- United Kingdom

- /

- Media

- /

- LSE:BMY

Possible Bearish Signals With Bloomsbury Publishing Insiders Disposing Stock

In the last year, many Bloomsbury Publishing Plc (LON:BMY) insiders sold a substantial stake in the company which may have sparked shareholders' attention. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, if numerous insiders are selling, shareholders should investigate more.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for Bloomsbury Publishing

Bloomsbury Publishing Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Founder, John Newton, sold UK£416k worth of shares at a price of UK£7.13 per share. That means that an insider was selling shares at around the current price of UK£6.66. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

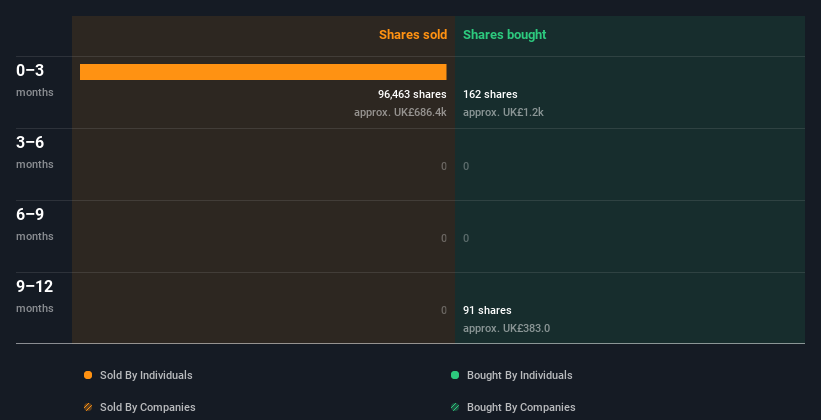

Over the last year we saw more insider selling of Bloomsbury Publishing shares, than buying. The sellers received a price of around UK£7.13, on average. It's not too encouraging to see that insiders have sold at below the current price. Of course, the sales could be motivated for a multitude of reasons, so we shouldn't jump to conclusions. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insiders At Bloomsbury Publishing Have Sold Stock Recently

We've seen more insider selling than insider buying at Bloomsbury Publishing recently. In that time, insiders dumped UK£688k worth of shares. On the other hand we note Independent Chairman John Bason bought UK£1.2k worth of shares. Since the selling really does outweigh the buying, we'd say that these transactions may suggest that some insiders feel the shares are not cheap.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. It appears that Bloomsbury Publishing insiders own 2.3% of the company, worth about UK£13m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Bloomsbury Publishing Tell Us?

The insider sales have outweighed the insider buying, at Bloomsbury Publishing, in the last three months. And our longer term analysis of insider transactions didn't bring confidence, either. But since Bloomsbury Publishing is profitable and growing, we're not too worried by this. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. So we'd only buy after careful consideration. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Bloomsbury Publishing. You'd be interested to know, that we found 2 warning signs for Bloomsbury Publishing and we suggest you have a look.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Bloomsbury Publishing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BMY

Bloomsbury Publishing

Bloomsbury Publishing Plc publishes academic, educational, and general fiction and non-fiction books for children, general reader, teachers, students, researchers, libraries, and professionals worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives