- United Kingdom

- /

- Media

- /

- AIM:SYS1

System1 Group PLC (LON:SYS1) Stock Rockets 59% But Many Are Still Ignoring The Company

System1 Group PLC (LON:SYS1) shareholders would be excited to see that the share price has had a great month, posting a 59% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 97% in the last year.

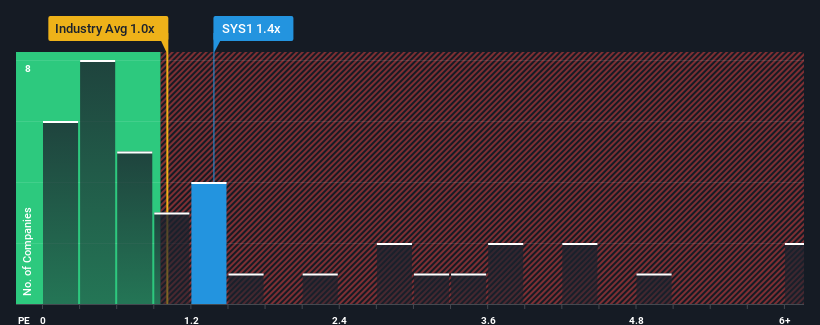

Although its price has surged higher, it's still not a stretch to say that System1 Group's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Media industry in the United Kingdom, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for System1 Group

How Has System1 Group Performed Recently?

System1 Group could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on System1 Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like System1 Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. As a result, it also grew revenue by 20% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 7.8% over the next year. That's shaping up to be materially higher than the 3.7% growth forecast for the broader industry.

In light of this, it's curious that System1 Group's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

System1 Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that System1 Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You need to take note of risks, for example - System1 Group has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SYS1

System1 Group

Provides market research data and insight services in the United Kingdom, the United States, Latin America, rest of Europe, and the Asia Pacific.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives