- United Kingdom

- /

- IT

- /

- AIM:ECK

3 UK Penny Stocks With Market Caps Under £400M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market concerns, investors can still find intriguing opportunities by exploring penny stocks—typically smaller or newer companies that may be overlooked yet offer potential growth at lower price points. With strong balance sheets and solid fundamentals, these stocks can present a compelling option for those looking to diversify beyond established names.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.125 | £806.26M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.32 | £348.23M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.425 | £121.23M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.40 | £183.08M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £194.41M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.404 | £215.61M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.495 | £188.48M | ★★★★★☆ |

| Serabi Gold (AIM:SRB) | £0.894 | £68.92M | ★★★★★★ |

Click here to see the full list of 474 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Eckoh (AIM:ECK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eckoh plc, with a market cap of £151.21 million, provides customer engagement data and payment security solutions across the United Kingdom, the United States, Canada, Ireland, and internationally.

Operations: The company's revenue is divided into two main segments: North America, contributing £18 million, and the United Kingdom and Rest of World, accounting for £19.20 million.

Market Cap: £151.21M

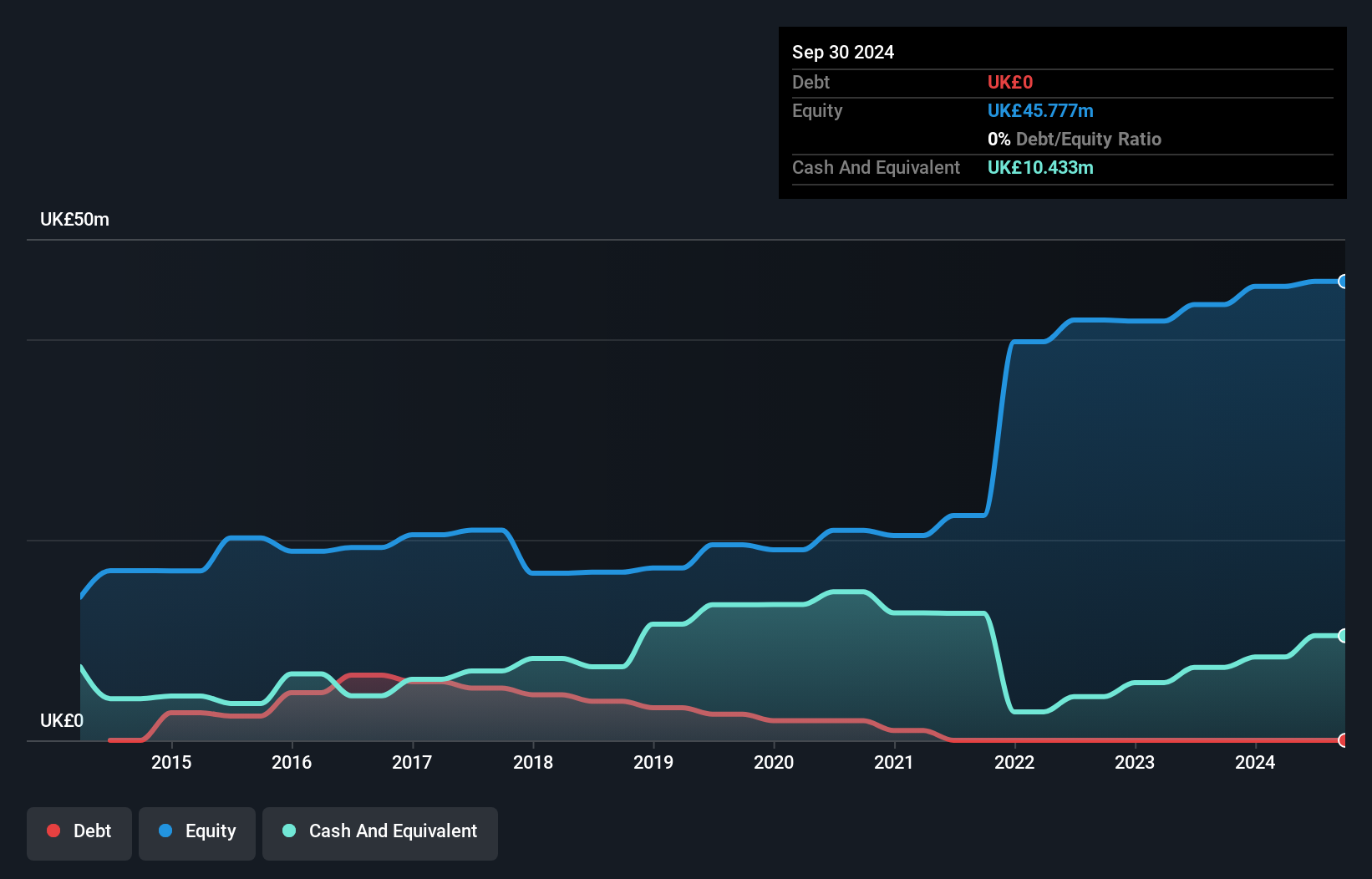

Eckoh plc, with a market cap of £151.21 million, has shown financial stability by maintaining no debt and having short-term assets (£21.1M) that exceed both its long-term (£562K) and short-term liabilities (£16.2M). Despite stable weekly volatility, the company's earnings growth has been negative over the past year, though it achieved a net profit margin improvement to 12.2%. Recent developments include a £160 million acquisition agreement by Bridgepoint Advisers II Ltd and resolution of a patent dispute resulting in a £2.25 million settlement for Eckoh, providing legal certainty against future litigation from the competitor involved.

- Dive into the specifics of Eckoh here with our thorough balance sheet health report.

- Evaluate Eckoh's prospects by accessing our earnings growth report.

Equals Group (AIM:EQLS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Equals Group plc develops and sells payment platforms, including prepaid currency cards, international money transfers, and current accounts in the UK, with a market cap of £236.06 million.

Operations: The company generates revenue from various segments including Banking (£8.26 million), Solutions (£42.15 million), Travel Cash (£0.02 million), Currency Cards (£15.46 million), and International Payments excluding Solutions (£40.71 million).

Market Cap: £236.06M

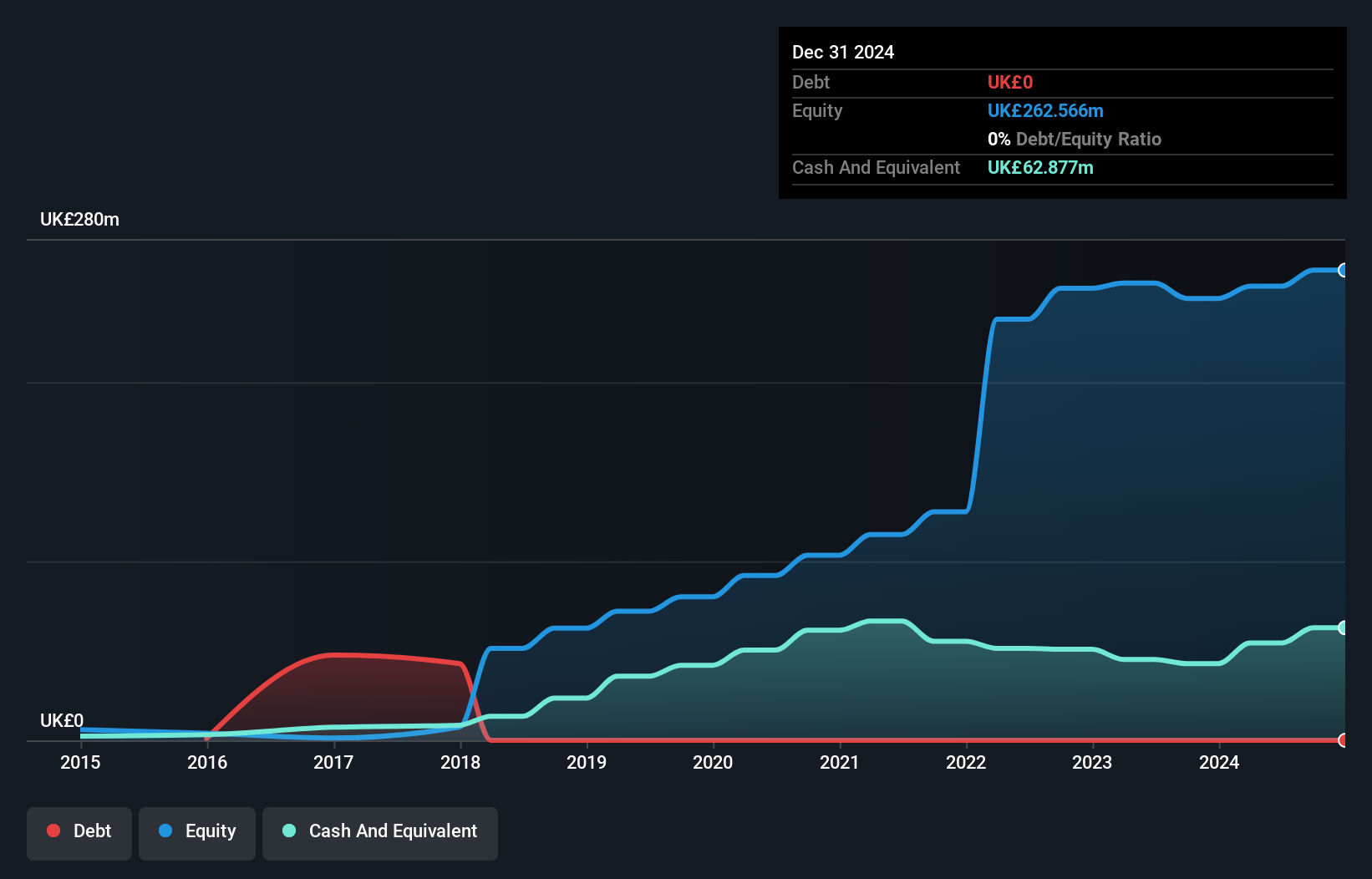

Equals Group plc, with a market cap of £236.06 million, has demonstrated financial resilience by maintaining a debt-free balance sheet and covering both short-term (£26.1M) and long-term liabilities (£2.5M) with its short-term assets (£41.0M). The company's earnings grew by 10.8% over the past year, surpassing the Diversified Financial industry growth of 2.8%. Despite shareholder dilution of 2.5%, Equals reported high-quality earnings and declared an interim dividend of 1 pence per share in September 2024. M&A discussions are ongoing with a consortium led by Railsr and TowerBrook for a potential all-cash offer at 135 pence per share, though no certainty exists regarding the outcome.

- Jump into the full analysis health report here for a deeper understanding of Equals Group.

- Assess Equals Group's future earnings estimates with our detailed growth reports.

Team17 Group (AIM:TM17)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Team17 Group plc, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the UK and internationally, with a market cap of £345.49 million.

Operations: Team17 Group generates revenue of £167.42 million from its game and app development and publishing activities.

Market Cap: £345.49M

Team17 Group plc, with a market cap of £345.49 million, has experienced significant share price volatility over the past three months. Despite being debt-free, the company is currently unprofitable with a negative return on equity of -0.12%. However, it trades at 64.4% below its estimated fair value and covers both short-term (£32.5M) and long-term liabilities (£11.4M) with short-term assets (£90.9M). Recent executive changes include the appointment of Rashid Varachia as CFO and COO, bringing extensive M&A and capital markets experience from his previous roles at Jagex and Codemasters.

- Navigate through the intricacies of Team17 Group with our comprehensive balance sheet health report here.

- Explore Team17 Group's analyst forecasts in our growth report.

Summing It All Up

- Click this link to deep-dive into the 474 companies within our UK Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eckoh might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ECK

Eckoh

Provides customer engagement data and payment security solutions in the United Kingdom, the United States, Canada, Ireland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives