If You Had Bought Auto Trader Group (LON:AUTO) Shares Three Years Ago You'd Have Earned 60% Returns

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Auto Trader Group plc (LON:AUTO), which is up 60%, over three years, soundly beating the market decline of 8.8% (not including dividends).

See our latest analysis for Auto Trader Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Auto Trader Group actually saw its earnings per share (EPS) drop 0.4% per year.

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. Therefore, it makes sense to look into other metrics.

We severely doubt anyone is particularly impressed with the modest 1.4% three-year revenue growth rate. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

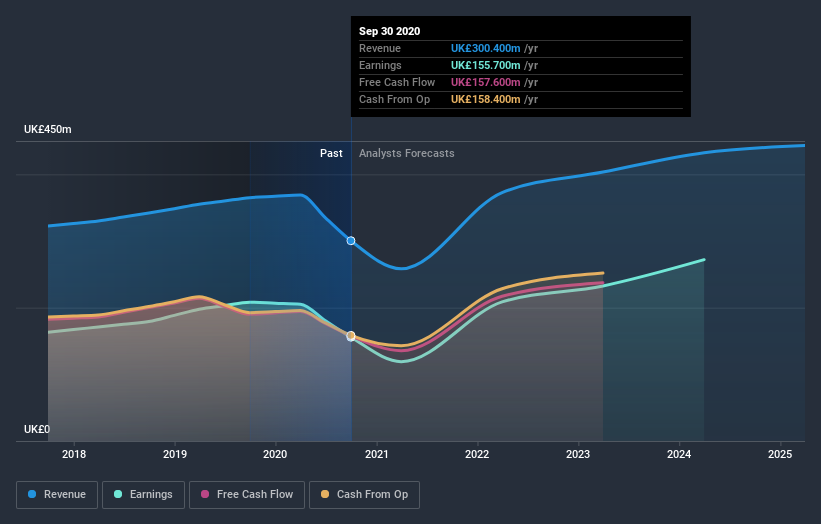

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Auto Trader Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Auto Trader Group shareholders, and that cash payout contributed to why its TSR of 64%, over the last 3 years, is better than the share price return.

A Different Perspective

While it's never nice to take a loss, Auto Trader Group shareholders can take comfort that their trailing twelve month loss of 3.0% wasn't as bad as the market loss of around 4.7%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 9% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Auto Trader Group better, we need to consider many other factors. For instance, we've identified 1 warning sign for Auto Trader Group that you should be aware of.

Auto Trader Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade Auto Trader Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AUTO

Auto Trader Group

Operates in the digital automotive marketplace in the United Kingdom and Ireland.

Outstanding track record with flawless balance sheet.