- United Kingdom

- /

- Metals and Mining

- /

- AIM:ALL

Discover 3 UK Penny Stocks With Market Caps Over £50M

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market fluctuations, certain stocks continue to capture investor interest by offering unique opportunities. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area for those seeking affordability and growth potential. In this article, we explore three UK penny stocks that stand out for their financial resilience and potential in the current economic landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.555 | £509.96M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.14 | £253.67M | ✅ 5 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.36 | £148.67M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.415 | £44.9M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.839 | £310.24M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.68 | £275.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.475 | £124.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £187.55M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.26 | £69.45M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Atlantic Lithium (AIM:ALL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atlantic Lithium Limited is involved in the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana with a market cap of £55.80 million.

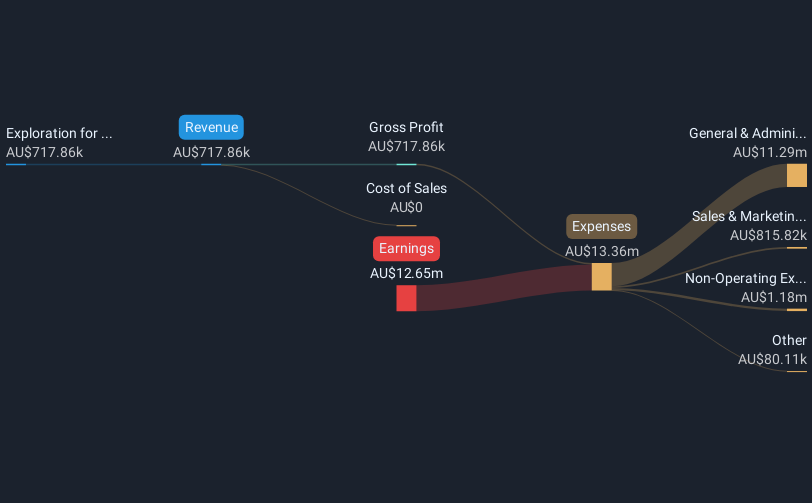

Operations: The company's revenue segment is derived from exploration for base and precious metals, amounting to A$1.15 million.

Market Cap: £55.8M

Atlantic Lithium's recent executive restructuring, with Neil Herbert stepping down as Executive Chairman, aims to streamline operations and reduce costs. The company is pre-revenue with less than US$1 million in revenue and remains unprofitable, facing a forecasted earnings decline. Despite this, Atlantic Lithium holds a strong short-term financial position with assets exceeding liabilities and no debt burden. The Ewoyaa Lithium Project in Ghana is progressing towards legislative ratification of its Mining Lease, offering potential socio-economic benefits despite fluctuating lithium prices. However, the company faces high share price volatility and limited cash runway under current conditions.

- Get an in-depth perspective on Atlantic Lithium's performance by reading our balance sheet health report here.

- Gain insights into Atlantic Lithium's future direction by reviewing our growth report.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Begbies Traynor Group plc is a UK-based company offering business recovery, financial advisory, and property services consultancy, with a market cap of £187.55 million.

Operations: The company generates revenue from two main segments: Property Advisory, which contributes £46.4 million, and Business Recovery and Advisory, accounting for £107.3 million.

Market Cap: £187.55M

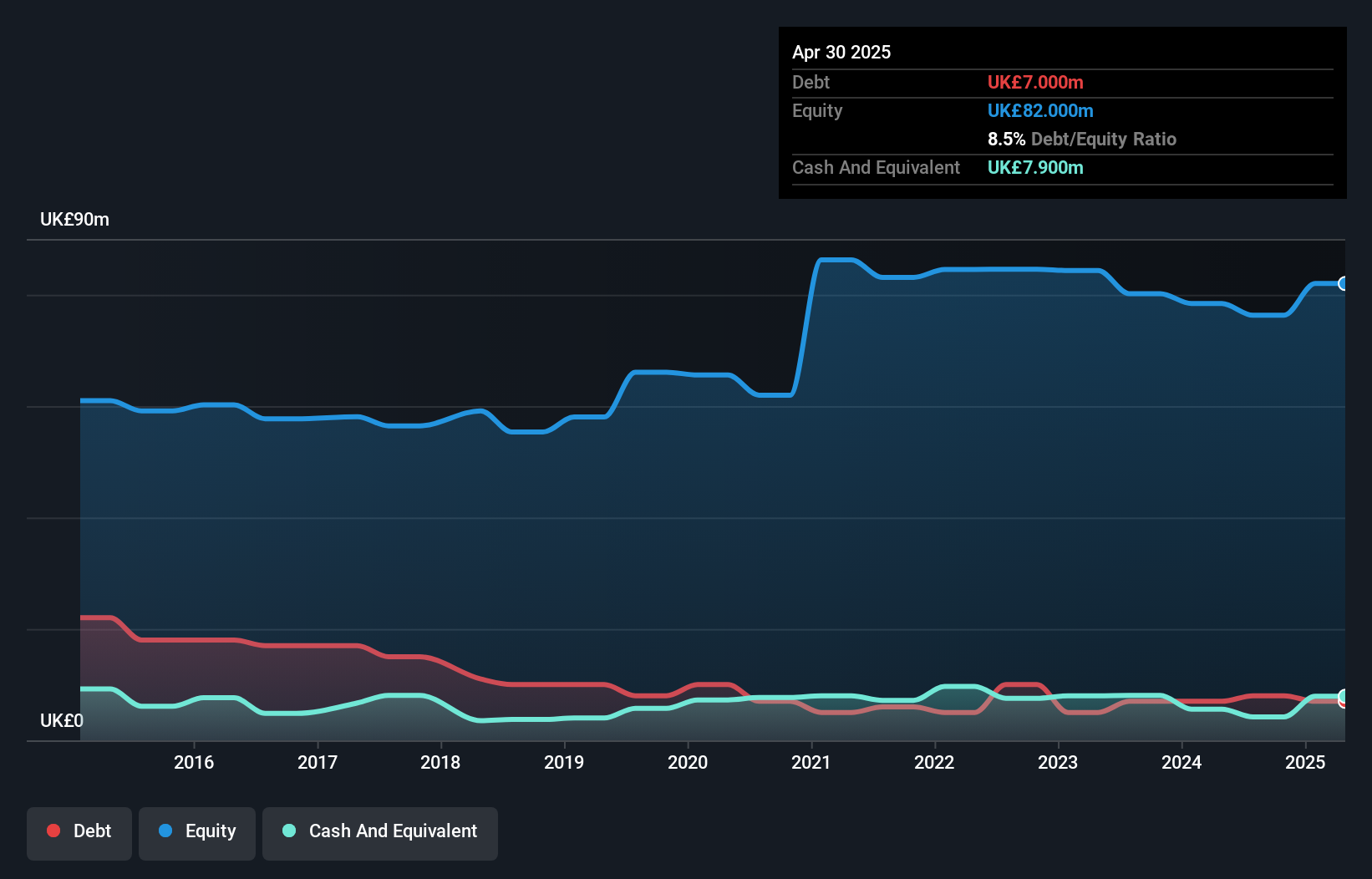

Begbies Traynor Group's recent financial performance highlights significant growth, with earnings surging by 320% over the past year and net profit margins improving to 4.1%. The company has a solid financial structure, with short-term assets exceeding both short and long-term liabilities. Despite a large one-off loss impacting recent results, its debt is well covered by operating cash flow, and the debt-to-equity ratio has improved over five years. Recent events include completing a share buyback program and proposing an increased dividend for 2025. Revenue guidance for FY26 suggests it may reach the upper end of market expectations (£158.9M - £162.8M).

- Jump into the full analysis health report here for a deeper understanding of Begbies Traynor Group.

- Evaluate Begbies Traynor Group's prospects by accessing our earnings growth report.

Baltic Classifieds Group (LSE:BCG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Baltic Classifieds Group PLC operates online classifieds portals for automotive, real estate, jobs and services, and general merchandise in Estonia, Latvia, and Lithuania with a market cap of £1.63 billion.

Operations: The company's revenue is derived from four main segments: Auto (€31.39 million), Real Estate (€22.25 million), Jobs & Services (€15.96 million), and Generalist (€13.22 million).

Market Cap: £1.63B

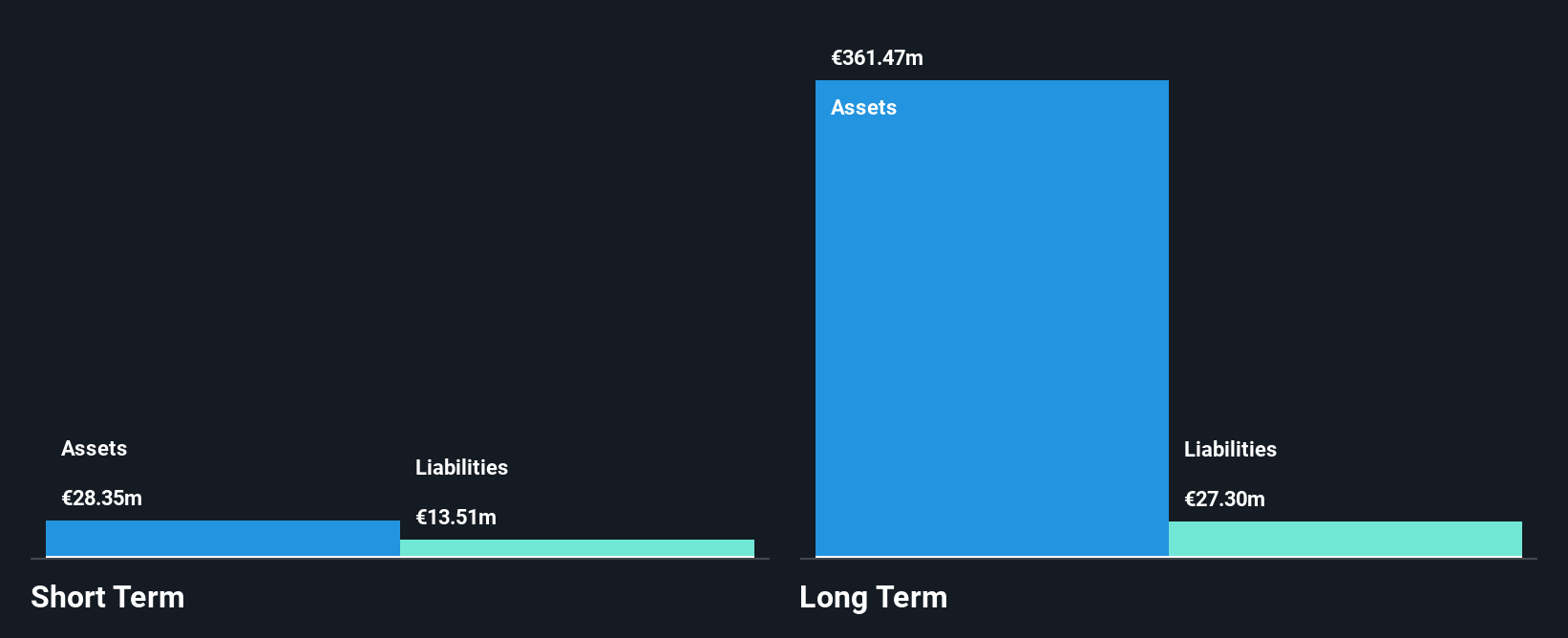

Baltic Classifieds Group has demonstrated robust financial performance with a net income of €44.76 million, reflecting growth from the previous year. The company's earnings growth of 39.7% surpasses the industry average, while its profit margins have improved to 54%. It maintains a satisfactory net debt-to-equity ratio and has strong interest coverage at 23.2 times EBIT. Recent strategic moves include share repurchase initiatives and a proposed dividend increase to 3.8 Euro cents per share for the year ended April 2025, indicating confidence in future cash flows and shareholder value enhancement strategies.

- Navigate through the intricacies of Baltic Classifieds Group with our comprehensive balance sheet health report here.

- Assess Baltic Classifieds Group's future earnings estimates with our detailed growth reports.

Make It Happen

- Gain an insight into the universe of 299 UK Penny Stocks by clicking here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ALL

Atlantic Lithium

Engages in the exploration and development of mineral properties in Australia, Ivory Coast, and Ghana.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives