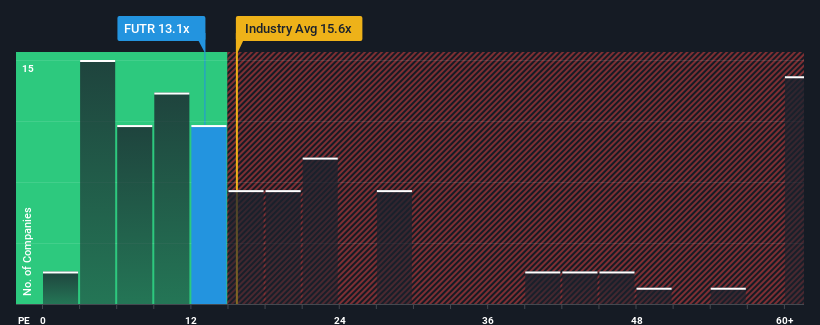

Even after such a large jump in price, Future's price-to-earnings (or "P/E") ratio of 13.1x might still make it look like a buy right now compared to the market in the United Kingdom, where around half of the companies have P/E ratios above 18x and even P/E's above 31x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Future could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Future

Is There Any Growth For Future?

The only time you'd be truly comfortable seeing a P/E as low as Future's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 6.1% per annum over the next three years. With the market predicted to deliver 15% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Future's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Future's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Future maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Future, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FUTR

Future

Future plc, together with its subsidiaries, publishes and distributes content for technology, gaming, sports, fashion, beauty, homes, wealth, and knowledge sectors in the United States and the United Kingdom.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives