- United Kingdom

- /

- Electrical

- /

- LSE:DSCV

Exploring Bloomsbury Publishing And 2 Other Undervalued Small Caps On UK With Insider Action

Reviewed by Simply Wall St

As the UK market navigates through global economic challenges, including weak trade data from China affecting major indices like the FTSE 100 and FTSE 250, investors are increasingly scrutinizing small-cap stocks for potential opportunities. In this environment, identifying undervalued small-cap companies with insider activity can be a strategic approach to finding resilient investments that might withstand broader market pressures.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| 4imprint Group | 14.6x | 1.2x | 43.51% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 36.16% | ★★★★★☆ |

| NCC Group | NA | 1.3x | 26.19% | ★★★★★☆ |

| Sabre Insurance Group | 11.4x | 1.5x | 12.62% | ★★★★☆☆ |

| iomart Group | 25.2x | 0.7x | 31.05% | ★★★★☆☆ |

| Breedon Group | 15.0x | 0.9x | 47.33% | ★★★★☆☆ |

| Warpaint London | 24.4x | 4.2x | 0.27% | ★★★☆☆☆ |

| Telecom Plus | 17.5x | 0.7x | 32.30% | ★★★☆☆☆ |

| discoverIE Group | 39.1x | 1.5x | 21.59% | ★★★☆☆☆ |

| THG | NA | 0.3x | -587.27% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

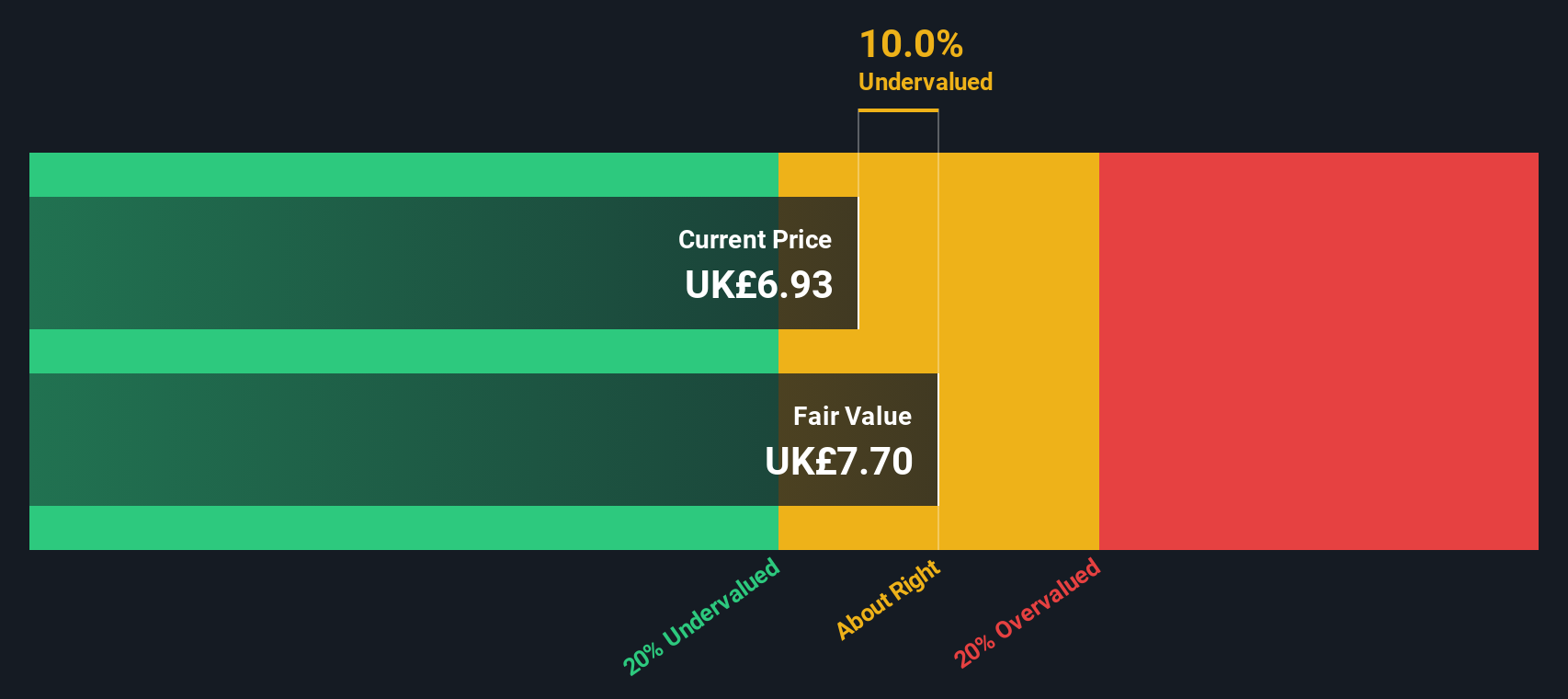

Bloomsbury Publishing (LSE:BMY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bloomsbury Publishing is a UK-based independent publishing house known for its diverse range of books and digital content, with a market capitalization of £0.94 billion.

Operations: Revenue streams are primarily driven by segment adjustments, with notable contributions from non-consumer special interest and academic & professional segments. The company has experienced a rising trend in gross profit margin, reaching 57.16% as of August 2024. Operating expenses have consistently increased over time, with general & administrative expenses being the largest component.

PE: 13.9x

Bloomsbury, a publishing company in the UK, is seeking acquisitions to leverage its strong financial position. Despite a forecasted earnings decline of 3.1% annually over the next three years, recent results show growth with sales reaching £179.8 million and net income at £16.6 million for H1 2024/25, up from last year. Insider confidence is evident through share purchases in late 2024. The company also increased its interim dividend by 5%, reflecting commitment to shareholder returns amidst industry challenges.

- Get an in-depth perspective on Bloomsbury Publishing's performance by reading our valuation report here.

Understand Bloomsbury Publishing's track record by examining our Past report.

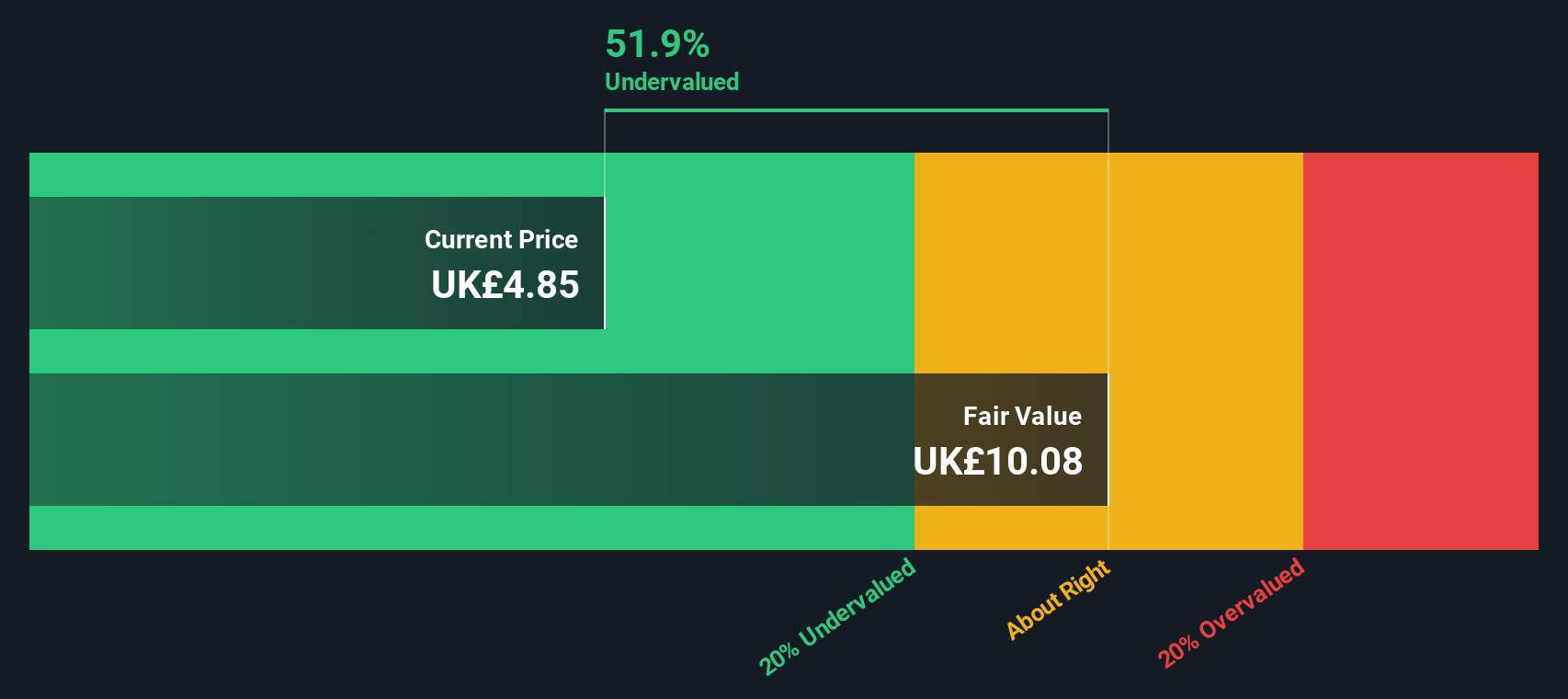

discoverIE Group (LSE:DSCV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: discoverIE Group is a company specializing in the design and manufacture of customized electronics for industrial applications, with a market capitalization of approximately £1.10 billion.

Operations: Magnetics & Controls and Sensing & Connectivity contribute significantly to revenue, with recent figures at £256.50 million and £169.60 million, respectively. The company has experienced a notable trend in gross profit margin, reaching 50.74% as of September 2024. Operating expenses have been a substantial part of the cost structure, with general and administrative expenses consistently around £112.5 million in recent periods.

PE: 39.1x

discoverIE Group, a UK-based company, shows promise as an undervalued stock with its earnings rising to £12 million for the half-year ending September 2024, up from £11.5 million previously. Despite a slight dip in sales to £211.1 million from £222 million, insider confidence is evident with recent purchases indicating belief in future growth prospects. The board's decision to raise interim dividends by 4% reflects their commitment to shareholder returns and investment in acquisitions through internally generated funds.

- Click here and access our complete valuation analysis report to understand the dynamics of discoverIE Group.

Assess discoverIE Group's past performance with our detailed historical performance reports.

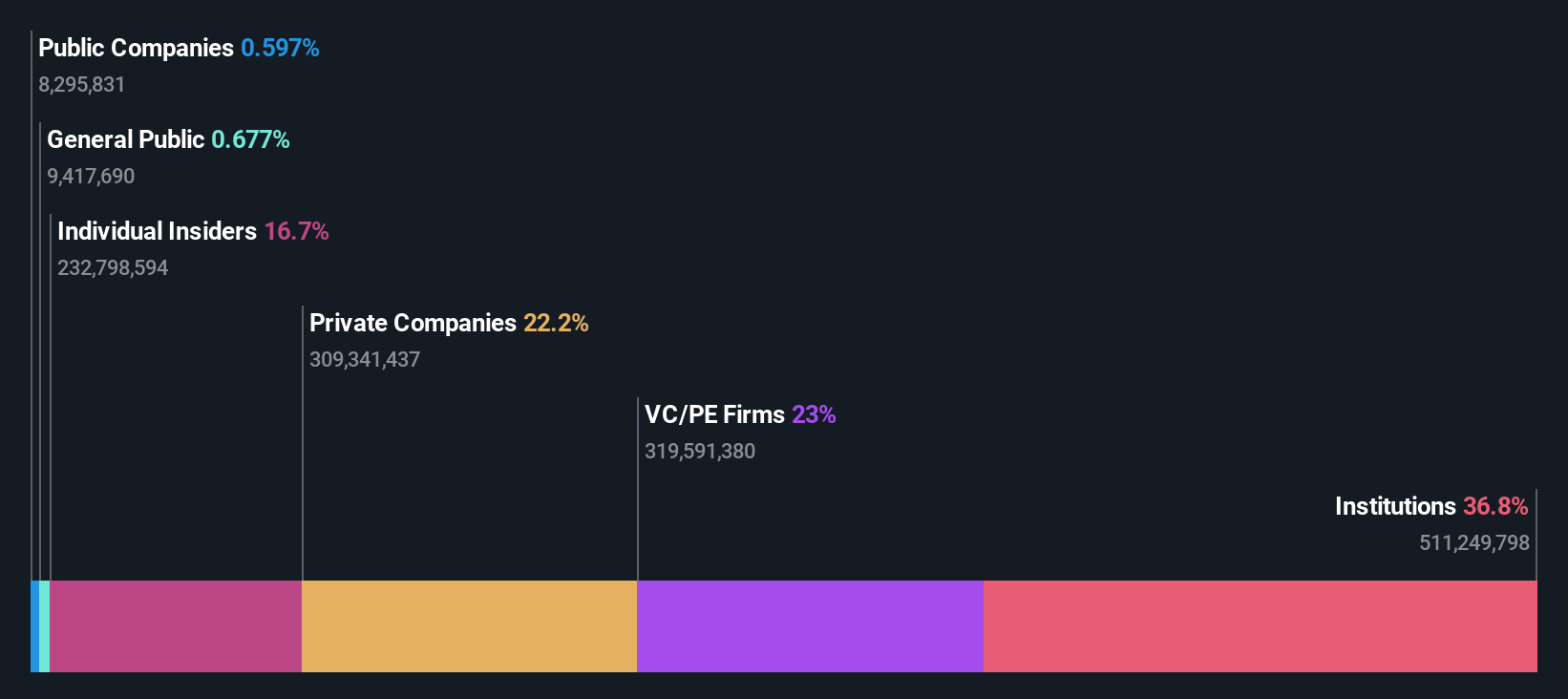

THG (LSE:THG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: THG operates as a digital-first consumer brands group with divisions in beauty, nutrition, and technology services, boasting a market cap of approximately £1.25 billion.

Operations: The company generates revenue primarily from its Beauty, Ingenuity, and Nutrition segments, with Beauty being the largest contributor at £1.20 billion. Over recent periods, the gross profit margin has shown a general trend of fluctuation around 41% to 45%. Operating expenses have consistently exceeded gross profit in recent years, contributing to ongoing net losses.

PE: -2.5x

THG, a UK-based company, has recently completed follow-on equity offerings totaling £100.8 million in October 2024, suggesting strategic capital raising efforts. Despite its current unprofitability and reliance on external borrowing for funding, revenue is expected to grow by 3.56% annually. The stock's high volatility could indicate potential value opportunities for investors seeking small-cap exposure. Insider confidence is evident with recent share purchases by management, hinting at their belief in the company's future prospects despite challenges ahead.

Taking Advantage

- Navigate through the entire inventory of 38 Undervalued UK Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DSCV

discoverIE Group

Designs, manufactures, and supplies specialist electronic components for industrial applications in the United Kingdom, Europe, North America, Asia, and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives