- United Kingdom

- /

- Real Estate

- /

- LSE:LSL

UK's Leading Growth Stocks With High Insider Ownership For June 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces challenges amid weak trade data from China and declining commodity prices, investors are increasingly focused on identifying resilient growth opportunities. In such a climate, companies with high insider ownership can offer a compelling proposition, as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| QinetiQ Group (LSE:QQ.) | 13.2% | 70.7% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.3% |

| Judges Scientific (AIM:JDG) | 10.6% | 23.1% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20% |

| Hochschild Mining (LSE:HOC) | 38.4% | 27.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.4% | 59.2% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 20.3% | 55.0% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| Audioboom Group (AIM:BOOM) | 15.7% | 59.3% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 112.4% |

Let's uncover some gems from our specialized screener.

M&C Saatchi (AIM:SAA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Asia Pacific, and the Americas, with a market cap of £213.93 million.

Operations: M&C Saatchi generates its revenue through advertising and marketing communications services across various regions, including the UK, Europe, the Middle East, Asia Pacific, and the Americas.

Insider Ownership: 15.4%

Return On Equity Forecast: 32% (2027 estimate)

M&C Saatchi has seen substantial insider buying recently, indicating confidence in its growth prospects. The company's earnings are forecast to grow significantly at 25.2% annually, outpacing the UK market's average. Despite a decline in revenue projections by 15% per year, M&C Saatchi’s profitability has improved, with net income reaching £14.73 million from a previous loss. Trading well below its estimated fair value enhances its appeal as an investment opportunity amidst recent board changes and dividend increases.

- Click here and access our complete growth analysis report to understand the dynamics of M&C Saatchi.

- According our valuation report, there's an indication that M&C Saatchi's share price might be on the cheaper side.

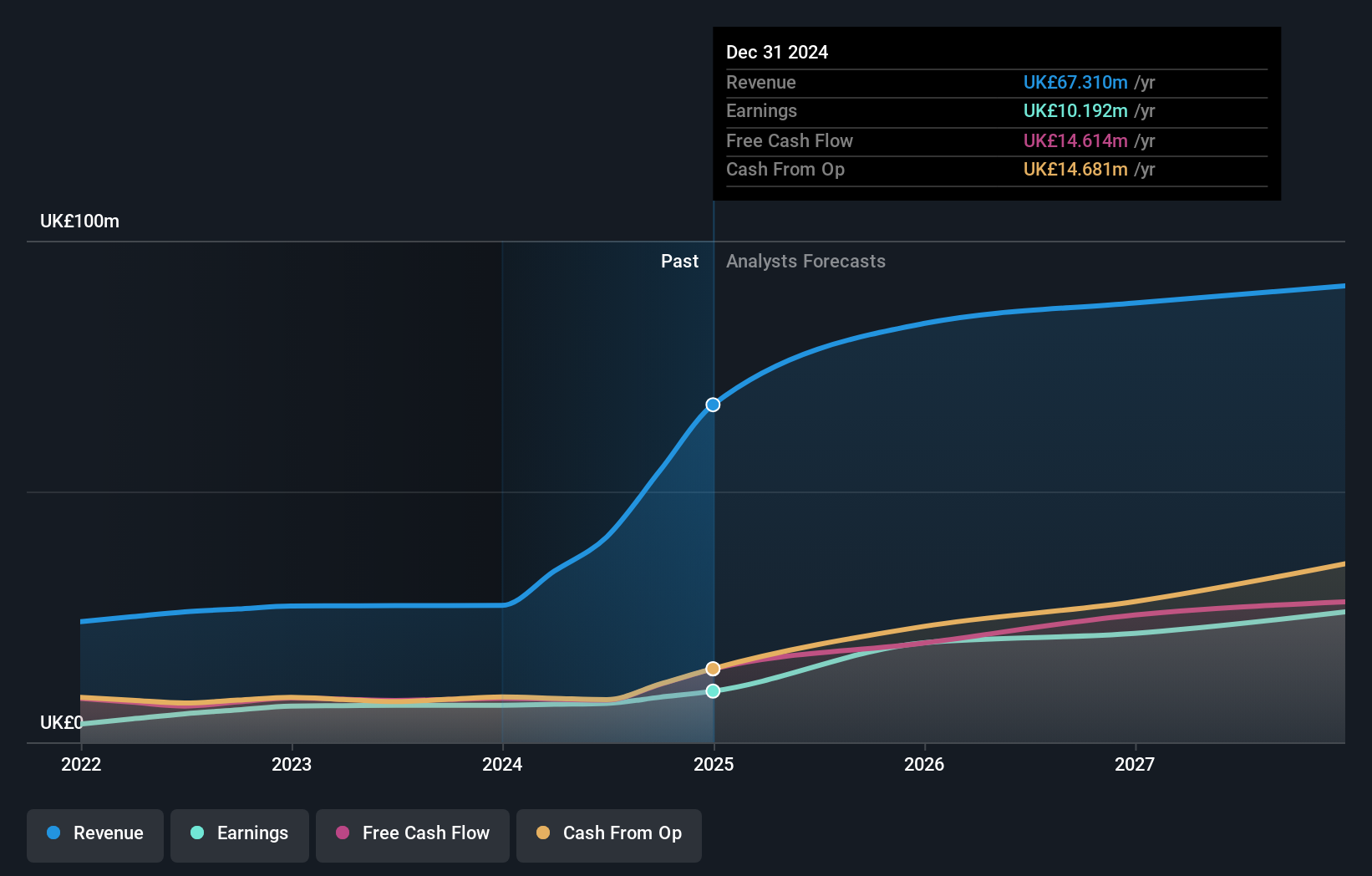

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Property Franchise Group PLC operates in the United Kingdom, focusing on residential property franchising, licensing, and financial services, with a market cap of £321.95 million.

Operations: The company's revenue segments consist of £40.90 million from property franchising, £7.21 million from licensing, and £19.20 million from financial services in the United Kingdom.

Insider Ownership: 12.8%

Return On Equity Forecast: N/A (2027 estimate)

Property Franchise Group has experienced moderate insider buying, reflecting some confidence in its future. The company's earnings are expected to grow significantly at 26.4% annually, surpassing UK market averages. Despite a slower revenue growth forecast of 6.8% per year, recent earnings rose by 37.8%. However, profit margins have declined from last year’s figures. Trading below estimated fair value and recent dividend increases may attract investor interest despite these mixed signals on growth and profitability.

- Take a closer look at Property Franchise Group's potential here in our earnings growth report.

- Our expertly prepared valuation report Property Franchise Group implies its share price may be lower than expected.

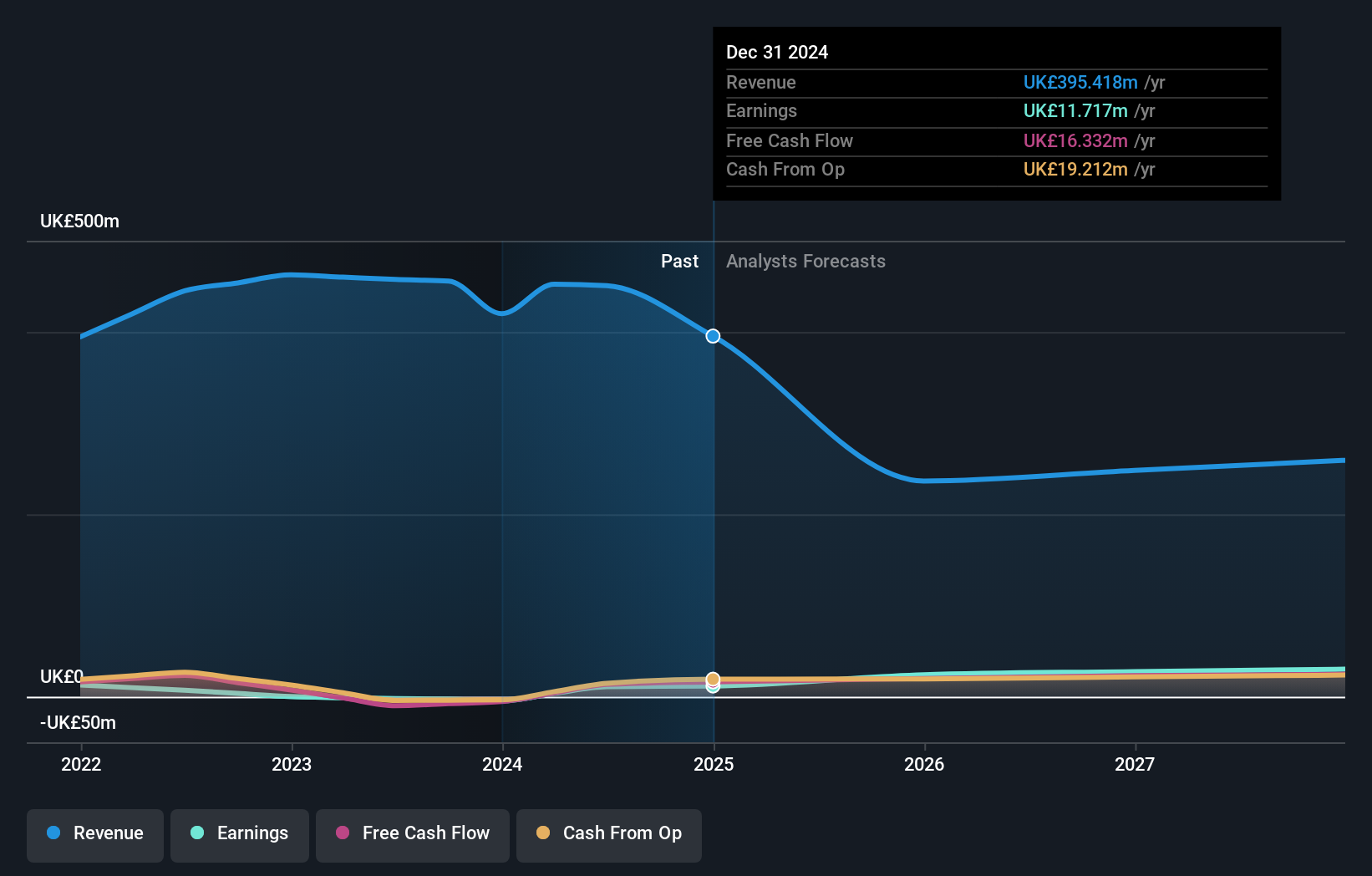

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LSL Property Services plc operates in the United Kingdom, offering business-to-business services to mortgage intermediaries and estate agent franchisees, as well as valuation services to lenders, with a market cap of £298.52 million.

Operations: The company's revenue is primarily derived from three segments: Financial Services (£48.40 million), Surveying and Valuation (£97.82 million), and Estate Agency (£26.96 million).

Insider Ownership: 10.1%

Return On Equity Forecast: 24% (2027 estimate)

LSL Property Services has seen substantial insider buying recently, indicating internal confidence. Earnings are projected to grow at 16.5% annually, outpacing the UK market average, though revenue growth is slower at 6.7% per year. The company trades at half its estimated fair value and has a high forecasted return on equity of 24.2%. Despite an unstable dividend track record, recent earnings improvements and analyst price target expectations suggest potential for future appreciation.

- Click to explore a detailed breakdown of our findings in LSL Property Services' earnings growth report.

- Our valuation report here indicates LSL Property Services may be undervalued.

Key Takeaways

- Investigate our full lineup of 61 Fast Growing UK Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LSL

LSL Property Services

Engages in the provision of business-to-business services to mortgage intermediaries and estate agent franchisees, and valuation services to lenders in the United Kingdom.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives