- United Kingdom

- /

- Software

- /

- LSE:PINE

Exploring Three High Growth Tech Stocks In The United Kingdom

Reviewed by Simply Wall St

The United Kingdom's market landscape has recently been influenced by global economic challenges, as seen with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, impacting companies tied to commodity imports and exports. In this environment, identifying high-growth tech stocks requires a focus on innovative companies that can navigate external pressures while capitalizing on technological advancements and domestic opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Filtronic | 20.89% | 35.52% | ★★★★★★ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 8.47% | 55.02% | ★★★★★☆ |

| Windar Photonics | 36.65% | 46.33% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Oxford Biomedica | 21.20% | 92.53% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

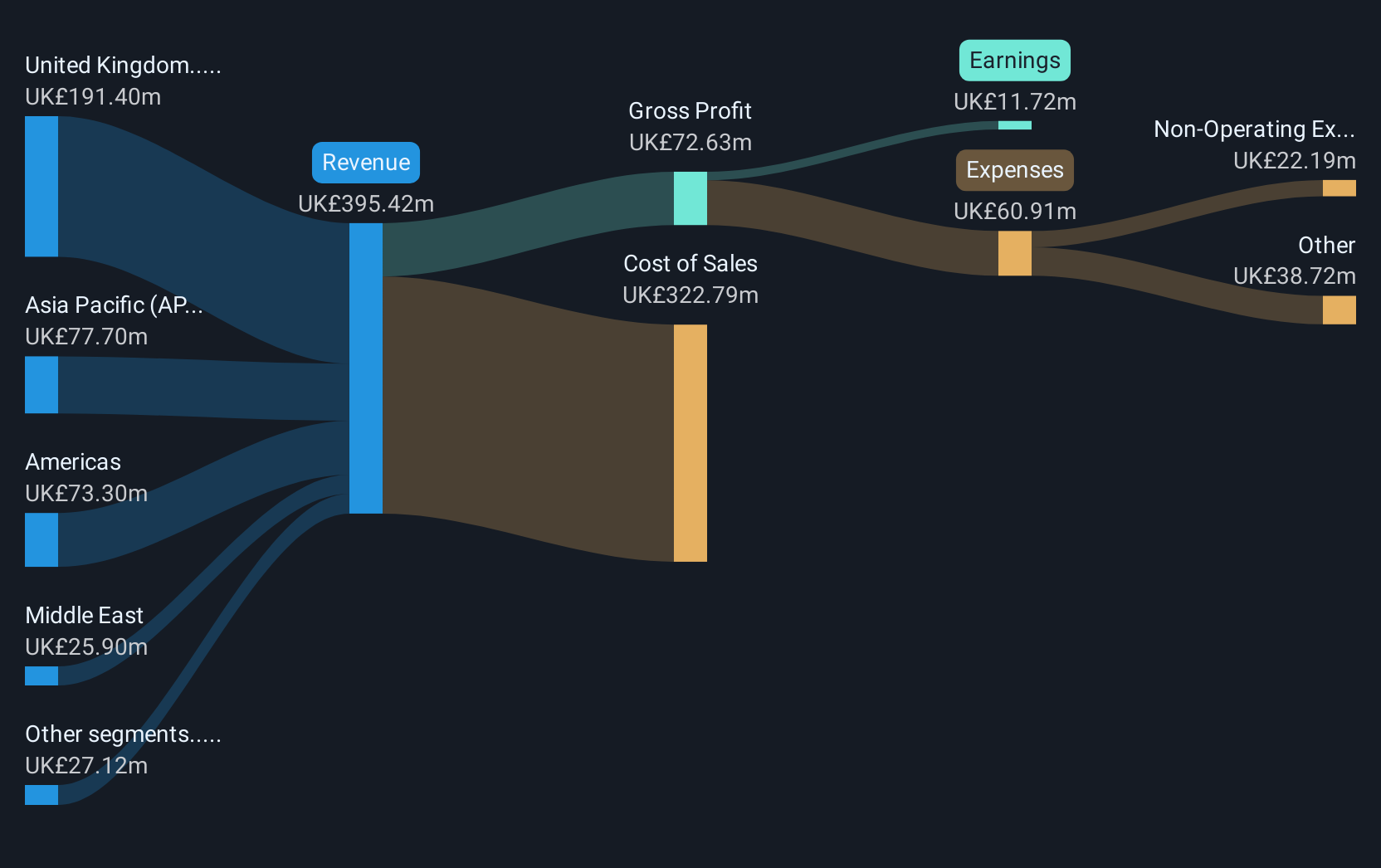

Overview: M&C Saatchi plc offers advertising and marketing communications services across the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £223.12 million.

Operations: The company generates revenue through a diverse range of advertising and marketing communications services across multiple regions, including the UK, Europe, the Middle East, Africa, Asia Pacific, and the Americas. It operates with a market cap of £223.12 million.

M&C Saatchi's strategic maneuvers, including the recent appointment of Nadja Bellan-White as CEO for North America, underscore its commitment to integrating and expanding its diverse agency network. This leadership change aligns with the company's robust performance in 2024, where it reported a net revenue increase of approximately 3.5% to £243 million, buoyed by significant contributions from its Issues and Media segments. Despite a challenging market environment with an expected annual revenue contraction of 15.4%, M&C Saatchi's earnings are forecasted to surge by 27.4% annually, outpacing the UK market average growth of 14.8%. This juxtaposition of declining revenue yet rising profits highlights a strategic pivot towards high-margin offerings and operational efficiencies that could redefine its market stance in coming years.

- Click to explore a detailed breakdown of our findings in M&C Saatchi's health report.

Review our historical performance report to gain insights into M&C Saatchi's's past performance.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Growth Rating: ★★★★☆☆

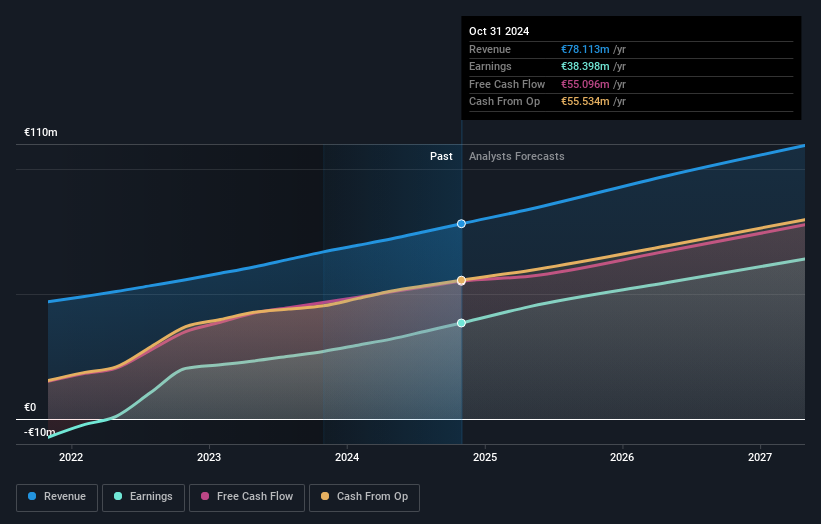

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise across Estonia, Latvia, and Lithuania with a market capitalization of £1.65 billion.

Operations: The company generates revenue through its online classifieds portals, with the automotive segment contributing €29.89 million, followed by real estate at €20.27 million, jobs and services at €15.03 million, and general merchandise at €12.92 million across Estonia, Latvia, and Lithuania.

Baltic Classifieds Group PLC, amid a dynamic tech landscape, is actively seeking M&A opportunities to bolster its market position, as evidenced by recent executive enhancements and strategic financial planning. With an impressive earnings growth of 42.1% over the past year—surpassing the industry average of 9.9%—and a robust annual revenue increase forecast at 11.8%, BCG is aligning its operations to capitalize on evolving market demands effectively. This forward-looking approach is further reflected in their balanced use of cash for dividends and share buybacks, demonstrating a prudent yet aggressive growth strategy that could reshape their sector presence significantly.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

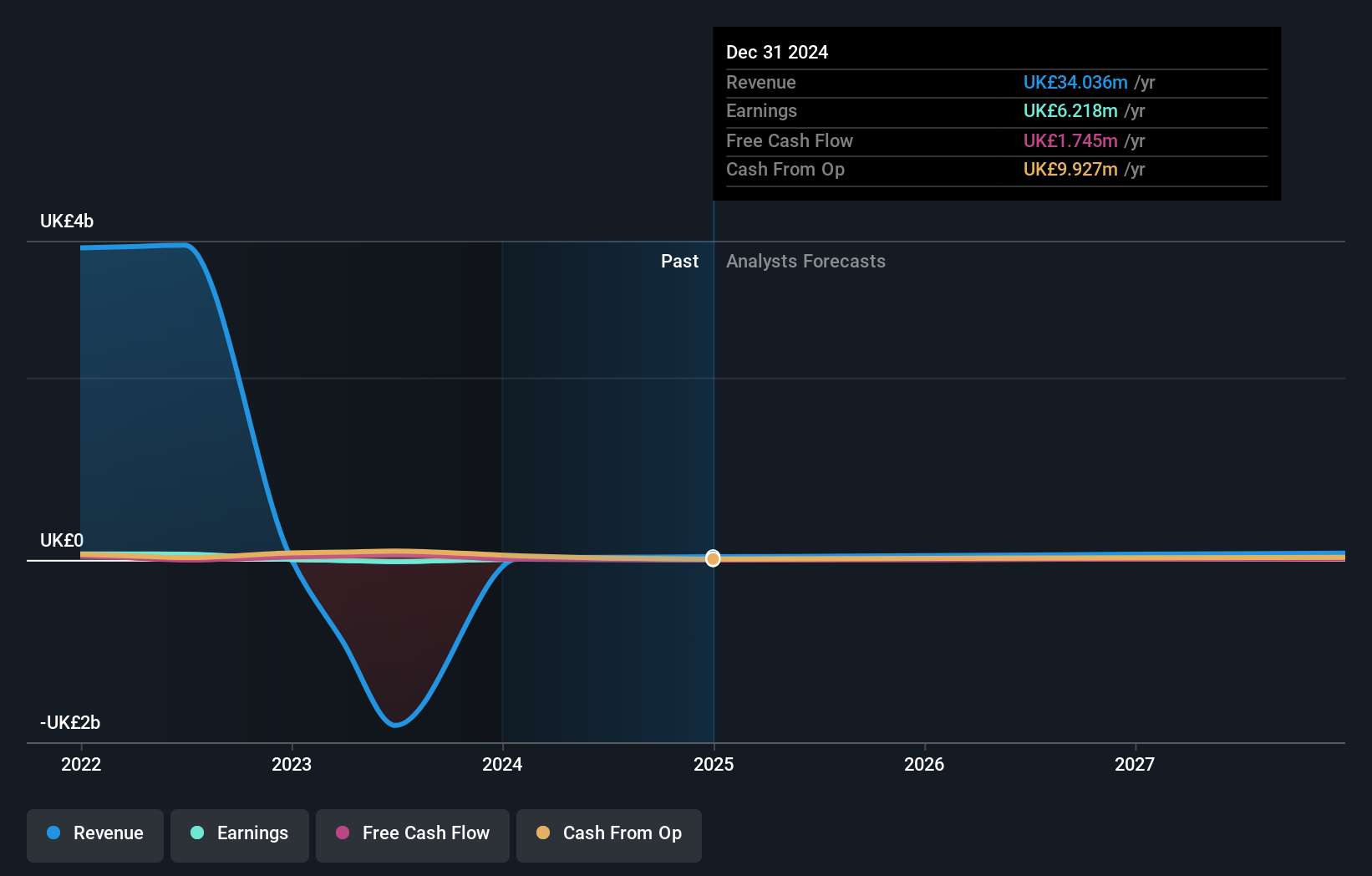

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the UK and internationally, with a market cap of £287.65 million.

Operations: Pinewood Technologies Group generates revenue primarily through its software solutions for the automotive industry, amounting to £22.62 million. The company focuses on delivering cloud-based dealer management systems both in the UK and internationally.

Pinewood Technologies Group, navigating a challenging landscape with a recent earnings dip of 81.6%, contrasts sharply with its robust revenue growth forecast at 20.1% annually, outpacing the UK market's 3.6%. This juxtaposition highlights a strategic focus on expanding market share despite short-term setbacks. With an anticipated earnings rebound to 25.1% annually, Pinewood is poised for significant recovery, underpinned by high-quality past earnings and no dilution over the past year, setting a strong foundation for future performance in the competitive tech sector.

- Navigate through the intricacies of Pinewood Technologies Group with our comprehensive health report here.

Understand Pinewood Technologies Group's track record by examining our Past report.

Make It Happen

- Get an in-depth perspective on all 43 UK High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider that offers software solutions to the automotive industry in the United Kingdom and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives