- United Kingdom

- /

- Entertainment

- /

- AIM:EVPL

3 UK Penny Stocks With Market Caps Under £300M To Watch

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices slipping amid concerns over weak trade data from China, highlighting global economic interdependencies. Despite these challenges, investors continue to seek opportunities in various segments of the market. Penny stocks, a term that refers to shares of smaller or newer companies often trading at lower prices, can still offer potential growth opportunities when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.19 | £825.11M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.69 | £70.37M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.275 | £425.17M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.22 | £104.12M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.00 | £75.73M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.284 | £198.03M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.407 | $236.6M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.25 | £202.69M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.35 | £77.01M | ★★★★★★ |

Click here to see the full list of 465 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Brickability Group (AIM:BRCK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brickability Group Plc, along with its subsidiaries, operates in the United Kingdom by supplying, distributing, and importing building products and has a market cap of £189.24 million.

Operations: The company's revenue is primarily derived from its Bricks and Building Materials segment (£380.56 million), followed by Importing (£90.55 million), Contracting (£88.22 million), and Distribution (£63.21 million).

Market Cap: £189.24M

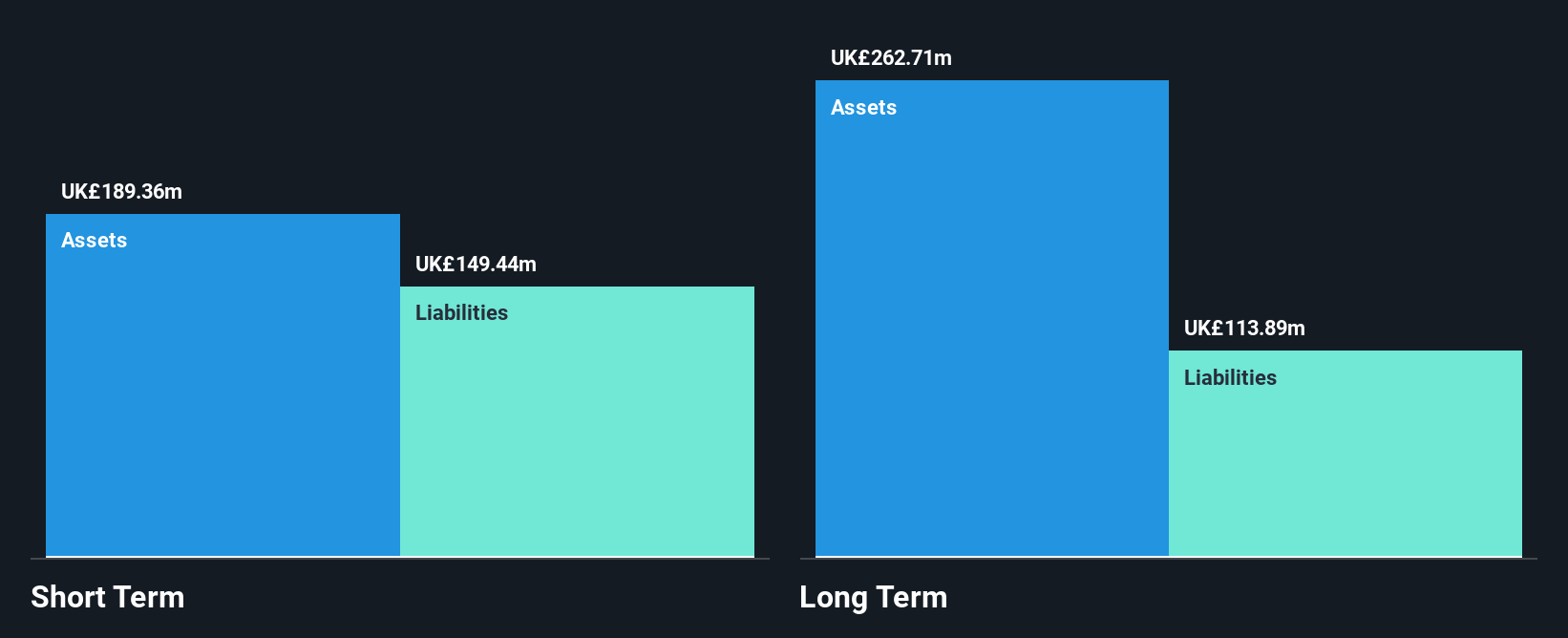

Brickability Group, with a market cap of £189.24 million, operates in the UK building products sector and faces challenges typical of penny stocks. Despite experiencing a significant decline in earnings growth (-70.3%) over the past year and shareholder dilution, it maintains satisfactory debt management with its net debt to equity ratio at 29.4%. The company's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. Recent earnings results show decreased net income (£4.26 million) compared to the previous year (£11.34 million), yet Brickability remains focused on potential acquisitions for growth amidst cautious market conditions.

- Click to explore a detailed breakdown of our findings in Brickability Group's financial health report.

- Review our growth performance report to gain insights into Brickability Group's future.

Team17 Group (AIM:TM17)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Team17 Group plc, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the UK and internationally, with a market cap of £296.64 million.

Operations: The company's revenue is primarily derived from its activities in developing and publishing games and apps, amounting to £167.42 million.

Market Cap: £296.64M

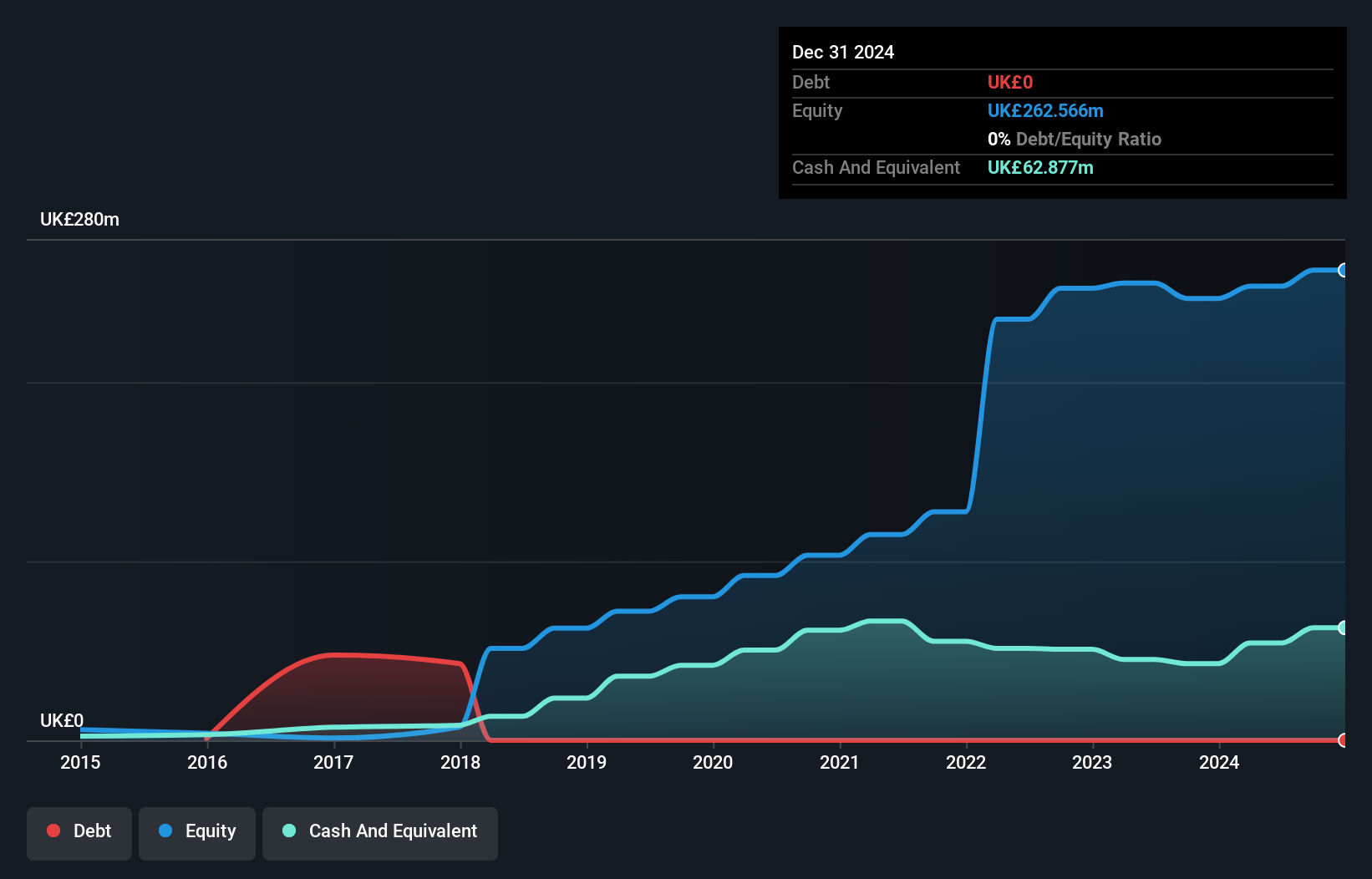

Team17 Group, with a market cap of £296.64 million, operates in the video game sector and exhibits characteristics common to penny stocks. The company is currently unprofitable, with losses increasing over the past five years at 16.2% annually, yet it trades at 69% below its estimated fair value and forecasts suggest earnings growth of 46.83% per year. Despite high weekly volatility (9%), Team17's short-term assets (£90.9M) comfortably cover both short- (£32.5M) and long-term liabilities (£11.4M). Recent executive changes include Rashid Varachia's appointment as CFO, bringing significant industry experience from Jagex and Codemasters amidst stable revenue growth (£80.65 million for H1 2024).

- Dive into the specifics of Team17 Group here with our thorough balance sheet health report.

- Learn about Team17 Group's future growth trajectory here.

Stelrad Group (LSE:SRAD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stelrad Group PLC is a manufacturer and distributor of radiators operating in the United Kingdom, Ireland, Europe, Turkey, and internationally with a market cap of £178.29 million.

Operations: The company generates revenue of £294.27 million from its radiator manufacturing and distribution activities.

Market Cap: £178.29M

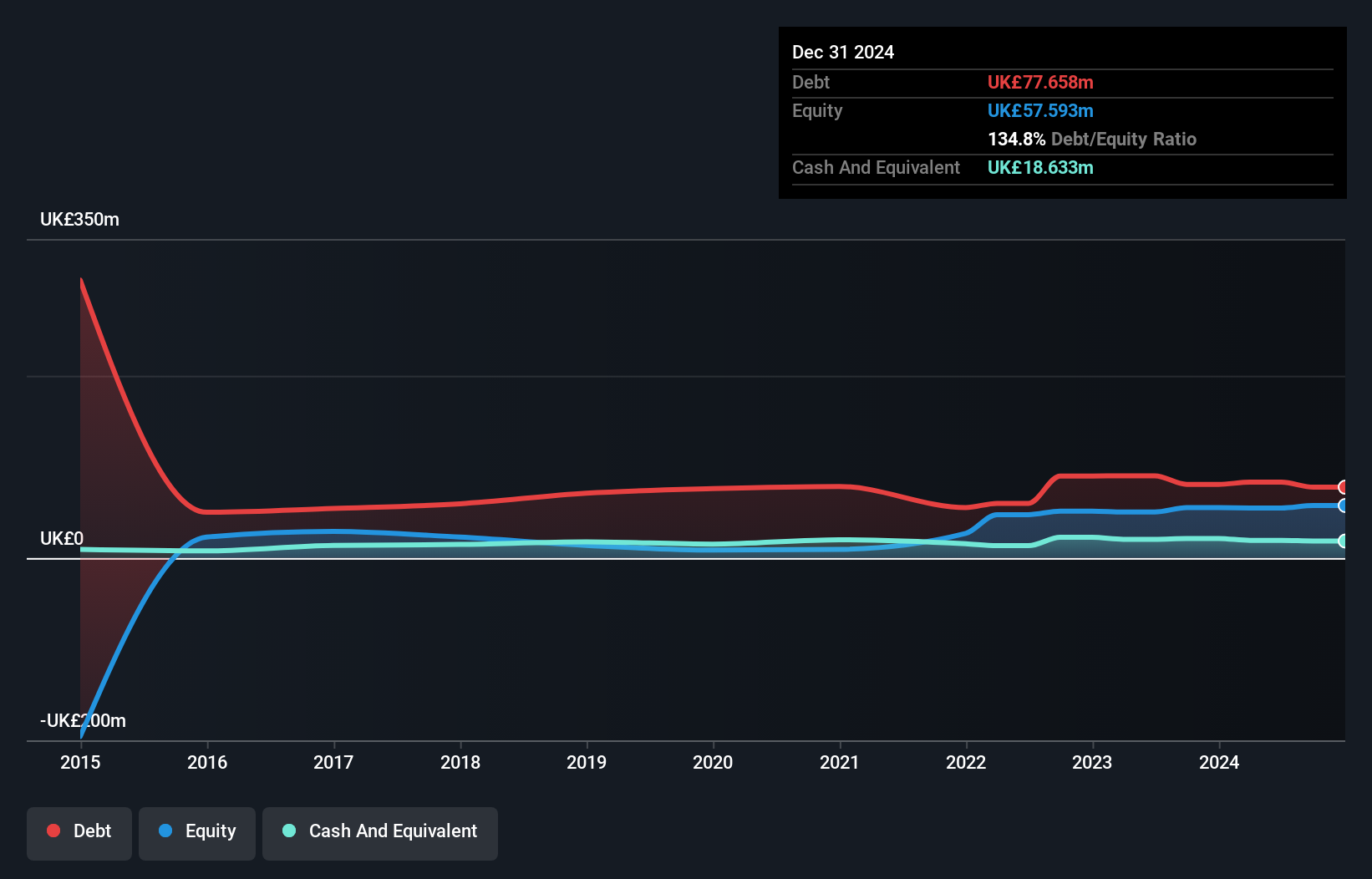

Stelrad Group, with a market cap of £178.29 million, shows typical penny stock features in the radiator manufacturing sector. The company has improved its net profit margins to 5.3% from 3.6% last year and maintains stable weekly volatility at 4%. Despite trading at a good value compared to peers and being 39.4% below estimated fair value, its high debt level remains a concern with a net debt to equity ratio of 116.1%. Recent executive changes include Leigh Wilcox's appointment as CFO, enhancing the management team’s financial expertise amidst unchanged guidance for 2024 earnings growth forecasts of 14.63% annually.

- Click here to discover the nuances of Stelrad Group with our detailed analytical financial health report.

- Explore Stelrad Group's analyst forecasts in our growth report.

Seize The Opportunity

- Navigate through the entire inventory of 465 UK Penny Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EVPL

everplay group

Develops and publishes independent video games for digital and physical market in the United Kingdom and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives