These 4 Measures Indicate That Auto Trader Group (LON:AUTO) Is Using Debt Safely

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Auto Trader Group plc (LON:AUTO) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Auto Trader Group

What Is Auto Trader Group's Net Debt?

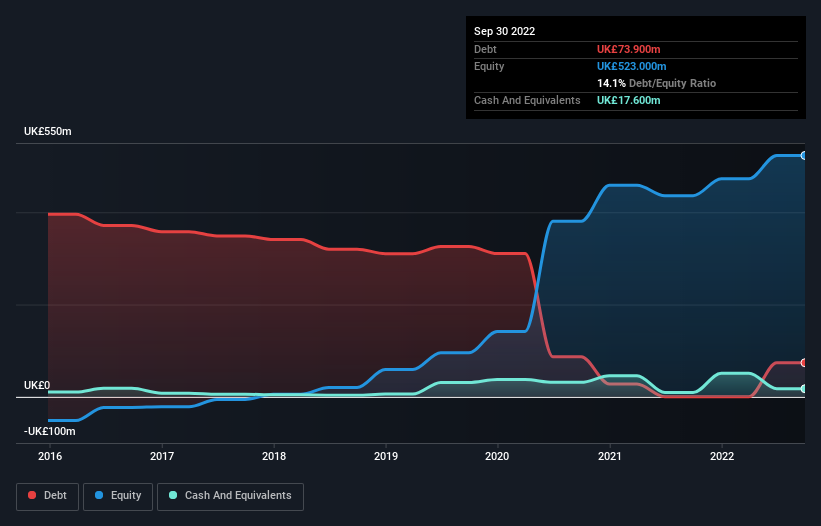

You can click the graphic below for the historical numbers, but it shows that as of September 2022 Auto Trader Group had UK£73.9m of debt, an increase on none, over one year. However, it does have UK£17.6m in cash offsetting this, leading to net debt of about UK£56.3m.

How Healthy Is Auto Trader Group's Balance Sheet?

We can see from the most recent balance sheet that Auto Trader Group had liabilities of UK£57.3m falling due within a year, and liabilities of UK£96.4m due beyond that. Offsetting this, it had UK£17.6m in cash and UK£68.1m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£68.0m.

This state of affairs indicates that Auto Trader Group's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the UK£4.99b company is struggling for cash, we still think it's worth monitoring its balance sheet. Carrying virtually no net debt, Auto Trader Group has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Auto Trader Group's net debt is only 0.18 times its EBITDA. And its EBIT covers its interest expense a whopping 151 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Another good sign is that Auto Trader Group has been able to increase its EBIT by 25% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Auto Trader Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Auto Trader Group recorded free cash flow worth a fulsome 86% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Auto Trader Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. It looks Auto Trader Group has no trouble standing on its own two feet, and it has no reason to fear its lenders. For investing nerds like us its balance sheet is almost charming. Over time, share prices tend to follow earnings per share, so if you're interested in Auto Trader Group, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AUTO

Auto Trader Group

Operates in the digital automotive marketplace in the United Kingdom and Ireland.

Outstanding track record with flawless balance sheet.