- United Kingdom

- /

- Software

- /

- AIM:ADVT

UK Penny Stocks To Watch: AdvancedAdvT Leads The Pack

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting concerns about global economic recovery. Despite these broader market pressures, certain investment opportunities remain intriguing. Penny stocks, though an older term, still capture interest as they often represent smaller or newer companies that can offer growth potential at lower price points. When backed by strong financials and solid fundamentals, these stocks can provide investors with unique opportunities for growth in a challenging economic landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Warpaint London (AIM:W7L) | £3.575 | £288.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.54 | £402.66M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £2.93 | £291.41M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.936 | £149.17M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.21 | £405.83M | ★★★★★★ |

| Van Elle Holdings (AIM:VANL) | £0.34 | £36.79M | ★★★★★★ |

| City of London Investment Group (LSE:CLIG) | £3.32 | £163.62M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.794 | £67.31M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.08 | £148.39M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.39 | £214.38M | ★★★★★☆ |

Click here to see the full list of 443 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AdvancedAdvT (AIM:ADVT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AdvancedAdvT Limited offers software solutions across Europe, the United Kingdom, North America, and other international markets with a market cap of £209.79 million.

Operations: The company generates £31.68 million in revenue from its Blank Checks segment.

Market Cap: £209.79M

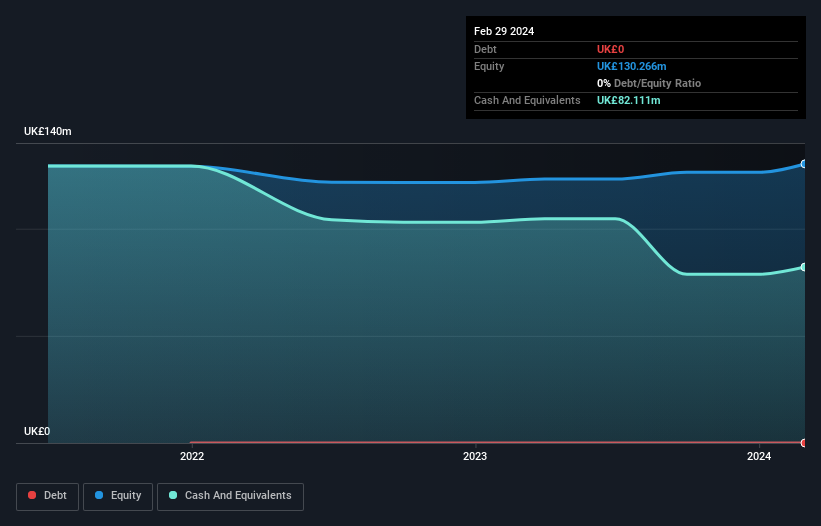

AdvancedAdvT Limited, with a market cap of £209.79 million, has recently become profitable and operates without debt, providing financial stability. The company's revenue is forecasted to grow annually by 16.74%, although its Return on Equity remains low at 5.5%. The board is experienced with an average tenure of 3.9 years, but the management team is relatively new with an average tenure of 1.2 years. Recent executive changes include the resignation of Non-Executive Director Mark Brangstrup Watts in February 2025. Despite past earnings being impacted by a one-off gain, shareholders have not faced significant dilution recently.

- Navigate through the intricacies of AdvancedAdvT with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into AdvancedAdvT's future.

M&C Saatchi (AIM:SAA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: M&C Saatchi plc is a global advertising and marketing communications company operating across the UK, Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of £213.95 million.

Operations: M&C Saatchi plc does not report distinct revenue segments.

Market Cap: £213.95M

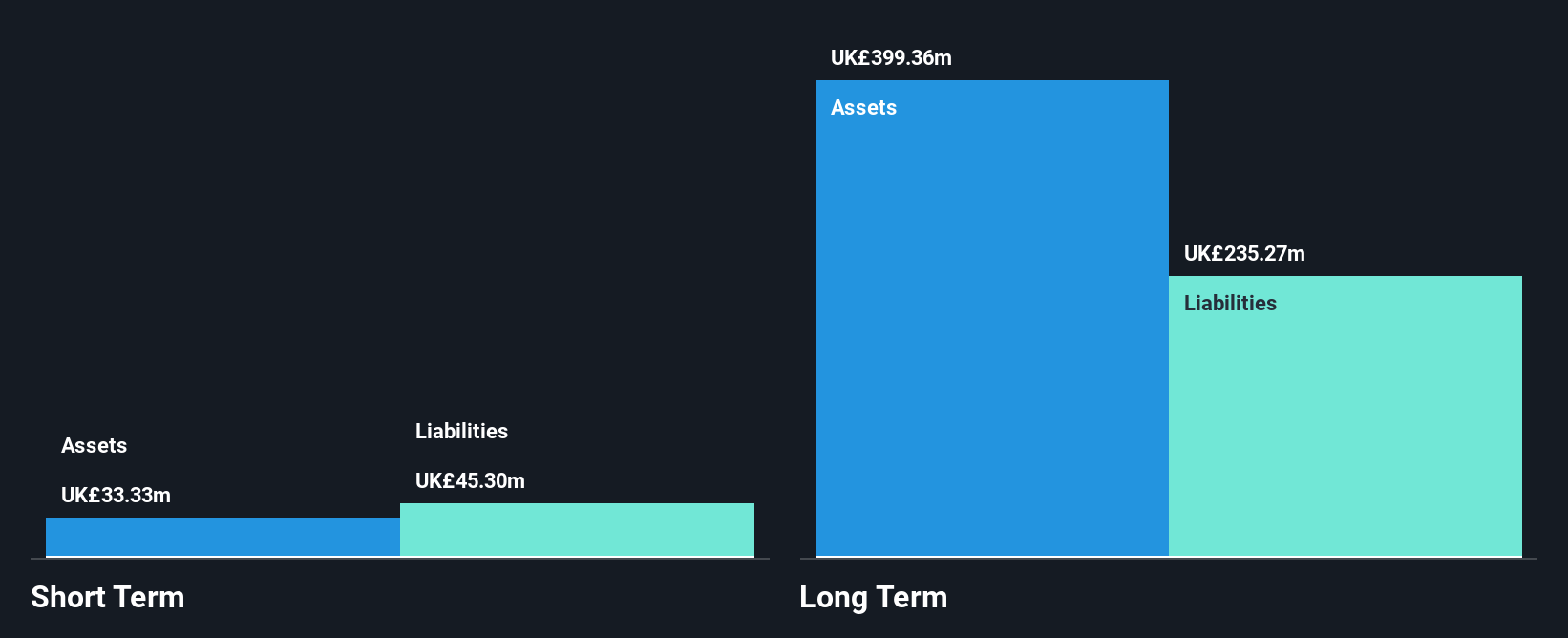

M&C Saatchi plc, with a market cap of £213.95 million, has recently turned profitable and shows promising financial health, with short-term assets exceeding both short-term and long-term liabilities. The company maintains more cash than its total debt and has a high Return on Equity at 33.1%. Despite being impacted by a one-off loss of £17.3 million in the last year, the company's earnings are forecast to grow significantly at 27.45% per year. Recent announcements indicate expected organic sales growth between 12%-16% for 2025, alongside EBIT growth surpassing organic sales growth projections.

- Dive into the specifics of M&C Saatchi here with our thorough balance sheet health report.

- Gain insights into M&C Saatchi's outlook and expected performance with our report on the company's earnings estimates.

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hollywood Bowl Group plc operates ten-pin bowling and mini-golf centers in the United Kingdom and internationally, with a market cap of £441.74 million.

Operations: The company generates revenue of £230.40 million from its recreational activities segment.

Market Cap: £441.74M

Hollywood Bowl Group plc, with a market cap of £441.74 million, demonstrates financial resilience despite some challenges. The company generates significant revenue (£230.40 million) from its recreational activities but faces short-term asset constraints against liabilities (£42.3M vs £44.7M). Its Return on Equity is relatively low at 19.7%, and profit margins have decreased slightly from last year (13% vs 15.9%). However, the firm benefits from being debt-free and has initiated a share buyback program authorized to repurchase up to 10% of its issued capital, indicating confidence in its value proposition amidst unstable dividend records.

- Jump into the full analysis health report here for a deeper understanding of Hollywood Bowl Group.

- Understand Hollywood Bowl Group's earnings outlook by examining our growth report.

Where To Now?

- Click here to access our complete index of 443 UK Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ADVT

AdvancedAdvT

Provides software solutions in Europe, the United Kingdom, North America, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives