For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in 4imprint Group (LON:FOUR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for 4imprint Group

How Fast Is 4imprint Group Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. 4imprint Group's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 53%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

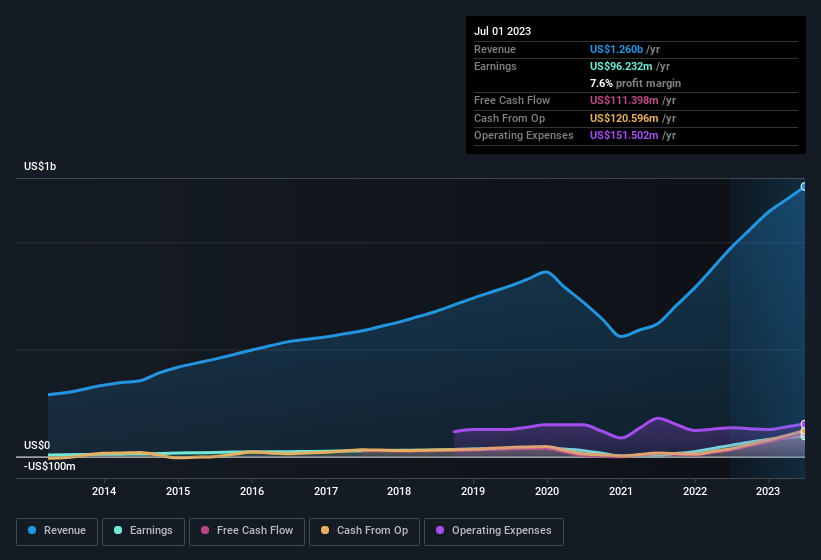

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that 4imprint Group is growing revenues, and EBIT margins improved by 2.5 percentage points to 9.8%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of 4imprint Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are 4imprint Group Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own 4imprint Group shares worth a considerable sum. Indeed, they hold US$27m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between US$1.0b and US$3.2b, like 4imprint Group, the median CEO pay is around US$2.1m.

4imprint Group's CEO took home a total compensation package of US$1.0m in the year prior to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add 4imprint Group To Your Watchlist?

4imprint Group's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. 4imprint Group certainly ticks a few boxes, so we think it's probably well worth further consideration. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with 4imprint Group , and understanding this should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in GB with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FOUR

4imprint Group

Operates as a direct marketer of promotional products in North America, the United Kingdom, and Ireland.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives